IG Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading forex carries a high level of risk. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IG offers the ultimate comprehensive trading package, featuring excellent trading and research tools, industry-leading education, and an extensive range of tradeable markets.

A trusted multi-asset broker, IG is publicly traded and regulated across the globe. I've been reviewing IG for over six years, and I still continue to be impressed by IG's all-around fantastic trading experience.

Can I open an account with this broker?

Yes, based on your detected country of US, you can open an account with this broker.

Recent news:

IG's offering for US forex traders is now under its new highly rated tastyfx brand.

IG pros & cons

Pros

- We named IG the #1 Overall Broker in our ForexBrokers.com 2025 Annual Awards.

- IG is publicly traded (LON: IGG) and regulated in eight Tier-1 jurisdictions.

- IG holds the highest Trust Score in our database and is the most trusted broker for forex and CFDs in 2025.

- US forex traders can access the IG trading experience via its new brand, tastyfx.

- IG finished Best in Class in 2025 for Range of Investments (with over 19,000 tradeable instruments).

- IG’s acquisition of tastytrade for $1 billion introduced options trading and listed-derivatives (i.e. futures) trading to U.S. clients.

- In addition to IG Smart Portfolios and share-dealing, IG offers listed derivatives including options and futures trading in the U.S. and Europe, alongside its forex and CFD trading (and spread betting for U.K. traders).

- IG holds more than double the required regulatory capital as of its 2023 annual report, with a $498 million capital headroom buffer as of May 31 2023.

Cons

- Though IG’s industry-leading web platform is fantastic, its lack of predefined layouts means that some manual configuration is necessary.

- Between premium MT4 add-ons from FX Blue, and Autochartist integration, IG’s MetaTrader offering still only offers barely 80 tradeable instruments.

- While IG's flagship platforms are Best in Class, MT5 is not yet available.

- IG's DailyFX website was recently discontinued.

Overall Summary

| Feature |

IG IG

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platforms & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is IG safe?

IG is considered Highly Trusted, with an overall Trust Score of 99 out of 99. IG is publicly traded, does operate a regulated bank, and is authorised by eight Tier-1 regulators (Highly Trusted), two Tier-2 regulators (Trusted), zero Tier-3 regulators (low trust), and one Tier-4 regulator (High Risk). IG is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), Financial Markets Authority (FMA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system Learn more about Trust Score or see where the different IG entities are regulated.

| Feature |

IG IG

|

|---|---|

| Year Founded | 1974 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 8 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

The range of markets available to you may vary depending on which of IG’s regulatory entities holds your account. Residents of the U.K., New Zealand, Japan, and the U.S. must choose their respective local IG entity.

Alongside nearly 20,000 CFDs, IG offers exchange-traded securities (non-CFDs) for residents of the U.K. (see our IG U.K. share dealing review), Germany, and Australia to access international stock exchanges, via its share trading account. In addition to forex options, IG offers exchange-traded Turbo warrants as part of Spectrum, its Multilateral Trading Facility (MTF) in Europe, and listed derivatives in the U.S. via tastytrade. IG Bank in Switzerland is also an option for eligible clients.

Cryptocurrency: Cryptocurrency trading is available at IG through CFDs, but not available through trading the underlying asset (e.g., buying Bitcoin). IG does not offer crypto derivatives in the U.K. to retail traders.

The following table summarizes the different investment products available to IG clients.

