Best Forex Chart Websites for 2026

Steven Hatzakis has been reviewing forex brokers for nearly ten years and has 25+ years of experience as a forex trader. His broker reviews are unbiased and independent, and his expertise is sought after for global FX conferences and speaking events around the world. Learn how we test.

Advanced forex charting tools help traders assess potential trends, analyze historical patterns, and perform sophisticated technical analysis. This guide will help you navigate the rich variety of forex charting technologies and dive into the best forex charting platforms in 2026.

Whether you are a beginner forex trader or a seasoned technical analyst, being able to chart the forex markets is an important skill. Basic forex charts help traders understand historical prices on a high level. Along with providing my picks for the forex brokers with the best charting software, I'll be describing a variety of chart types and how best to use them.

Best free charting tools provided by forex brokers

Many traders use the trading platform and integrated charts available directly from their forex broker. I’ve tested the platforms and charting tools of dozens of the top forex brokers. Below you’ll find my picks for the best free charting tools provided directly from the best brokers.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 71000

Saxo is a highly trusted financial institution with multiple banking and brokerage licenses and significant assets under custody. Saxo’s charting technology balances simplicity with advanced features. Watch lists, screeners, and alerts work together in unison, and the platform brings powerful features together without creating a cluttered user experience. Read full review

- 70,000+ instruments including forex options.

- SaxoTraderGo has advanced tools and a clean interface.

- Offers algo orders, risk tools, and execution by order size.

- TradingView implementation supports Pine Script and API trading.

- No progress tracking or quizzes in education content.

- Platinum and VIP accounts have high deposit requirements.

- SaxoTraderPRO lacks quick-start layouts.

- Can’t drag-to-edit orders on SaxoTraderGo charts.

- Minimum Deposit: £1

- Trust Score: 99

- Tradeable Symbols (Total): 19537

IG (LON:IGG) holds more regulatory licenses than any other broker in our database and ranks highly across nearly every major category. Charts on IG’s app are unmatched in the mobile trading space and charts on its web platform are equally impressive. The broker’s less-modern L2 desktop platform offers even more charting features. Read full review

- #1 Overall Broker in our ForexBrokers.com 2026 Awards.

- Highest Trust Score in 2026; most trusted forex broker.

- tastyfx brings IG access to U.S. forex traders.

- IG’s web platform requires some manual setup.

- MT5 is not available on IG.

- Only ~80 symbols available via MetaTrader.

- IG’s DailyFX news and research site has been discontinued.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 8500

IBKR is a highly-regulated broker (NASDAQ:IBKR) with significant assets under its custody. The broker’s powerful TWS desktop platform suite delivers highly capable charts and offers the ability to write custom indicators and scripts. Though its web and mobile charts are not as advanced, they still hold their place among the best brokers in this category. Read full review

- Access 150 markets in 34 countries; 28 base currencies.

- TradingView launched for both manual and algo traders.

- TWS desktop offers powerful tools for advanced strategies.

- New IBKR InvestMentor app offers beginner-friendly finance courses.

- TWS platform is overwhelming for beginners.

- No MetaTrader suite or copy trading tools available.

- $2 minimum commission can be costly for small trade sizes.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 12029

CMC Markets’ NextGeneration web platform and mobile application rank highly year after year and feature easy-to-use charts. The process for adding indicators is smooth and pattern recognition is directly integrated. Read full review

- 12,000+ instruments and over 282 forex pairs available.

- Next Gen platform is packed with tools and charts.

- Industry-best pricing with low spreads and active trader perks.

- Launched 24/7 crypto trading, following its acquisition of StrikeX.

- MetaTrader 4 has fewer symbols and limited product depth.

- Spreads have worsened slightly year-over-year on certain pairs.

- No automated trading on CMC’s proprietary platform.

- Education lacks progress tracking or interactive features.

- The quantity of research content produced has slowed.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 40000

Charts on the thinkorswim desktop platform are powerful, responsive, and can be loaded with numerous studies and indicators for performing complex technical analysis. Read full review

- thinkorswim supports advanced forex trading.

- Multi-asset access with 40,000+ tradeable symbols.

- Live webinars and strong educational content.

- Forex trading only available on thinkorswim and to U.S. residents.

- No trading signals or copy trading.

- Forex-specific education is limited.

- Minimum Deposit: Starts from $50

- Trust Score: 95

- Tradeable Symbols (Total): 440

Charts in FXCM’s Trading Station desktop platform are highly advanced and include the ability to use custom scripts and indicators. The web and mobile versions of this platform are more beginner-friendly. Read full review

- Wide support for algo trading.

- TradingView, MT4, and FXCM's Trading Station available.

- Trading Station charts come with 100+ indicators and tools.

- Under 500 tradable symbols.

