Top picks for brokers best for beginners

Best forex broker for beginners - IG

| Company |

Education |

Mobile Trading |

Average Spread EUR/USD - Standard |

Minimum Deposit |

IG IG

|

|

|

0.98 info |

£250.00 |

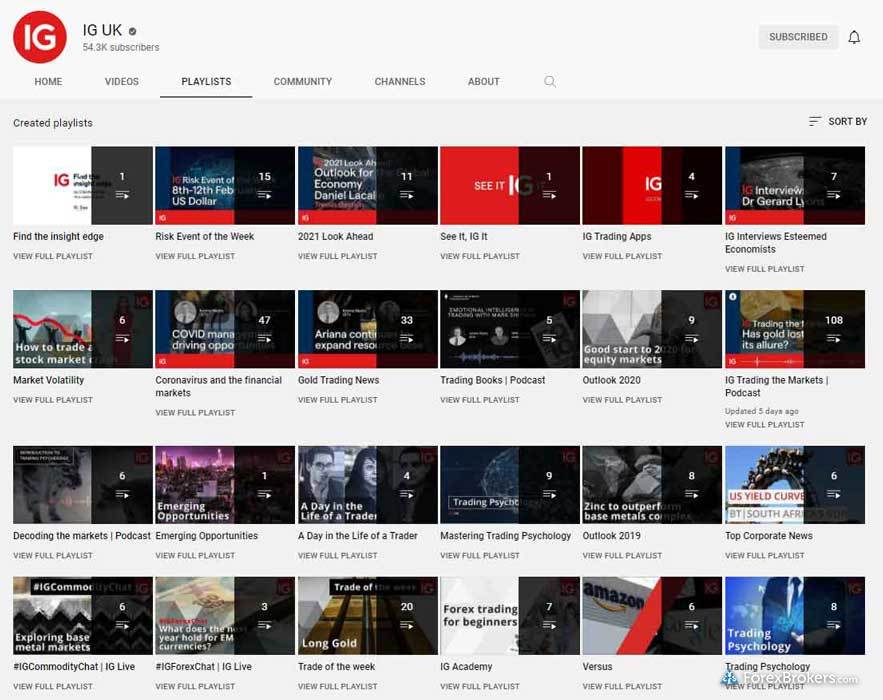

IG’s easy-to-use trading platforms and in-depth educational content make it a great choice for beginners or first-time forex traders looking for a reliable, highly-trusted broker. IG’s educational content is so highly rated that it won the ForexBrokers.com 2025 Annual Awards for #1 Education. Featuring a wide range of material in a variety of formats, IG’s educational articles, videos, webinars, and courses are designed to appeal to traders of all experience levels. IG even has a standalone mobile app dedicated to education.

Beyond education, IG is one of the highest-rated brokers I’ve ever reviewed for ForexBrokers.com and consistently rates at or near the top of nearly every important scoring category. As a result, IG was my pick for #1 Overall Broker in the ForexBrokers.com 2025 Annual Awards.

Highly trusted and reliable, IG is publicly traded (LON: IGG) and regulated in eight Tier-1 jurisdictions. It’s hard to pick a better-suited broker for beginner forex traders. I’ve been reviewing IG for almost ten years; learn more about why they’ve consistently been my top choice by checking out my IG review.

Best for copy trading - eToro

| Company |

Education |

Mobile Trading |

Average Spread EUR/USD - Standard |

Minimum Deposit |

eToro eToro

|

|

|

1 info |

$50-$10,000 |

eToro is well-known for being a pioneer in the copy trading space, but it’s also a great choice for beginner forex traders. In recent years, eToro has supercharged its educational content. Beginners will find videos, articles, weekly webinars within the eToro Academy all organized by experience level.

eToro also balances useful tools and powerful features within a user-friendly platform suite that is great for casual traders and beginner investors. I’ve found that eToro’s web platform and mobile app are easier to use than some of the more sophisticated trading platforms on the market.

One feature I like at eToro that beginners will appreciate is the educational tidbits that the broker integrates directly within its platform suite. For example, traders will find extra information next to each symbol available within its platform, such as information about trading instruments (like the EUR/USD currency pair), and general info to consider before investing. Learn more about the overall trading eToro trading experience by reading my eToro review.

