Top picks for forex options

Best broker for trading forex options – IG

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

IG IG

|

|

£250.00 |

0.98 info |

With both over-the-counter (OTC) and exchange-traded options on offer, via Turbos in the EU and exchange-traded futures in the US, IG is my top choice in 2025 for forex options trading. I've been testing and reviewing IG for over 8 years, and it consistently ranks as one of the best forex brokers in the world. Check out my IG review to learn more.

Options at IG: The diversity of instruments available for options trading at IG makes it a great broker for options traders; there are times when certain contracts are thinly-traded and being able to switch from one type to another can be advantageous when timing is important. For example, I might be looking for a certain strike price for a put option – if it's not available as a CFD option, I can look at the futures markets options through tastytrade, IG’s US subsidiary, or via Turbo options in Europe.

Options on CFDs: IG offers forex options on CFDs as one way to take a time-based position in the market, although the availability will depend on your country of residence (i.e. CFDs are not available in the US). For its vanilla options on forex, you can choose from a range of expiration dates, such as daily, weekly, or as far out as three months for OTC options.

Turbo Options: IG provides exchange-traded options as part of its Turbo options offering. Forex turbo options are traded on its regulated multilateral trading facility (MTF) exchange in Europe. Options products at IG range from plain vanilla options to Barrier Options, which allow you to set the knockout level and include pre-trade risk-management parameters such as stop-loss and take-profit.

Options on forex futures: tastytrade offers options on a variety of forex futures, including micro futures for $0.85 per contract and small futures options for just $0.50 per contract. Options on foreign currency futures including CME Futures, such as EuroFX (/6E), Micro Euro (/M6E) and eight other popular currencies. Plain vanilla options on stocks, ETFs, and indexes are $1.20 per contract (round-trip), with additional discounts as you trade higher volumes (i.e. 25 contracts would cost $15.00, which is great pricing for active options traders).

tastytrade, IG’s U.S. subsidiary: It’s worth mentioning the tastytrade options trading platform, which delivers innovative tools with advanced trading capabilities. The tastytrade acquisition in 2021 has helped IG gain an edge in catering to options traders. Whether you need advanced Greeks or complex multi-legged options strategies, tastytrade has some of the most sophisticated options trading platform technology in the industry. You can learn more about tastytrade by checking out the tastytrade review at StockBrokers.com.

