Top picks for bitcoin brokers

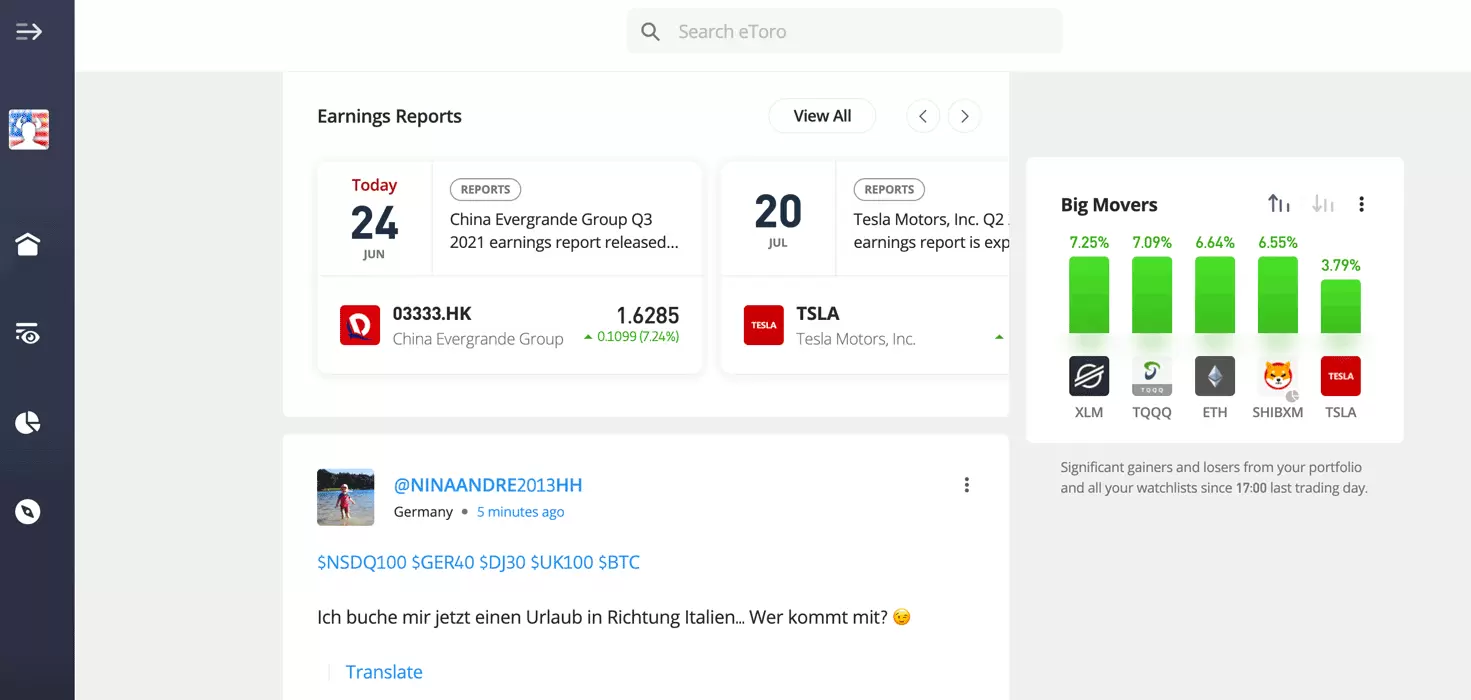

Best broker for crypto trading – eToro

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

eToro eToro

|

|

Yes |

Yes |

Yes |

eToro is a long-time pioneer of cryptocurrency trading and one of the first global forex brokers that offered bitcoin trading in the early years before it became an established asset class.

Selection of cryptocurrencies: eToro offers a wide range of 111 cryptocurrencies, including popular crypto tokens. Traders can compare daily movers, cryptos by market cap, crypto portfolios to copy, as well as crypto-focused investors. Directional signals from COINFI are also directly integrated within the platform, along with client sentiment.