| Feature |

IG IG

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 19537 |

| Forex Pairs (Total) | 97 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

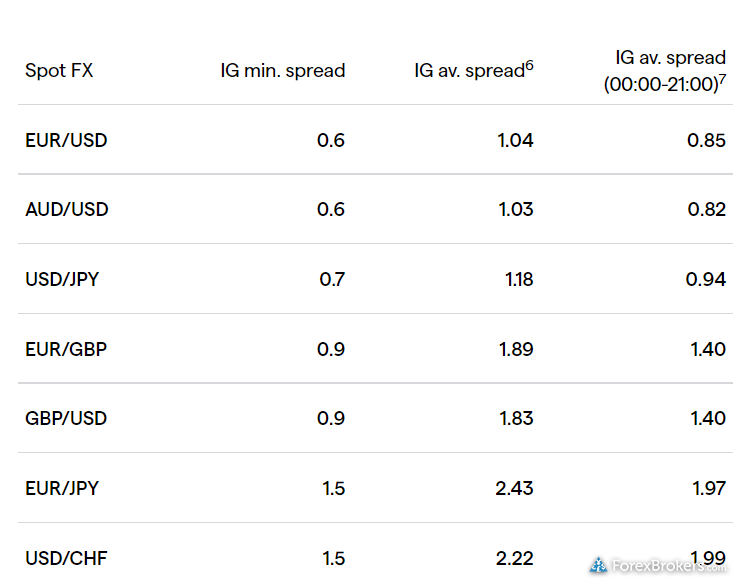

IG’s size allows it to provide scalable execution across the board – regardless of the product being traded. IG offers multiple execution methods beyond the market maker option available on its standard account. While IG can’t be considered a discount broker, it shines for the active trader pricing available through its Forex Direct accounts, and its ability to execute large orders. Spreads on its main Forex Direct account offering are closer to the industry average in 2025, with spreads averaging 0.62 during July 2023 or an all-in cost of 0.82 after factoring in a per trade commission equivalent of 0.2 pips.

CFD account average spreads: For both mini and standard-size contracts, typical spreads during the main trading session (22 hours each day from 0000 – 2200 GMT) averaged 0.69 pips for the month of July 2023 – which is slightly better than the industry average. It is worth noting that – just like with most forex brokers – IG’s spreads during low-liquid times can be higher than normal, averaging 1.03 pips when including the remaining hours in the trading day (2100 to 0000 GMT) during the same timeframe as the above July 2023 data. Otherwise, its average spread during the whole month of July 2023, including all trading sessions, was 0.98 pips for IG globally, whereas for IG US the EUR/USD pair averaged 1.18 pips during that time.

CFD account active trader rebates: For volume traders who qualify as professionals under EU rules, IG offers pricing discounts via its three-tier active-trader rebate program. In tier one, you can earn a 10% spread rebate if you transact over £50 million worth of forex volume per month. Meanwhile, if you trade over £300 million per month, the rebate jumps to as much as 20%. To put this into a different context, 20% off of 0.76 pips is 0.17 pips, which would result in an all-in cost of just 0.60 pips – a very competitive spread. In other regions, where permitted, IG's premium trader program provides various perks and lifestyle benefits that require over $50 million in forex volume, $20 million worth of indices or commodities, or $5 million worth of share trading volume per month to be eligible.

DMA account (Forex Direct): For the savviest traders seeking more significant discounts than what is offered in the CFD account, the DMA account is an even better option than the active trader rebates on IG's spread-only pricing. This commission-based offering, Forex Direct, is available via the DMA account and provides traders access to the L2 Dealer platform. The DMA account requires just a £1,000 minimum and uses a tiered pricing scale based on the trader's previous month's trading volume.

DMA account average spreads: With average spreads of 0.62 on the EUR/USD for July 2023 (including all trading sessions), the all-in spread will be be based on the commission you pay, with the base tier of $60 per million for traders that do less than $100 million per month. Traders that do over 1.5 yards (one yard = $1 billion in volume) see their per-side commission drop to $10 per million ($20 round-turn), resulting in an effective spread of 0.82 pips – using the July 2023 data.

Execution method: Forex Direct streams from interbank liquidity providers where IG acts as an agency broker. IG doesn't add on any additional spread, instead adding a commission to each trade you make (similar to IC Markets, FP Markets, and FOREX.com.

| Feature |

IG IG

|

|---|---|

| Minimum Deposit | £250.00 |

| Average Spread EUR/USD - Standard | 0.98 |

| All-in Cost EUR/USD - Active | 0.82 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Getting Started with IG

Opening an account with a forex broker for the first time can feel complicated. A variety of factors can affect a forex broker’s application process, including your country of residence. No matter where you live, you’ll need to choose the account type and trading platform that suits your individual trading needs and familiarize yourself with the account agreement and terms and conditions that will govern your relationship with your broker.

Note: We don’t currently assign ratings or rankings to brokers based on the difficulty of opening a brokerage account.

Account opening

I found IG’s account opening process to be straightforward and relatively easy to navigate. Let’s go over some important points about opening a forex trading account with IG:

1. Basic information

You should expect to put aside ten minutes or so (depending on how fast you type) to fill out some basic forms and check some boxes applicable to your personal finances and experience with investments.