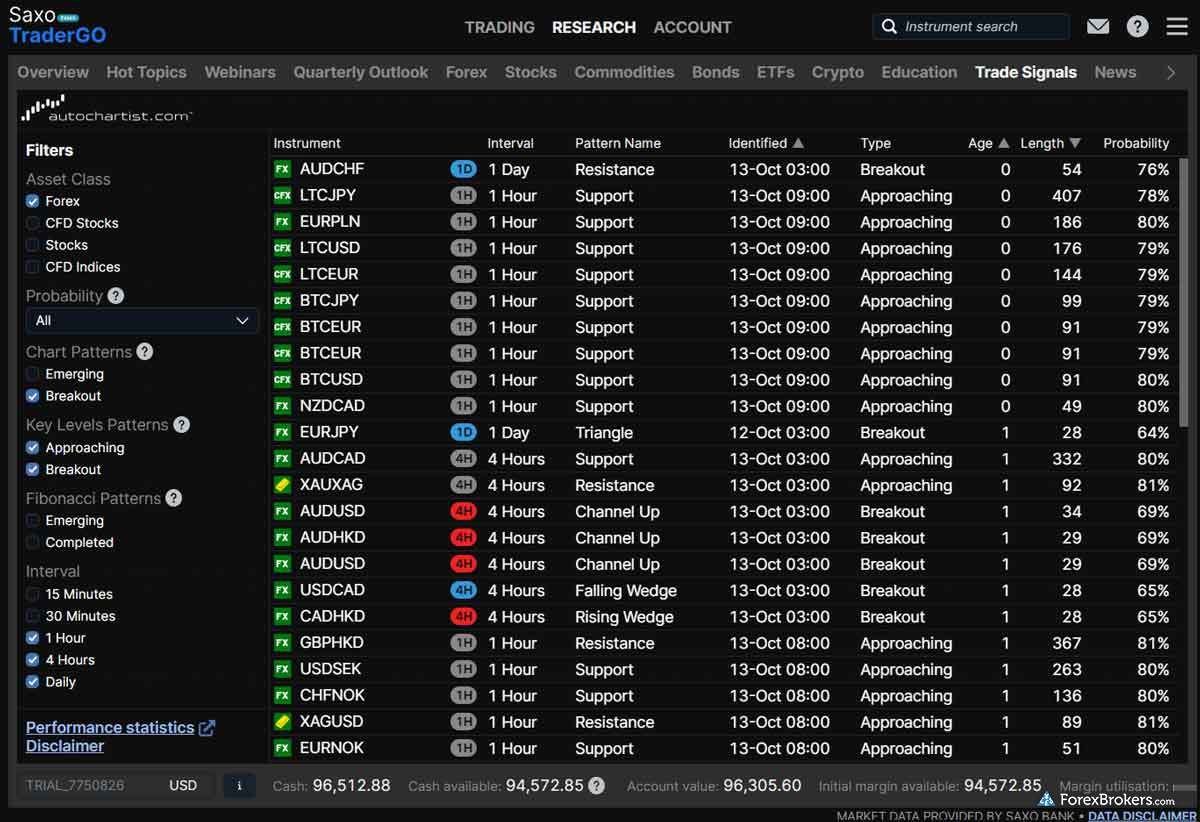

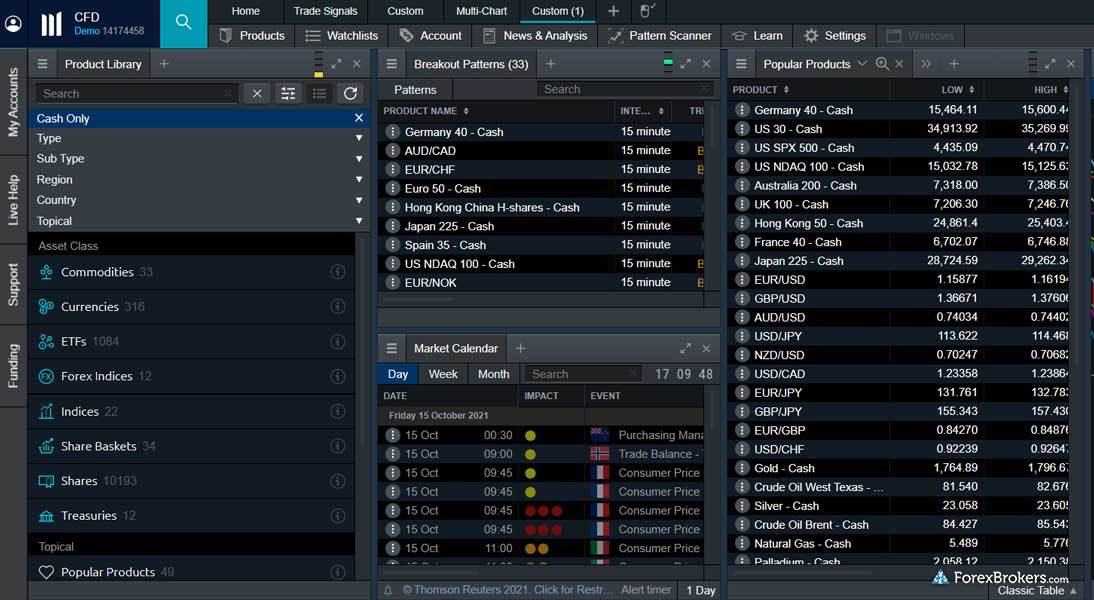

OTC and exchange-traded options – Saxo

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

Saxo Saxo

|

|

$0 |

1.1 info |

Saxo Bank, a multi-asset broker, is a long-time provider of both over-the-counter (OTC) forex options, and exchange-traded options.

Versatile order ticket for options: What I like most about Saxo’s forex options offering is that when you are trading forex, you can switch from spot forex to forex swaps to forex options, right from within the trade ticket window when creating an order. Choosing, for instance, a plain vanilla option will load a vanilla call contract, but then you can cycle through other contract types such as one-touch or no-touch options.

Advanced options analysis: For more advanced options strategies, Saxo has a dedicated options section under its markets categories, where you can choose from seven pre-defined options strategies, such as a Straddle, Strangle, Calendar Spread, or Butterfly, or create custom multi-legged positions, including net-credit and net-debit spreads. You can also analyze Greeks, for those who want more granular options metrics, and there is an integrated risk graph showing the options payoff diagram. Read my Saxo review to learn more.

OTC options, forwards, and countdowns – CMC Markets

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

CMC Markets CMC Markets

|

|

$0 |

0.61 info |

CMC Markets is a highly-trusted multi-asset broker that offers forex, shares, CFDs, and other derivatives including over-the-counter (OTC) options, forex forwards, and countdowns. It’s worth mentioning that while CMC Markets doesn't explicitly offer forex options, it offers many similar products both off-exchange and on-exchange.

CMC Markets recently added several OTC options on its CFD platform, mainly across U.S. and EU stock indices, with more assets expected to roll out. Its Forward CFD contracts and its exchange-traded options on CMC Invest constitute the bulk of its options offering.