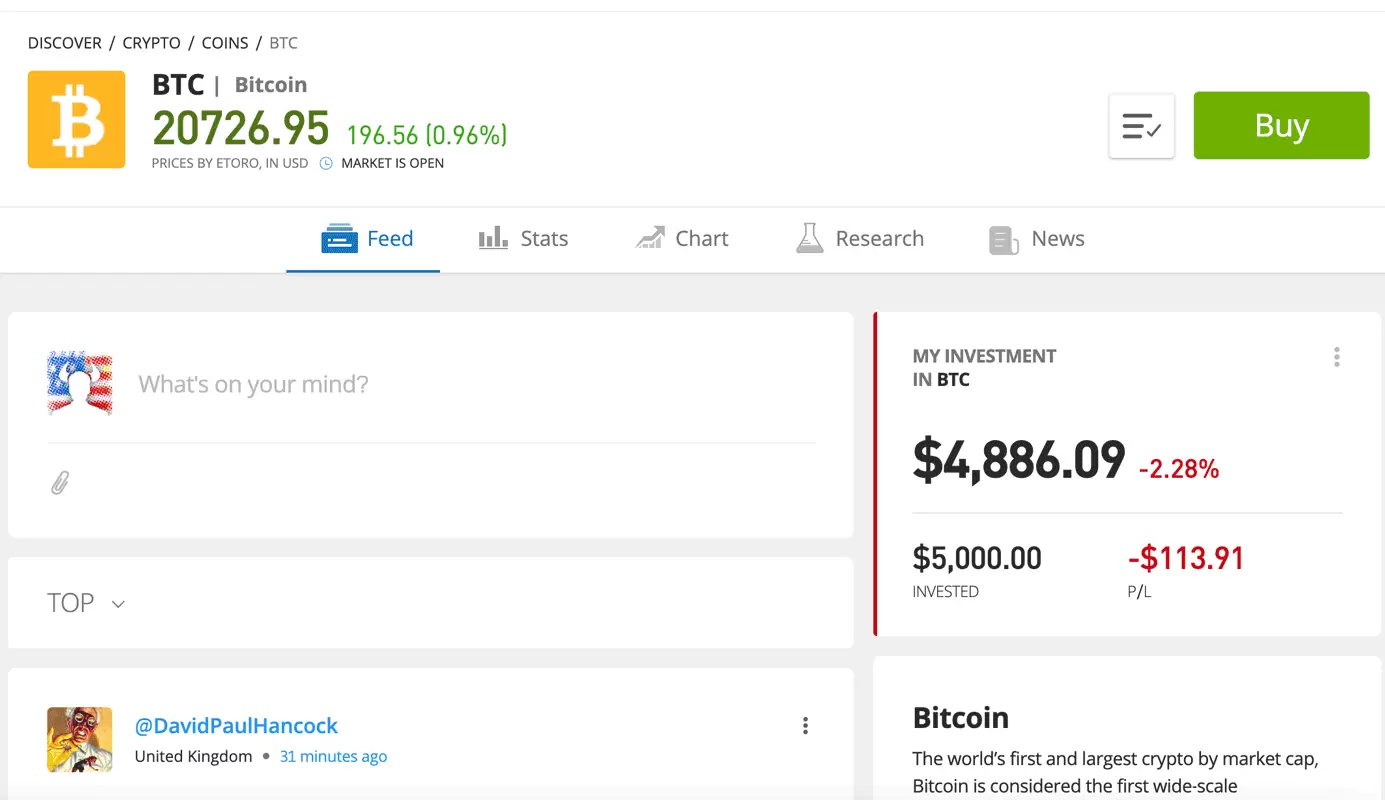

Trading costs: It’s worth noting that eToro is not a discount broker – it charges about 1% for buying or selling underlying crypto assets, in addition to prevailing spreads. There may be brokers out there that offer lower fees, but you won’t get the same research or trading tools that you’ll find at eToro. There is also a 2% fee (minimum $1) or maximum fee of $100 for transferring crypto out into the eToro Money crypto wallet.