You’ll also need to provide personal information required by Know-Your-Customer (KYC) and Anti Money Laundering (AML) regulations when opening a forex trading account. Here are some common examples of fields you’ll need to complete during this process:

- Full legal name

- Country of residency

- Tax residency

- Permanent address

- Mailing address

In some cases, you may be required to verify your identity by taking a selfie with your ID or scanning your face with a verification app. This will depend on the preference of your broker and your country of residence.

2. Assessment of trading knowledge

Forex brokers licensed and regulated in competent jurisdictions are required to ascertain your degree of trading knowledge and experience (or lack thereof). Typically, you’ll need to check a few boxes or answer a handful of multiple-choice questions to prove that you have some basic trading knowledge. If you fail to pass the assessment, the broker will often just require that you sign additional agreements acknowledging that your lack of experience may contribute to a higher chance of risk and financial loss.

3. Risk acknowledgments

You should expect to agree to various risk disclaimers and related disclosures. Learn more about why most forex traders lose money by checking out my educational series about forex trading.

4. Account creation

Once your account is established, you’ll be able to log in to the IG web portal and access both a demo account and your live trading account (each trading account has a dedicated account number). Now you can fund your account using your chosen deposit method (provided that it is accepted by IG).

PayPal has become a popular payment method for funding forex trading accounts (and is an accepted payment method at IG); learn more by checking out my PayPal guide.

Check out this gallery of screenshots taken while setting up a trading account with IG:

Deposit options

Clicking the “Add More Funds” button just below your demo or live account will bring up the available funding options at IG. You can also click “Add Funds” from within IG’s mobile app under the “More” section.

IG supports a wide variety of payment methods (depending on your country of residence and the related IG entity that holds your account), such as via bank wire, payment via debit card, and through third-party payment providers such as Wise and PayPal.

Withdrawal options

Making withdrawals from your IG forex trading account is as simple as making deposits. Your options for withdrawing funds can be found directly within the client portal.

A few things worth noting about withdrawals: Depending on your account’s currency denomination, there may be minimum thresholds for withdrawing funds using debit or credit cards. The maximum you can withdraw using this method is $25,000 per day, and these transactions may take two to five days.

No limits on bank wire transfers: There are no withdrawal limits applied to bank wires at IG. These transactions are processed within one to three business days.

Mobile trading apps

IG's mobile app, IG Trading, competes with the best in the industry and won our 2025 Annual Award for #1 Mobile App. It comes packed with plenty of features that will satisfy both casual and advanced traders. The charts in IG’s app are my favorite from among all brokers, due to the extensive range of available features.

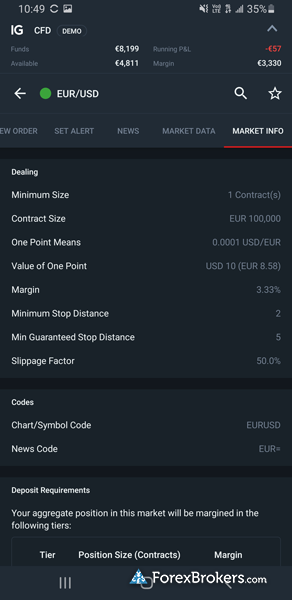

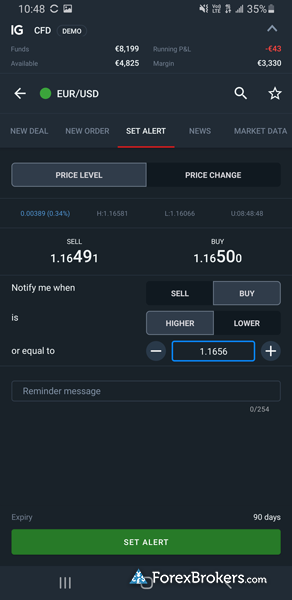

Apps overview: IG offers two trading apps: the popular MetaTrader 4 (MT4) app, alongside its own flagship mobile app, IG Trading (also known as IG Forex). There is also the IG Academy app for education, and IG Access for account security – but neither supports trading. The IG Trading app has a well-designed layout that’s teeming with features such as alerts, sentiment readings, and highly advanced charts. Research consists of news headlines from Reuters, signals from Autochartist, and PIA First.

Ease of use: IG’s mobile app does a decent job of balancing ease-of-use with the depth of its available features. Navigating integrated news headlines from Reuters, or switching to market analysis and trading signals is a breeze on IG’s app.