Excellent for ease of use - Plus500

| Company |

Education |

Mobile Trading |

Average Spread EUR/USD - Standard |

Minimum Deposit |

Plus500 Plus500

|

|

|

1.5 info |

€100 |

An excellent choice for beginner forex traders thanks to its streamlined platform design and simple user interface, Plus500 is a great platform to get started on before progressing to more advanced platforms. Beginners looking for simplicity will find the Plus500 WebTrader platform intuitive and straightforward, complemented by more advanced features like guaranteed stop-loss orders (GSLO) and robust charting tools with over 100 indicators.

Traders at Plus500 also benefit from the +Insights analytics tool, which incorporates sentiment data from Trading Central and FactSet to help identify market trends. This feature, alongside a growing library of educational content, helped Plus500 earn Best in Class honors for Ease of Use, Trust Score, and Beginners categories in our ForexBrokers.com 2025 Annual Awards.

Plus500 is a great all-around choice for traders seeking simplicity without sacrificing essential functionality. Plus500’s proprietary platform provides a consistent experience across its web and mobile, making it a top contender for new traders. Like with any platform or broker, it’s worth remembering that just because a platform is easy to use, doesn't mean you will be successful trading. Find out more about its overall offering at my comprehensive Plus500 review.

Forex trading platforms education comparison

FAQs

What are some tips to get started forex trading?

Forex trading is complex and may not be suitable for everyone. Whether forex trading is right for you will depend on your individual financial situation, trading goals, and level of experience as a trader and investor. Beginners who are just getting started as forex traders should exercise caution; the majority of forex traders lose money.

That said, forex trading continues to grow in popularity. If you want to jump into the largest financial market in the world, here are my top 6 tips for getting started as a forex trader:

- Study free educational material. Before you even open an account, you should learn about forex trading to see if it's right for you. Check out my guide to the best free forex trading courses.

- Open a forex trading account with a trustworthy forex broker. Read through your forex broker’s applicable terms and conditions (it’s always a good idea to read all the fine print) and complete the live account application process.

- Fund your new brokerage account. You’ll need to choose a reliable deposit method (supported by your broker) for sending and receiving funds. Always make sure you are starting with an amount you can afford to risk.

- Try out a free demo account. Starting with a forex demo account (also known as virtual trading or paper trading) lets you try out your broker’s platform and get comfortable with the broker’s offering – without risking any real money.

- Create a trading plan. Even the best forex traders can lose money. The key to long-term success as a forex trader is to create a trading plan that helps you establish a consistent trading record, and keep your average losses low (relative to your average profits). Keep track of your trading plan (along with new forex lingo and trader jargon) in a dedicated trading journal. I suggest checking out StockBrokers.com's guide to the best online trading journals for some great resources

- Enter the forex market and place your first trade. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell. You are now a forex trader! Again, you should only risk funds that you can afford to risk and only scale up once you’ve established a consistent track record. Focus on managing percentage returns.

warning Pro tip:

If you're a beginner, you should familiarize yourself with the risks associated with forex trading. Beginners will also need to watch out for sophisticated forex scams. Check out my guide to forex scams to protect yourself – and your funds – from scammers.

Can I teach myself forex trading?