Integrated copy trading and research: Additional standout features that make eToro my top choice for bitcoin and crypto trading across forex brokers include the integrated news and research articles within the “Latest News” section for each crypto asset, as well as the ability to copy trade crypto investors and crypto portfolios.

NFTs: In addition to cryptocurrencies, eToro has an app called Delta, dedicated to Non-Fungible Tokens (NFTs). This app lets you connect a Web3 wallet and explore NFTs across compatible blockchain networks. As an owner and creator of NFTs, I’m glad to see features like this coming to established brokerages such as eToro, helping to solidify its position as a market leader for cryptocurrency.

Find out more about its full range of offerings at my full eToro forex review.

Trusted Swiss crypto custodian – Swissquote

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

Swissquote Swissquote

|

|

Yes |

Yes |

Yes |

Swissquote is another early pioneer in the world of crypto trading and was one of the first global banks to offer the underlying bitcoin asset. It was also one of the first to launching exchange-traded products (ETPs) dedicated to crypto. It’s worth noting that traders don’t choose Swissquote for its low fees, but rather for the security of holding their crypto with a Swiss Bank.

Variety of crypto assets: Swissquote offers nearly 40 crypto assets, with underlying assets available via its in-house crypto exchange SQX, which includes digital asset custody via its Swissquote Wallet. The only downside here is that these are separate from its forex and CFD trading account. Multi-asset traders looking to trade crypto will have to open a separate crypto account and then switch between them from within the broker’s web platform.

Range of crypto instruments: Swissquote also offers bitcoin and ethereum futures contracts via the CME and EUREX. Other exchange-traded crypto products at Swissquote include crypto tracker certificates, mini futures via Swiss DOTS, crypto ETFs, and crypto ETPs.

Crypto Staking: Swissquote is one of the few forex broker banks that offers crypto staking, which allows you to lock your crypto assets for a period of time in return for interest that can be payable in native tokens. Staking is currently available across Ethereum (ETH), Solana (SOL), Polkadot (DOT) and Tezos (XTZ). Staking fees come to 20%, which is steep, but setting up manual staking would require self-custodial crypto wallets and quite a bit of technical expertise.

Learn more about its extensive range of tradeable symbols at my comprehensive Swissquote forex review.