The only drawback is the lack of predefined watchlists or screeners, which makes it more difficult to sift through IG’s massive product list. Charts, however, are superb on mobile, and sync seamlessly with the web platform. For example, a chart template saved on the web can be applied to charts on the mobile appThere are syncing watchlists, though it’s worth noting that trend lines do not sync, like they do on SaxoTraderGO from Saxo. Still, there is a lot to like about the IG mobile app.

Charting: IG's mobile app is loaded with 30 technical indicators, 20 drawing tools, and 16 selectable time frames across five distinct chart types – including tick charts. Setting up charts is easy, and zooming in and out across time frames feels quick and precise. Chart indicators added on the web platform won’t automatically sync with the mobile app (although they can be saved as presets). Still, it was an absolute pleasure to use IG Mobile’s charts.

Educational videos: For educational content, IG offers a separate standalone mobile app called IG Academy.

| Feature |

IG IG

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlist Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 33 |

Other trading platforms

IG provides an outstanding selection of trading platforms and tools, with functionality that serves traders of all experience levels.

Platforms overview: While IG does offer the popular MetaTrader 4 platform, alongside the L2 Dealer DMA platform and ProRealTime charting software platform, I focused my testing on IG's award-winning web platform. Usability is at the heart of the experience for IG’s proprietary web-based platform, which won our 2025 Annual Award for #1 Web Platform and comes loaded with a vast selection of features.

Charts open from nearly any view, and display live market prices and streaming bid/ask rates. There is a seemingly endless variety of research and trading tools, including integrated risk-management modules. One minor caveat is that you must take a few minutes to set up the layout, as the default view is mostly empty – though you can save multiple custom layouts. IG's overall implementation of charts into the platform is why they are one of my top picks for day trading forex.

Charting: Default charts within the IG platform feature advanced functionalities, such as the ability to add up to four alerts to any of its 11 supported indicators. Besides five chart types, there is also a tick chart – a useful feature that isn’t offered by every broker. I also appreciated that zooming in and out and resizing the view across time frames all felt very fast and smooth. Lastly, trading from the chart with an integrated trade ticket shows risk/reward ratios, and allows you to drag stops/limits with great precision.

Specialty platforms: IG offers the MetaTrader 4 (MT4) platform and its L2 Dealer platform, where Forex Direct and Direct Market Access (DMA) are available for share trading. While I do not recommend MT4 due to its limited available product range, L2 Dealer - which requires a minimum deposit of $1,000 - can be a viable option due to the discounts available for active traders, and for its support of advanced algorithmic order types.

ProRealTime charts: ProRealTime – a third-party platform exclusively offered by IG in the U.K. – offers advanced charting with nearly 100 indicators and support for automated strategies. ProRealTime costs £30 per month unless you make at least four trades during each calendar period. While the ProRealTime layout is highly customizable, my testing left me thinking it could use a modern upgrade. For example, floating windows can get messy and are inferior to modern snap grid layouts. That said, its charts were an absolute pleasure to use, and I appreciated the automatic coloring of studies, which made them easier to view when adding multiple indicators.

Trading Signals: Traders who want to use forex signals will appreciate that PIA First and Autochartist are directly integrated within IG’s web platform. One thing I appreciate about IG’s integration of trading signals is the ability to copy a trading signal directly into a trade ticket. Learn more about forex signals by checking out our guide to the best forex trading signal providers.

Learn how to use trading signals on IG's web platform by checking out our video walkthrough:

| Feature |

IG IG

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 33 |

| Charting - Drawing Tools (Total) | 20 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 5 |

Market research

IG provides a vast selection of excellent quality market research from both in-house and third-party providers. The sheer amount of content in IG's platform – including in-house broadcasting with IGTV – helped it win best-in-class honors for Research in our 2025 Annual Awards.

Research overview: IG's research tools include streaming news and TV from Reuters, trading signals, in-house broadcasting via IGTV, and an economic calendar and weekly forecast (The Week Ahead series) in video and article format, alongside multiple daily blog updates with market analysis. IG also delivers 10 hours of daily live programming as part of its coverage of global markets. IG's platform is also fully integrated with TipRanks, adding in-depth analysis for those also using the broker to trade non-forex asset classes.

Advanced tools include a customizable screener for various asset classes, including CFDs on global stocks, forex. IG’s innovative “Recommended News” section personalizes your content, aiming to tailor headlines based on your account traits.

