City Index Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Backed by StoneX Group, City Index is a trusted brand known for its versatile trading platforms, excellent mobile app, diverse market research, and extensive range of tradeable markets.

However, average pricing and a limited MetaTrader offering hold City Index back from competing with the best forex brokers.

-

Minimum Deposit:

£100.00 -

Trust Score:

99 -

Tradeable Symbols (Total):

13500

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

City Index pros & cons

Pros

- City Index is part of StoneX Group (NASDAQ: SNEX), which is regulated in seven Tier-1 jurisdictions, one Tier-2 jurisdiction, and one Tier-4 jurisdiction.

- City Index’s flagship Web Trader platform offers a brilliant combination of advanced trading tools and integrated research.

- City Index's PlayMaker tool won our Annual Award for #1 Risk Management Tool the year it was launched.

- The City Index mobile app balances advanced functionality with ease-of-use, and offers features such as integrated research, news headlines, and market commentary.

- City Index also rolled out extended hours trading for US stocks via its CFD offering.

- Great choice for traders seeking a market maker broker.

Cons

- City Index doesn’t yet offer MetaTrader 5, and its MT4 offering includes a smaller product range.

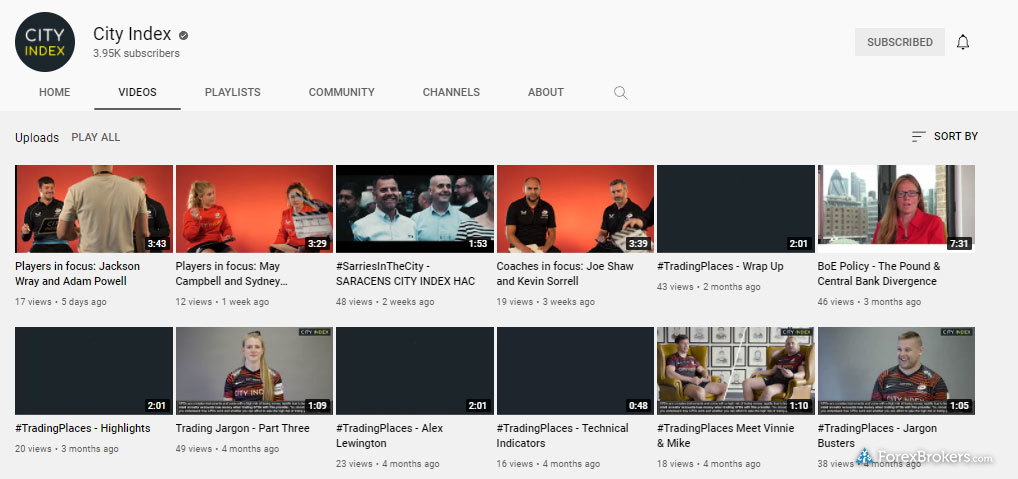

- City Index has resumed updating its YouTube channel with educational content but still trails the most active brokers in terms of the quantity of research articles it produces.

- SMART Signals subscription with in-house trading signals was discontinued.

Overall Summary

| Feature |

City Index City Index

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is City Index safe?

City Index is considered Highly Trusted, with an overall Trust Score of 99 out of 99. City Index is part of a publicly listed firm, the StoneX Group (NASDAQ:SNEX), that is authorised by seven Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). City Index, through its parent company (StoneX) is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Monetary Authority of Singapore (MAS), Financial Conduct Authority (FCA), Canadian Investment Regulatory Organization (CIRO), Japanese Financial Services Authority (JFSA), Commodity Futures Trading Commission (CFTC) , and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score.

| Feature |

City Index City Index

|

|---|---|

| Year Founded | 1983 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 7 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