Best for crypto derivatives - Interactive Brokers

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

Interactive Brokers Interactive Brokers

|

|

Yes |

Yes |

Yes |

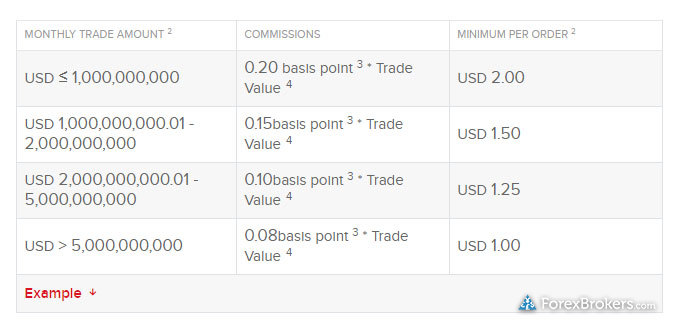

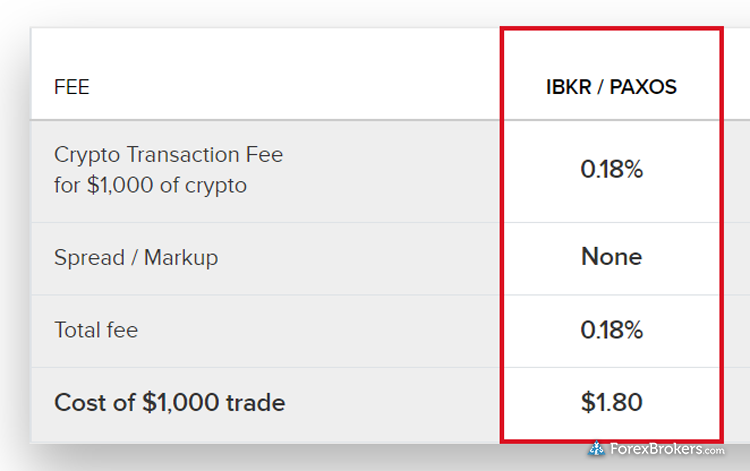

Interactive Brokers (IBKR) delivers a comprehensive cryptocurrency trading experience, with low crypto fees (ranging from 0.12% to 0.18% of trade value), professional-grade platforms, and access to the most popular crypto assets. Through its partnership with Paxos and Zero Hash, IBKR offers access to underlying crypto assets including Bitcoin, Litecoin, Bitcoin cash, and Ethereum. In addition to trading the underlying through its partnership with Paxos, cryptocurrency futures and ETFs are also available from IBKR (more on that below).

Underlying crypto assets: Unlike some brokers that limit crypto offerings to CFDs, Interactive Brokers lets traders directly buy and hold cryptocurrencies through Paxos and Zero Hash. This provides direct ownership of popular digital assets like Bitcoin and Ethereum, which can be securely stored or transferred externally.

Crypto futures and ETFs: In addition to direct crypto trading, Interactive Brokers supports Bitcoin futures through its platform via regulated exchanges such as CME and Bakkt, providing a familiar environment for derivatives traders from within the same account. IBKR also offers a wide selection of exchange-traded funds (ETFs) focused on Bitcoin (Bitcoin ETFs) and other cryptocurrencies, making it an excellent choice for investors looking to diversify within the crypto space.

Discover more about its wide range of available markets at my complete Interactive Brokers forex review.

Comparison of crypto brokers

| Company |

Bitcoin |

Ethereum |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Physical) |

Cryptocurrency (Derivative) |

eToro eToro

|

Yes |

Yes |

Yes |

Yes |

Yes |

Swissquote Swissquote

|

Yes |

Yes |

Yes |

Yes |

Yes |

Interactive Brokers Interactive Brokers

|

Yes |

Yes |

Yes |

Yes |

Yes |

Capital.com Capital.com

|

Yes |

Yes |

No |

No |

Yes |

Eightcap Eightcap

|

Yes |

Yes |

Yes |

No |

Yes |

Saxo Saxo

|

Yes |

Yes |

No |

No |

Yes |

XTB XTB

|

Yes |

Yes |

Yes |

No |

Yes |

FAQs

Is trading cryptocurrency legal?

In some jurisdictions, cryptocurrency is banned or illegal to purchase, trade, or own. Meanwhile, in other countries, it is perfectly legal. For example, in the United States (U.S.) and the United Kingdom (U.K.), it is legal to buy cryptocurrency from regulated brokers. However, CFDs are illegal to trade in both countries. The U.K. ban on bitcoin CFDs went into effect on Jan. 6, 2021.

United States residents: If you live in the U.S. we recommend reading our best U.S. brokers for bitcoin trading guide on our sister site, StockBrokers.com

.

Where you can buy and sell cryptocurrency?

There are three primary ways to buy and sell cryptocurrencies like bitcoin:

- Buy the coin (the underlying asset) - The most common way to buy cryptocurrency is to buy physical coins from an online crypto broker or exchange such as

eToro. Your bitcoin is then held and secured in a digital wallet provided by the broker (or you can withdraw it to the wallet of your choice).

- Buy a crypto CFD (contract for difference) - Another popular way to trade crypto is through CFDs. With a CFD, you do not own the underlying coin. Instead, you are betting on the direction that the crypto coin's price will go — either up or down. With CFDs, you can short the coin if you expect the price to go down. However, holding longer term can be expensive due to the cost of carrying CFDs overnight – you can learn more about how CFDs work by checking out our full-length guide to CFDs.