Market news and analysis: IG integrates Autochartist and PIA First into its platform, allowing traders to view trade signals generated by automated pattern recognition and technical analysis. These trading ideas can be conveniently copied with a single click, which pre-populates the trade ticket window. IG also provides multiple daily articles and videos that are posted throughout the trading week.

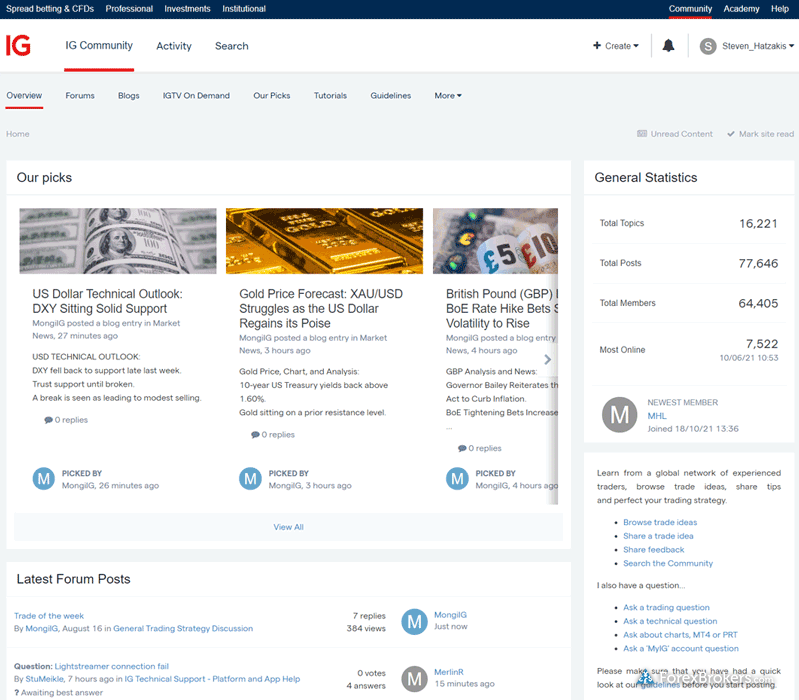

IG Community: IG recently launched the IG Community, a social network resembling an advanced forum that brings together over 60,000 users. While the content is crowdsourced, I still found it to be valuable as IG hand-picks the best research articles. There is also a timeline (akin to a social network) that shows member actions such as new joins, follows, and comments on threads.

| Feature |

IG IG

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

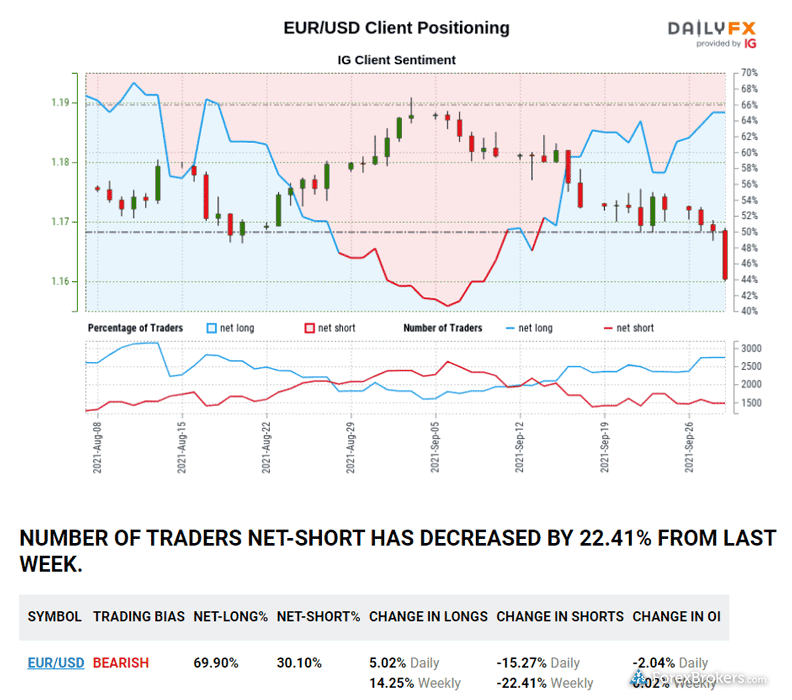

| Social Sentiment - Currency Pairs | Yes |

Education

IG, winner of our 2025 Annual Award for #1 Education, is a leader for its educational content. IG offers a vast selection of material in a variety of formats, including video, written articles, numerous weekly webinars, and guides. There are educational courses organized by experience level on IG Academy, complete with progress tracking and quizzes. IG also provides a dedicated mobile app for education, and its strong social community of over 64,000 members provides a selection of crowd-sourced articles.