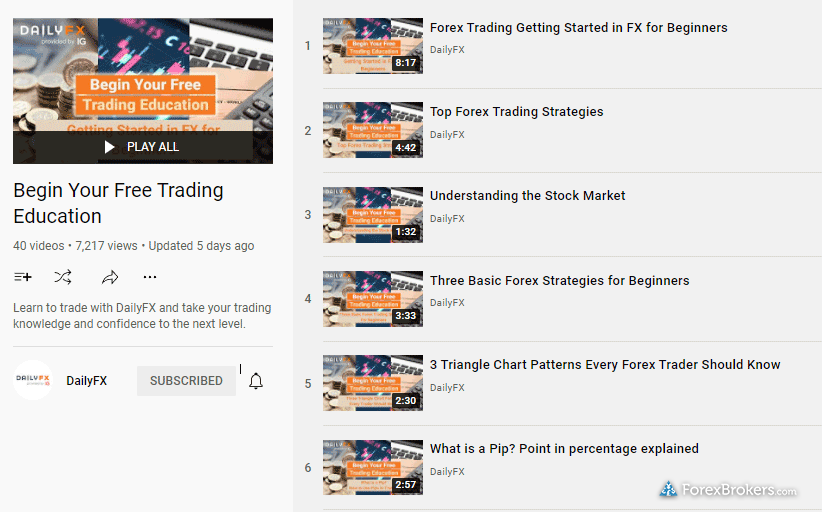

Yes, and you shouldn't pay for any courses as there is plenty of high-quality free education available directly from most online brokers, as well as third-party websites (check out my guide to the best free forex trading courses). However, forex trading is not easy — the majority of traders lose money.

To be successful in trading forex, you must learn how to manage risk properly, depending on your goals and the strategy you choose to follow or develop. First, open a free demo account and trade using fake money to learn how the trading platform software works.

What are some educational resources for first-time forex traders?

While studying the fundamentals of forex trading won’t guarantee success in the forex markets, it's an important first step for beginner forex traders.

Check out this quick video where I break down some of the forex market fundamentals and some important facts about forex trading:

The best forex brokers also offer a wide range of free educational materials in a variety of formats. We’ve compiled some free beginner’s resources as well as some expert tips for beginners to aid you in your forex educational journey. You can also check out my guide to the best free forex trading courses.

Free forex trading educational courses and resources:

How do I choose a forex broker?

Your first step when choosing a forex broker is ensuring that holds regulatory licenses from reputable jurisdictions. Choosing a regulated broker that is permitted to offer services in your country helps you avoid potential forex scams. Also, by selecting a trusted forex broker that is well-capitalized, you reduce the risk of the broker going bankrupt and losing your deposit.

To select a forex broker, start by looking for brokers that are regulated in your country and any available consumer compensation funds provided as protection against bankruptcy. Next, read full-length forex reviews. Finally, compare your top two choices side by side to decide on a winner.

auto_stories Pro tip:

Beginner forex traders should also consider trading costs, range of markets, available platforms, mobile trading apps (see our top picks for forex trading apps), market research and news sources, educational articles, and the quality of customer service that the forex broker provides.

Which forex broker has the lowest minimum deposit?

There are several forex brokers, such as CMC Markets, that advertise a $0.00 minimum deposit. This just means that you can open a live account and deposit whatever amount you’d like to start trading – there’s no minimum funding requirement.

The following five brokers have zero-dollar minimum deposit requirements for opening a live forex trading account:

Note: When deciding how much money to start with, be sure to keep extra costs in mind such as wire transfer fees and other transfer-related costs that may depend on your chosen payment method. It’s also important to consider the collateral (margin) you plan to use for your expected trade sizes.

Even if your forex broker does not have a minimum deposit requirement, you’ll still need a method for funding your account to place live forex trades. PayPal has become a popular way for forex traders to fund their trading accounts, due to PayPal’s extensive international presence and wide range of supported currencies. Check out our guide to the best PayPal forex brokers to learn more about using PayPal to fund your account, and to see our list of the best forex brokers that accept PayPal.

What is the best forex account type for beginners?

For beginners, a demo account is the best place to start in forex trading. Demo accounts allow you to practice trading with virtual funds, enabling you to learn the ropes without risking real money. Once you feel confident, transitioning to a micro account is ideal. Micro accounts let you trade with smaller position sizes (often 1,000 units), which limits your risk while still giving you real market experience.

Among forex brokers, IG stands out as the best choice for beginners. IG offers an extensive selection of educational materials, from webinars to tutorials, helping you build a solid trading foundation. Their intuitive platform is easy to navigate, making it perfect for those just starting out.

Another noteworthy option is Plus500, known for its beginner-friendly interface. The simple layout of its trading platform makes it easy for new traders to learn how to execute trades without feeling overwhelmed.

How to calculate your starting balance for forex trading

The amount of money you will need to trade forex depends on several factors, including your expected trade sizes, risk threshold per trade, the available margin requirements from the broker (i.e., leverage), and any minimum deposit requirement to open your account.