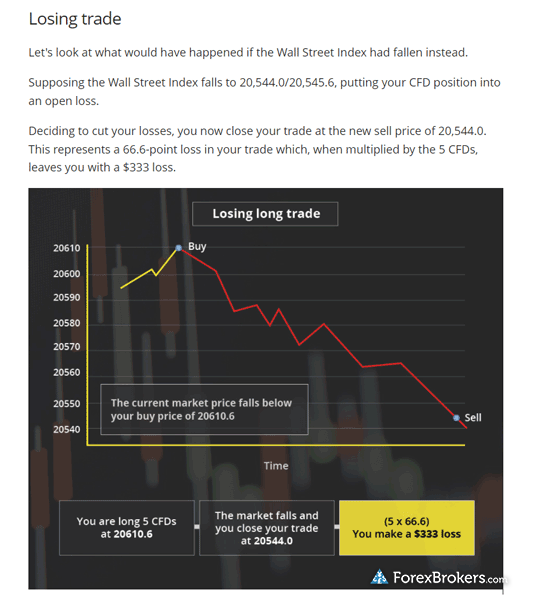

Like other brokers in the U.K., City Index offers spread-betting across its available markets, providing tax efficiencies for U.K. residents that aren’t available when trading CFDs. City Index also offers forex options and forwards. The following table summarizes the different investment products available to City Index clients.

Cryptocurrency: Cryptocurrency trading is available at City Index through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

City Index City Index

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 13500 |

| Forex Pairs (Total) | 66 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

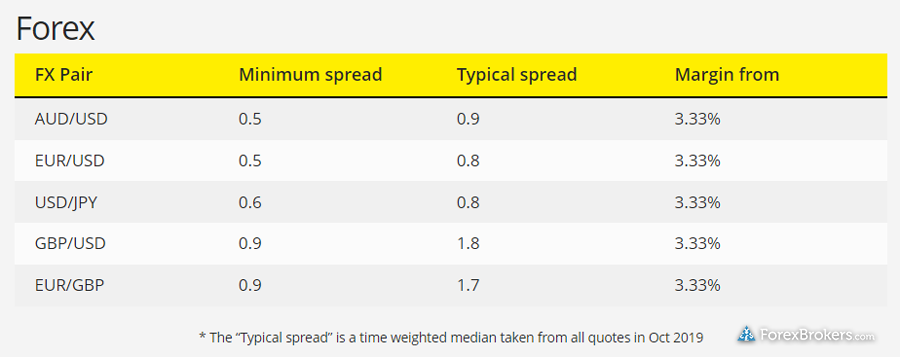

Pricing at City Index for trading CFDs, forex, and spread-betting products is in line with the industry average. For the best pricing, use City Index’s proprietary platforms or MetaTrader.

CFD account: City Index has an average spread of 0.74 pips on the EUR/USD as of July 2023, bringing the all-in cost in-line with the the industry average, yet still behind the best forex brokers in this category – such as Tickmill and FP Markets.

Active trader rebates and discounts: Rebates for U.K.-based professional traders start at £4 per million if you trade more than £25 million per month, and can reach up to £7.5 per million for volumes above £300M per month. Likewise, in Australia, rebates range from AUD $4.5 per million for tier one to AUD $14.5 per million for tier-3.

| Feature |

City Index City Index

|

|---|---|

| Minimum Deposit | £100.00 |

| Average Spread EUR/USD - Standard | 1.4 |

| All-in Cost EUR/USD - Active | 0.74 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

City Index’s cleanly-designed mobile app is a versatile trading tool and ranks with what’s offered by category leaders such as IG, CMC Markets and Saxo.

Apps overview: City Index offers its own proprietary mobile app alongside the popular MetaTrader 4 (MT4) platform developed by MetaQuotes Software Corporation.

Ease of use: City Index’s well-designed app offers a smooth user experience, whether you are adding alerts, depositing money into your account, reading news headlines, or placing trades. The MT4 mobile app is also available at City Index.

Charting: Charts are powered by TradingView, and come loaded with over 80 indicators and an assortment of drawing tools to assist your technical analysis. TradingView comes with powerful charting capabilities and is used by technical analysis enthusiasts across the world; learn more by checking out our TradingView guide.