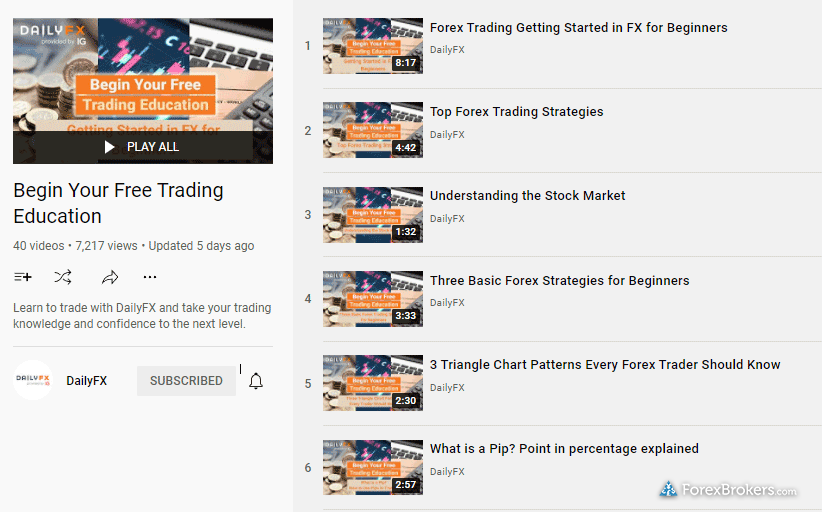

Learning center: Educational content is scattered across its website, its YouTube channel, and offers eight trading guides for beginners, five advanced guides, and written materials in a well-designed course that features progress tracking. In addition to educational content, there are seven articles about risk-management from Bollinger Bands, 17 beginner articles, and support is also available for additional languages.

IG Academy: IG Academy features eight courses that are organized by experience level, each containing nearly a dozen chapters. These courses are an interactive experience, with video content, lesson summaries, and quizzes incorporated throughout the coursework. There is also a final quiz where you receive a total score reflecting how many questions were answered correctly.