Let’s look at an example:

Say that you plan to trade one mini lot (10,000 units) of the euro currency, and your forex broker offers a maximum of 20:1 leverage. Your trading funds will need to cover at least 5% of the trade value just for the margin, and another €1 for every pip you plan on risking when the market moves against your position. Note: In this case, 1 pip is 0.0001 euros worth of currency.

That mini lot of 10,000 EUR/USD would require at least 500 euros in margin (based on the 20:1 leverage). If you wanted to risk no more than 200 pips per trade you’d need another 200 euros, bringing the required starting balance up to 700 euros.

Let’s look at a couple of other examples of how this could break down in your forex trading account:

Trading a standard lot: Calculating for the above trading scenario, but for a standard lot (100,000 units of currency), you’d just add an extra zero to each variable. The 20:1 margin requirement would be 5,000 euros and the pip value would be 10 euros per pip. Risking 200 pips would require 2,000 euros in risk capital, bringing the total to 7,000 euros.

Trading a micro lot: Likewise, calculating the same scenario for a micro contract or (1,000 units of currency per lot), we can just remove one zero from each variable. The pip value becomes 10 cents, the margin requirement would be 50 euros, and the risk capital (for 200 pips) would require 20 euros.

What are the most common forex trading platforms?

The most popular forex trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer advanced charting tools, technical indicators, and automated trading options, making them more suitable for intermediate and advanced traders who want more control and customization in their trading environment. To trade forex successfully, you'll need a reliable forex trading platform that facilitates order execution, analysis, and management of your trades. Most brokers provide their own proprietary platforms, but often third-party software like MT4 and MT5 can be used as well.

cTrader is another popular forex trading platform known for its powerful charting, copy trading through cTrader Copy, and support for algorithmic trading via the cTrader Automate module. It offers realistic backtesting with adjustable commissions and spread costs, and traders can connect via API using FIX credentials or the cTrader Open API. cTrader also ensures brokers have recognized liquidity providers for better trade execution, including partial fills. However, it's available from fewer brokers compared to MetaTrader, and its reliance on the .NET framework may not suit all developers. Despite its strong backtesting features, it's still less advanced than MetaTrader 5's cloud-based resources.

Finally, you’ll want to use software for market analysis. This can range from tools built into your trading platform, such as technical indicators and drawing tools, to separate programs for economic news and financial reports. A great example of a third-party app for analysis, which is often incorporated into broker's platforms, is TradingView, a popular trading platform that delivers a range of powerful charting functions, robust analysis tools, and engaging community features.

Is forex trading profitable?

The majority of traders lose money. Therefore, to beat the odds and make money trading forex, you must have a trading strategy that focuses not only on identifying trading opportunities (i.e., signals when to buy or sell) but also calculates the optimum trade size relative to your balance. In addition, your target risk and profit levels should be determined in advance using a stop-loss order and limit.

This way, you have a plan on when to exit a trade – whether at a loss or profit. To be successful in trading, you just need to keep your average losses smaller than your average profit (though of course, that’s easier said than done).

Gambling versus investing: One of the reasons that so many traders lose money is that they take risks that are larger than their budget allows. Many traders treat investments as they would gambling, where their risk is uncontrolled or unbalanced.

If you want to increase your chances of trading forex profitably, treat it as an investment by focusing on limiting your risk relative to the target profit on each trade. In addition, look for trading opportunities that have a higher probability of reaching their profit potential – though these may be harder to find, it’s sometimes better to wait for the right opportunity, rather than jumping into the market just because it is there.

Practice and skill are required to make money trading forex. Successful traders strive to make trades that, on average, return larger profits (winners) than losses (losers) over time. Historically speaking, several hedge fund managers have been able to get rich trading forex.

For example, George Soros made over £1 billion in profit by short selling the British pound in 1992, in what can be described (if one is prone to understatement) as a large bet. Read more about what's known as Black Wednesday on Wikipedia.

percent Pro tip:

Even if you have a sizeable investment portfolio or budget for trading, starting small and focusing on the percentage returns can be a great way to scale your investment over time.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IG

IG

eToro

eToro

Plus500

Plus500

AvaTrade

AvaTrade

XTB

XTB

easyMarkets

easyMarkets

OANDA

OANDA