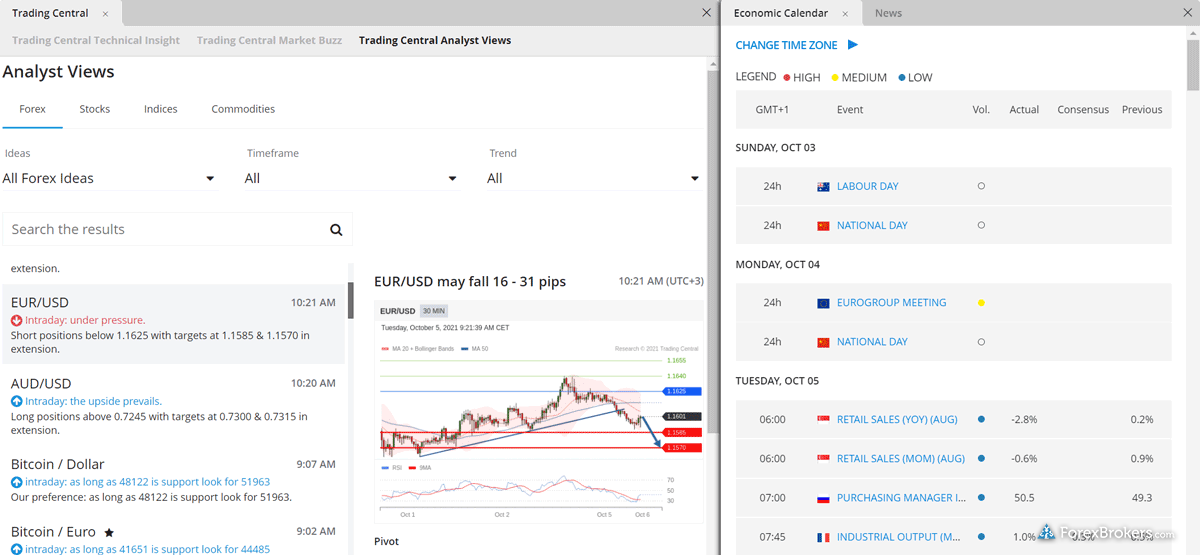

Trading tools: Trading Central modules are directly integrated into the City Index mobile app, including the Technical Insights, Featured Ideas, and Analyst Views modules City Index also supports complex order types such as trailing stop-loss orders and OCOs (the ability to close all trades in one order for a given instrument).

Other trading platforms

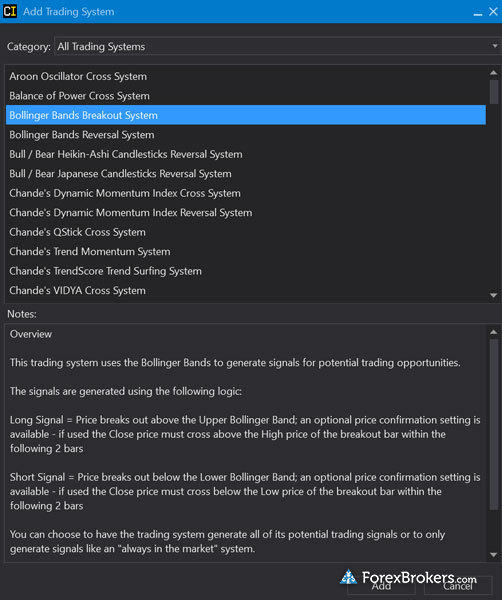

City Index’s proprietary Web Trader platform delivers a rich trading experience while providing access to City Index’s full product offering. Web Trader offers excellent trading tools and a variety of advanced features, and delivers access to more tradeable markets than MT4.

Platforms overview: Web Trader is designed for everyday traders and comes loaded with a wide variety of predefined screeners and layouts, and features the ability to execute complex order types – such as OCO orders. I found it easy to search across markets with Web Trader, from popular watchlists to accessing integrated research.

AT Pro desktop: City Index no longer promotes the AT Pro desktop platform, leaving Web Trader as its primary platform offering (other than MT4).

Charting: I found Web Trader to be responsive, flexible, and easy to use. Charts are powered by TradingView, and come with nearly 90 indicators and a vast array of drawing tools. Besides trading from the chart, I enjoyed the ability to drag your stop-loss or limit order to a new price level, which triggers an automatic update to your selections. This kind of time-saving feature is especially valuable for day trading, when speed matters and time is of the essence (check out my picks for the best brokers for day trading forex).