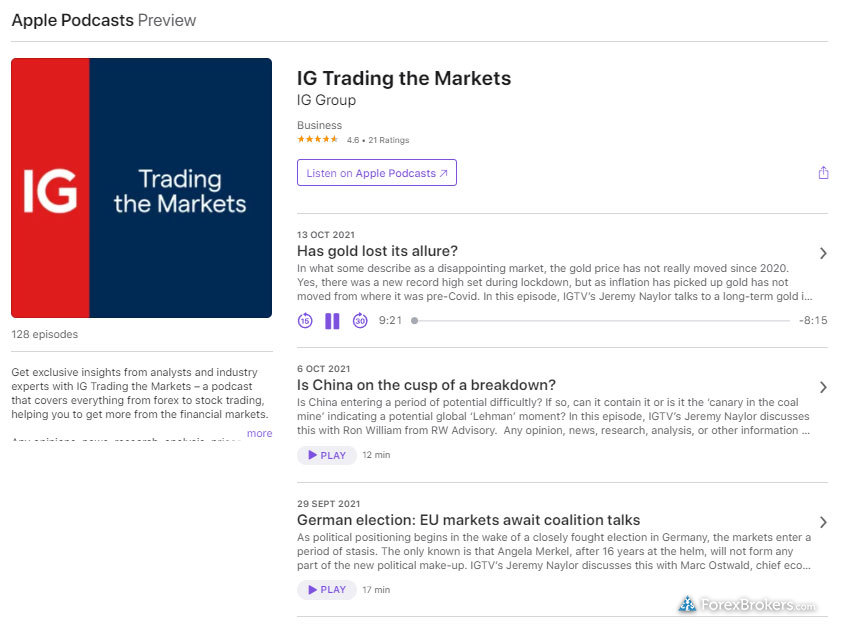

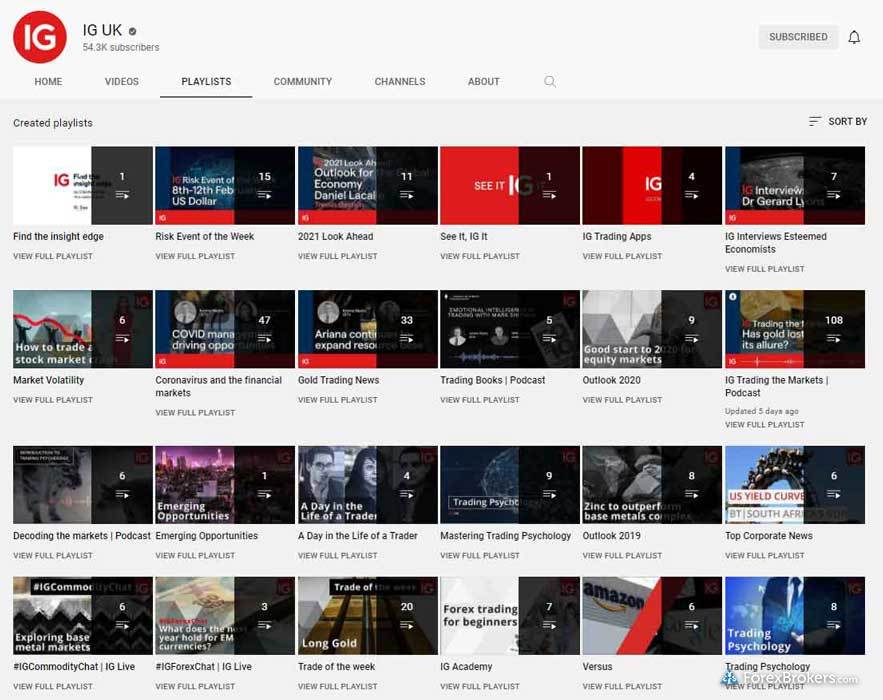

Videos: In addition to a wealth of archived content and various playlists on its YouTube channels, IG offers its own in-house broadcasting with IGTV. Featuring content such as multiple weekly webinars, weekly podcasts, IGTV is an excellent educational tool. IG staff also cover educational topics in a live format, such is the Technical Analysis Masterclass. Even archived webinars are organized by experience level, making it easy to find what you need quickly.

IG Community: As noted in the research section above, the IG Community produces content that is curated by IG. Some of this content takes the form of educational articles, while some of it has more of a narrative structure, with traders sharing their personal views, as well as their past trading successes and failures.

Room for improvement: As a leader in this category, IG has little room to enhance its already well-rounded educational offering. Consolidating content from the IG Academy mobile app into the main IG Trading app could be one way to bring all of its educational material into one place, which would make for a more streamlined, accessible experience. It also wouldn’t hurt to include more advanced material, in both written and video format.

| Feature |

IG IG

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Retail forex and CFD traders who want a trusted broker with brilliant tools, research, and access to nearly every global market (over 19,500 tradeable assets) will find that IG is a fantastic choice.

IG finished Best in Class across multiple categories in 2025, including Range of Investments, Platform and Tools, Research, Professional Trading. IG took first place in multiple categories in the ForexBrokers.com 2025 Annual Awards, including Overall, Mobile Trading Apps, Trust Score, Education, Beginners, and TradingView.

Bottom line, IG is my top pick for 2025.

Is IG legit?

Yes, IG is a legit, highly trusted broker with nearly 40 years in operation and a strong reputation as a well-regulated company. IG is publicly traded and holds numerous regulatory licenses across the globe, as well as a banking license in Switzerland. It’s also worth noting that IG has a market capitalization of 2.46 billion GBP (as of October 2023) – learn more about why these things matter by visiting our Trust Score page. IG recently acquired TastyTrade, following its entry into the U.S. market, and expanded into futures, options, and a vast array of other asset classes.

Is my money safe with IG?

Yes, IG holds more regulatory licenses than any other online broker that offers forex and CFDs. Its decades of operation, reputation, and requirements as a publicly traded company mean IG is considered a safe broker to hold client assets, including cash money.

IG holds your funds across a variety of banks and collectively services over 190,000 active clients as of its latest annual report for 2023. It is important to use a broker that is well-capitalized to reduce your potential counterparty risk, and IG’s market capitalization of over 2.94 billion pounds (as of January, 2024), makes it a safe choice.

Is IG available in the US?

Yes, US-based forex traders can benefit from IG’s platform suite, pricing, and regulatory licenses via tastyfx, IG’s new brand for US forex traders. Tastyfx is designed specifically to cater to the U.S. forex market and offers the same IG trading experience that has earned countless Annual Awards from ForexBrokers.com. Bottom line: If you reside in the U.S. and want to trade forex, tastyfx is IG’s answer for you. Read my tastyfx review to learn more.