- No MetaTrader 5 (MT5) support across any platforms.

- Research and education trail top-tier brokers like IG and Saxo.

- Minimum Deposit: $100

- Trust Score: 99

- Tradeable Symbols (Total): 5500

The FOREX.com desktop platform (previously known as FOREXTraderPRO) features robust charts, and the broker’s more modern web and mobile platforms support charts from popular provider TradingView. Read full review

- Trading Academy is great for all experience levels.

- Advanced charting through TradingView with 5,500+ symbols.

- Pro-grade trading tools on web and desktop.

- Spreads are higher than other low-cost brokers.

- Pricing is average unless you qualify for active trader discounts.

- Stock and futures trading require a separate StoneXone account.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why is forex charting important?

Every day across the world, millions of investors and traders use forex charts to assess price actions and historical market trends to plot potential future price trajectories. Charts are an important visual aid that can help forex traders analyze both the past and the present in the hopes of predicting a future outcome.

Even if you don’t believe in the importance of historical prices in predicting future trends, advanced charting software can be useful. The best charting tools allow you to drag and drop trade orders directly on the chart, manage your risk/reward levels, and view economic calendar events plotted into the future. The availability and usefulness of these features will of course vary depending on the provider, broker, and/or platform you are using.

Types of forex charts

The best chart providers will let you choose from numerous chart types that are far more complex than your run-of-the-mill line charts (where an ascending line means prices are rising and a descending line means prices are falling). I’ve been using forex charts of all kinds for over 20 years; below you’ll find some helpful explanations of some of the most popular chart types for forex traders.

Common chart types

Tick chart

In a tick chart, every “tick” (represented as a bar) expresses a price update. There can be multiple price ticks per second, and the price changes can be small or significant. Tick charts are not bound by time like candlestick charts. Tick charts represent the smallest level granularity for measuring intervals.

Mountain chart

Mountain charts function similarly to line charts. If you take a line chart and fill in the space below the line with color, you have a mountain chart. The resulting visual resembles a mountain, and the ridgeline represents the historical mountain price.

Candlestick chart

A candlestick chart is a way to interpret data about open, high, low, and close (OHLC) pricing information for a given duration. The “wick” of the candle can extend above and below the main candle formation to denote the high and lows of a given session. The bottom and top of the candle represent the open or close. If the close is lower than the open, the candle will typically be colored a shade of red, whereas if the candle closed higher than the opening price of the candle it will usually be colored a shade of green.

Advanced chart types

Heikin-Ashi chart

Similar to the candlestick charts, Heikin-Ashi charts take into consideration the open, high, low, and close prices (OHLC) but go a step further by factoring prices from the previous period in an effort to average out the prices and create a smoother appearance. As a result, some more granular information may be lost, but the chart may be easier to read. Heikin-Ashi charts are still available at a wide number of brokerages but are not as popular as traditional candlestick charts. Heikin-Ashi are slightly more complex and typically favored by traders experienced with technical analysis.

Renko chart

Renko charts appear as a series of blocks (also known as boxes or bricks) that are set a 45-degree angle from each other resulting in diagonal lines that either ascend or descend (depending on market conditions). With Renko charts, the block size can be calibrated to represent a specific number of points or pips. For example, if you have a block size set to 10 pips or points, then the market will need to move up (or down) more than 10 points in order for a new block to appear on the chart.

Note: Renko charts are not bound to time like candlesticks charts. As such, if prices stay within your block range, then no new block will form until the market prices passes above or below that threshold (which may takes hours, days, weeks, or even months).

Point and Figure chart

Functionally similar to Renko charts, Point and Figure charts display a series of vertically stacked Xs or Os. Each stack is either all Xs or all Os, and the height of each stack is determined by the size of the market movement and the box size for each X or O. For example, if you set the box size to 10 pips and the market increases by 50 pips, you will see 5 vertically stacked Xs. If the market drops by 20 pips, a vertical stack of Os will form with 2 Os.

Kagi charts

Kagi charts are a sophisticated type of line chart, in which the line changes from thick to thin (and vice versa) as market conditions change. Kagi charts factor in previous highs and lows, and are based on a predefined, specified threshold. For example, if you specify a 10-pip threshold, the market will need to reverse from its current levels by at least 10 in order for the chart line to change from thick to thin.

Important charting features for forex traders

Technical studies and indicators: The best charting providers for forex trading provide a comprehensive range of studies and dozens (in some cases, hundreds) of indicators that can be added to charts.

Indicators can be overlaid or added to charts in order to provide provide information via math formulas that can be complex or as simple as a moving average. For example, say you are looking at a daily candle chart with 50 days worth of candles. A simple 20-day moving average would compute the average across the last 20 days of prices and plot that as a line on your chart.