- Buy an exchange-traded product (ETP) - Exchange-traded products are a class of securities that can be anything from a structured product or fund to a derivative contract or trust. Bitcoin ETPs, for example, include exchange traded funds (ETFs), exchange traded notes (ETNs) and other securities such as the Greyscale Trust (GBTC) that aim to track the price of bitcoin.

currency_exchangeMore about Bitcoin ETFs

Curious about spot Bitcoin ETFs following their approval by the SEC? Check out my guide to the Best Bitcoin ETF Brokers to learn more about this exchange-traded product.

Note: Confused about the difference between a crypto broker or a crypto exchange? The term “crypto broker” is virtually synonymous with the term “crypto exchange” – all crypto exchanges provide crypto broker services, in that they’ll let you buy and sell currency via their online trading platform. That said, a crypto broker can, in some cases, refer to a dedicated individual – such as an institutional trader – working on a trading desk. While the individual on the trading desk is helping to “broker” each trade, it’s important to note that they will almost always utilize underlying crypto exchanges to execute their trades.

How do I know if a crypto broker is regulated?

To avoid scams, you should only use regulated bitcoin brokers. To verify a broker's regulatory status, start by determining the broker's legal name and country, and then find the appropriate regulator website to look them up. For example, a broker in the U.K. must be authorized and regulated by the Financial Conduct Authority (FCA). Here at ForexBrokers.com, we track, rate, and rank brokers across 100+

international regulators.

Which forex broker offers the most cryptocurrencies to trade?

Our research found that Capital.com offers the most cryptocurrency pairs to trade, followed by Eightcap and then eToro. It’s worth noting that Capital.com and Eightcap only offer crypto CFDs, while eToro investors can buy and sell bitcoin (as the underlying asset), trade crypto CFDs, and even copy trade other investors. After eToro, other crypto brokers that offer the underlying crypto assets include Swissquote and Interactive Brokers.

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to residents of the U.K. or the Netherlands.

Which crypto broker has the lowest fees?