What is the minimum deposit for IG trading?

The minimum deposit with IG varies from $250 or 300 euros (EUR), to as much as 2,500 Swiss francs (CHF), depending on which IG entity you choose to establish a trading account with as well as your country of origin.

For example, clients of IG South Africa must deposit at least 4,000 South African rand (ZAR), whereas at IG Japan the minimum is 35,000 Japanese yen (JPY). With IG Australia the smallest deposit for a live account is 450 Australian dollars (AUD); in Singapore, it’s 400 Singapore dollars (SGD).

If you are looking for a convenient way to make deposits into your IG account, we picked IG as one of the best forex brokers that allows traders to send and receive funds with PayPal. PayPal supports a wide range of global currencies and has an extensive international presence. Learn more by reading our full PayPal guide.

Is IG good for beginners?

IG has consistently ranked at the top of our education category, which is a key factor in determining the best brokers for beginners. IG delivers a wide range of powerful educational content and related materials as part of its IG Academy. which features university-style courses along with progress tracking and quizzes to help accelerate your learning.

Where is IG regulated?

Of the 60+ forex brokers in the ForexBrokers.com global database, IG holds the highest number of regulatory licenses and owns our top Trust Score rating. IG currently holds a staggering 11 regulatory licenses across a wide range of international jurisdictions, the majority of which are in top-tier financial hubs. This dedication to regulatory compliance makes IG one of the most regulated brokers in the world.

Let’s take a look at IG’s regulatory licenses:

Tier-1 Licenses

- Australian Securities & Investment Commission (ASIC) - Australia

- European Union Authorised (MiFID) - Europe

- Japanese Financial Services Authority (JFSA) - Japan

- Monetary Authority of Singapore (MAS) - Singapore

- Financial Markets Authority (FMA) - New Zealand

- Swiss Financial Market Supervisory Authority (FINMA) - Switzerland

- Financial Conduct Authority (FCA) - United Kingdom (UK)

- Commodity Futures Trading Commission (CFTC) - United States

Tier-2 Licenses

- Financial Sector Conduct Authority (FSCA) - South Africa

- Dubai Financial Services Authority (DFSA) - United Arab Emirates

Tier-4 Licenses

- Bermuda Monetary Authority (BMA) - Bermuda

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

About IG

As an early pioneer in offering contracts for difference (CFDs) and spread betting, IG was founded in 1974 and has grown to be a global leader in the online trading industry. IG is a London-based public company listed on the London Stock Exchange's FTSE 250 (LON: IGG) with a market capitalization of £2.94B as of January 2024.

As of its annual report for the financial year ending May 31, 2022, IG has over 2600 staff, servicing over 358,000 active clients globally across its regulated entities in the UK and internationally. Read more on Wikipedia.

ForexBrokers.com 2025 Annual Awards

For the ForexBrokers.com 2025 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Range of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Copy Trading, Ease of Use, MetaTrader, TradingView, Algo Trading, Crypto Trading, and Professional Trading.

ForexBrokers.com also recognized brokers that demonstrated excellence and innovation with our exclusive Industry Awards.

Category awards

| Rank #1 | Streak #1 | Best in Class | Best in Class Streak | |

| Overall | 7 | 9 | ||

| Range of Investments | 9 | |||

| Mobile Trading Apps | 2 | 8 | ||

| Platforms & Tools | 9 | |||

| Trust Score | 6 | 6 | ||

| Research | 9 | |||

| Education | 5 | 9 | ||

| Professional Trading | 4 | |||

| Beginners | 4 | 5 | ||

| TradingView | 1 | 1 |

Industry awards

| Rank #1 | Streak | |

| #1 Mobile App | 5 | |

| #1 Web Platform | 2 | |

| #1 Most CFDs | 1 | |

| #1 Forex Options | 5 |

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

IG Regulation, IG Academy, IG YouTube channelPopular Forex Guides

- Best Copy Trading Platforms for 2025

- Compare Forex Brokers

- Best Forex Trading Apps for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- International Forex Brokers Search

- Best Low Spread Forex Brokers for 2025

- Best Brokers for TradingView of 2025

- Best Forex Brokers for 2025

- Best Forex Brokers for Beginners of 2025