Algorithmic trading tools: Some charting providers will offer integrated algorithmic trading tools. These allow you to code your own strategy or select from a range of available automated trading strategies.

Data quality: The quality and accuracy of the historical forex price data from any chart provider can be an important factor when making calculations about potential future trajectories, as tiny deviations over time can lead to significant differences in the future. The best charting providers use high-quality tick data (which includes every single price update).

Final thoughts from a trader’s perspective

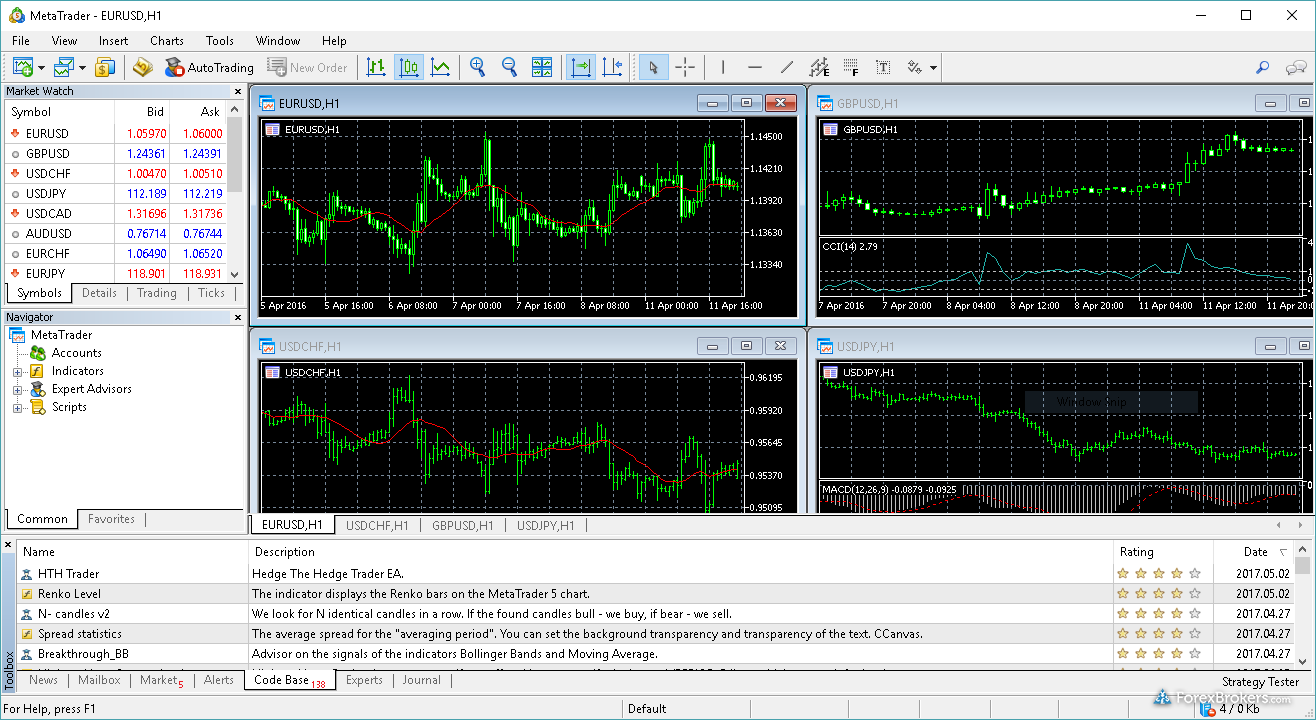

If you are just getting started as a forex trader and you are curious about forex charts, I’d recommend checking out some basic charts (like on Yahoo Finance). If, however, you want to dive deeper into the vast world of forex charting, dozens of the best forex brokers offer powerful charting options for free. I also recommend checking out third-party charting technology providers such as TradingView, MetaTrader, and cTrader.

ForexBrokers.com Overall Rankings

Now that you've seen our picks for the best brokers on this guide, check out ForexBrokers.com's overall broker rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Also take a look at our full-length, in-depth forex broker reviews.

Popular Forex Trading Tools and Platform Guides

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best MetaTrader 5 (MT5) Forex Brokers for 2026

- Best Forex Signal Providers for 2026

- Best Brokers for TradingView for 2026

- Best Trading Central Forex Brokers for 2026

- Best Forex Brokers with Trading APIs

Popular Forex Guides

- Best Brokers for TradingView for 2026

- Best Low Spread Forex Brokers for 2026

- Best Copy Trading Platforms for 2026

- Best Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- International Forex Brokers Search

- Best Forex Trading Apps for 2026

- Compare Forex Brokers

- Best MetaTrader 4 (MT4) Brokers for 2026

Saxo

Saxo

IG

IG

Interactive Brokers

Interactive Brokers