Trading Tools: It’s worth noting that setting up a new workspace with Web Trader can be cumbersome, as widgets must be manually arranged. Aside from that minor annoyance, the platform offers a good variety of features, including integrated research tools from Trading Central, as well as market commentary and headlines. Watchlists sync with its mobile counterpart, and there is module linking – in which charts can be updated by clicking on a symbol.

| Feature |

City Index City Index

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 88 |

| Charting - Drawing Tools (Total) | 239 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 11 |

Market research

City Index delivers high-quality market research that scores above the industry average. The only downside with its research coverage is a general lack of daily video content. Its in-house written materials are high quality, and market coverage is diverse.

Research overview: Trading Central’s suite of research tools are conveniently integrated directly within City Index’s flagship platforms. Other research highlights include daily editorial from City Index’s team of analysts, news headlines from Thomson Reuters, an economic calendar powered by FxStreet, and an SMS alert service for clients who wish to receive trading ideas directly to their phone.

Market news and analysis: City Index organizes in-house content under its Market News section with the ability to filter articles by asset class, category subject, and author. I found the content to be well-written, such as the Week Ahead Report which includes charts, and bullet point format updates for global financial markets. There are also occasional webinars that provide market forecasts for the upcoming quarter.

Video content: City Index appears to have resumed video production with new YouTube Shorts as well as some research and educational videos. It's great to see City Index ramping up the production of content for its YouTube channel.

| Feature |

City Index City Index

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment - Currency Pairs | Yes |

Education

City Index offers a rich educational experience that will satisfy both beginner and intermediate traders. Its YouTube channel has a robust archive of educational videos, but City Index offers fewer written articles than leaders in this category.

Learning center: The Training section of City Index’s website contains two main guides organized by chapter, with material for both beginner and intermediate traders. The beginner chapters cover basic categories that range from risk-management to forex and CFD trading, while the intermediate chapters cover advanced subjects such as options trading strategies.

In a break from the norm, City Index’s Trading Academy is a video series produced in the style of a reality show. The series follows a group of novice traders learning how to trade over a period of six weeks. City Index also produced its Celebrity Trader series, where celebrities share their own trading tips and tricks. All told, eighteen videos are available on City Index’s website. Archived webinars such as the “Become A Trader” series are also available on City Index’s YouTube channel.

Room for improvement: I was glad to see City Index incorporate progress tracking and quizzes in its already-impressive educational content, which are part of its revamped Trading Academy. Interactive educational experiences have become a new industry standard for trader education, and City Index has improved its offering in this category with its recently updated Trading Academy content.

| Feature |

City Index City Index

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Across its offices in Europe and the Asia-Pacific region, City Index provides access to a variety of global markets, as well as over 80 forex pairs and over 13,500 CFDs on its flagship web and mobile app.

MT4 is available for City Index traders – albeit with fewer markets to trade – and MT5 is only available in select regions for City Index clients. Until then, with the discontinuation of AT Pro desktop, algo trading is limited to MetaTrader, which remains the most popular platform globally for automated trading (in addition to TradingView).

Though City Index’s pricing might not lead the industry, its solid platform suite, wide range of tradeable markets, and exceptional proprietary mobile app will attract traders of all experience levels.

About City Index

Founded in 1983 in the United Kingdom, City Index has grown to become one of the leading multi-asset brokers after its acquisition in 2015 by GAIN Capital Holdings, the operator of FOREX.com. City Index’s parent, StoneX Group Inc (NASDAQ: SNEX), is a Fortune 100 company. City Index is a trading name of StoneX, which holds $7.8 billion in assets as of its latest annual report (2023), and caters to over 400,000 retail customer worldwide. City Index has over 30 years’ experience providing traders with Contracts for Difference (CFDs) and spread-betting derivatives. Read more on Wikipedia.

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Brokers for Beginners of 2025

- International Forex Brokers Search

- Best Forex Brokers for 2025

- Best Low Spread Forex Brokers for 2025

- Best Forex Trading Apps for 2025

- Compare Forex Brokers

- Best Copy Trading Platforms for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- Best Brokers for TradingView of 2025

More Forex Guides

Popular Forex Broker Reviews

Compare City Index Competitors

Select one or more of these brokers to compare against City Index.

Show all