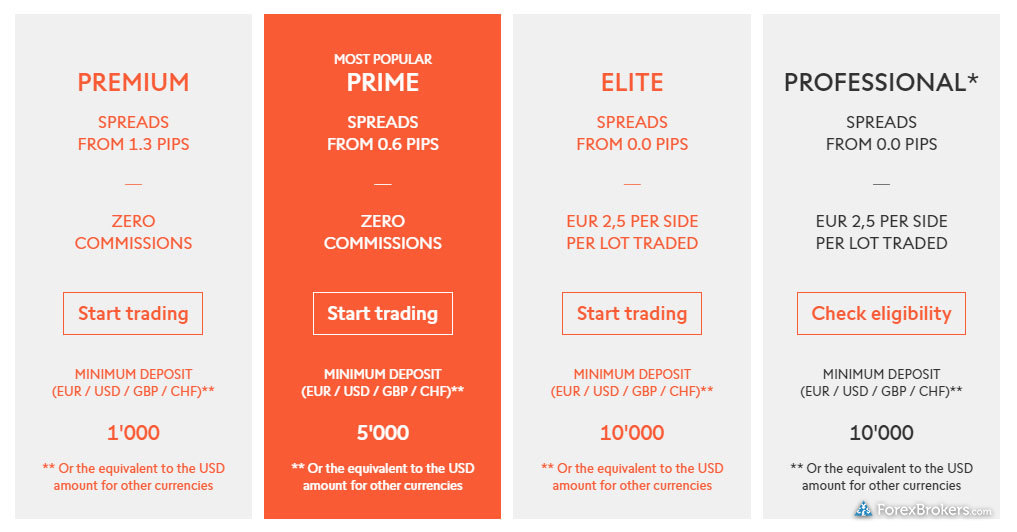

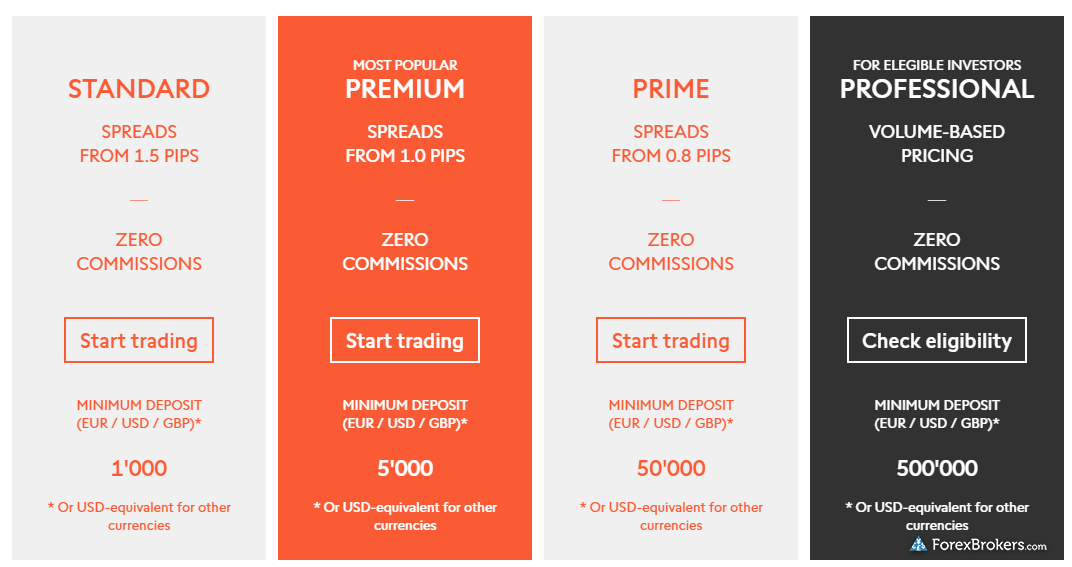

While Coinbase and Binance both offer entry-level pricing, Binance is cheaper with just 0.1% for the maker fee (when you place a limit order) or taker fee (when you place a market order), compared to Coinbase which charges 0.5% for both maker and taker fees on its base level (lowest) pricing tier. Binance and Coinbase are the largest cryptocurrency exchanges globally.

In terms of fees for active traders, Coinbase only outranks Binance when you compare the highest tiers offered by each broker. For example, for traders that surpass $1 billion dollars in volume — or 150,000 BTC — Coinbase is cheaper, offering a 0% maker fee and 0.04% taker fee. The 0% maker fee kicks in when you surpass $300 million on Coinbase, whereas on Binance you are charged a maker fee no matter how much volume you trade.

Which crypto broker is best for trading on a mobile device?

If you're after the best crypto broker for mobile trading, eToro is a clear standout. An early adopter of cryptocurrency, eToro delivers a sleek mobile experience that brings all the power of its web platform to its convenient mobile apps. Whether you're trading bitcoin or exploring other cryptocurrencies, the app makes it seamless to switch between crypto CFDs and actual crypto holdings with just a few taps.

Beyond the main app, eToro offers eToro Money, a dedicated crypto wallet that lets you securely deposit, withdraw, and manage real cryptocurrencies. It mirrors the intuitive design of the main app, making it easy to navigate your assets. Plus, the wallet supports social trading, allowing you to interact with the broader eToro community while managing your digital currencies. It's a practical tool for any serious crypto trader looking to keep everything in one place.

The eToro app gives you access to 111 cryptocurrencies, with features like integrated news, research, and the option to copy-trade top crypto investors. While the fees—about 1% per transaction—aren't the lowest out there, the tradeoff is a platform rich in tools, information, and features like Delta for NFTs. Whether you're using Android or iOS, eToro's mobile apps deliver a powerful, well-rounded crypto trading experience.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

eToro

eToro

Swissquote

Swissquote

Interactive Brokers

Interactive Brokers

Capital.com

Capital.com

Eightcap

Eightcap

Saxo

Saxo

XTB

XTB