Forward contracts: From the more than 210 available forward contracts (forwards contracts are available for 92 commodities, 66 indices and 37 treasuries), CMC Markets offers 16 forward contracts for forex, depending on the time of the year, as some contract dates may not yet be tradable. These contracts have expiration dates that range from the current month to three months out.

Exchange-traded options: CMC Markets offers both cash-settled and deliverable exchange-traded options (ETOs) from its Pro and desktop platforms via its CMC Invest brand in Australia (these products are not available on the NextGeneration platform, which is for forex CFDs and forwards). Note: The range of options strategies available will depend on your “Tier.” Tiers range from Tier 1, for buying basic puts and calls and simple strategies, all the way up to Tier 4, which is for more advanced multi-legged positions including naked puts and calls. Check out my CMC Markets review.

FAQs

What are forex options?

All forex options are either puts or calls, similar to regular options. Holding a put option conveys the right to sell while holding a call option conveys the right to buy. Like regular options, forex options are a riskier investment.

- The holder (buyer) of a put option has the right to sell the underlying asset at a specified strike price on or before expiration. A put option is a bearish (short) position that profits when the cost of the underlying decreases.

- The holder (buyer) of a call option has the right to purchase the underlying asset at a specified strike price on or before expiration. A call option is a bullish (long) position that profits when the cost of the underlying increases.

The gallery below contains pictures of forex options featured on the best forex options brokers.

What is the best broker for trading forex options?

IG is my pick for the best forex broker for options trading. IG offers exchange-traded as well as off-exchange (over-the-counter) options across a number of global marketplaces, as well as Turbos and other exotic options that cater to a wide variety of investor risk appetites. IG offers exchange-traded options in the U.S. through its TastyTrade subsidiary. In the EU, IG operates a Multilateral Trading Facility (MTF) for its exchange-traded forex options. It’s also worth noting that the off-exchange OTC options available at IG feature versatile contract sizes (compared to the standardized contracts you’ll find on exchanges).

Check out some screenshots of IG’s highly rated suite of trading platforms, taken during our product testing.

Forex options terms to know

Below are seven terms every trader should know before trading forex options:

- Strike Price - The price level the contract can be exercised at (i.e., exercise price)

- Time Value - The portion of the premium represented by any remaining time

- Spot Price - The current market price of the underlying asset

- Premium - The value of time remaining plus any positive difference between spot and strike price

- Break-Even Level - The difference between the Spot price and any time value

- Intrinsic - The positive difference between the strike price and underlying spot price

- Extrinsic - The negative difference between the strike price and the underlying spot price

Different types of forex options

Aside from differences related to where you trade forex options, there are also different forex options types beyond the plain-vanilla options, including more exotic currency options. Here is a basic course on options. Below are examples of varying forex option types:

- Average rate options

- Barrier options (turbo warrants, touch brackets)

- Swaptions (converts to a swap position)

- Currency warrants (long-term options)

- Binary options (Digital 100s)

- Countdowns

Why trade forex options?

While not suitable for all investors, options can be attractive to forex traders due to their inherent properties not found in other forex instruments. Below is a list of some of the perceived advantages of why investors trade forex options trading:

- Pre-defined risk when buying options

- No chance of a margin call or getting liquidated (except for Turbo or Barrier options)

- Can be used to offset or fully hedge an existing position

- A combination of options can create highly specific trading strategies

- Have pre-defined time remaining until expiry

- Can be highly risky if selling options with undefined risk or buying low probability out-of-the-money options

What is a forex put option?

A put option is a bearish (short) position that profits when the price of the underlying decreases.

A trader who is expecting the price of the EUR/USD to fall by a specific date may purchase a put option with enough remaining time-value.

What is a forex call option?

A call option is a bullish (long) position that profits when the price of the underlying increases.

A trader who is expecting the price of a currency pair such as the EUR/USD to appreciate by a specific future date may purchase a call option. The option should have enough remaining time-value to cover the trader's forecasted time-horizon for that trade.

What are the different levels of forex options trading?

Selling puts or calls to open a position will generally require considerably more margin than buying puts or calls. Forex traders in the US are required to get approval for that level of options trading, across the following four tiers:

- Level one options trading: Default level, includes protective puts and covered calls

- Level two options trading: Buying options (puts or calls)

- Level three options trading: Credit and Debit spreads (defined risk/reward)

- Level four options trading: Naked position (undefined risk)

What are some common strategies for options trading?

Depending on what you are expecting in the market for a given forex pair and time-frame, there are over a dozen popular strategies used to establish an options position with predefined risk in anticipation of specific market behavior related to price direction and volatility, some of which are listed below:

- A combination position includes more than one option in the same contract at the same time.

- A straddle (or strangle) combines writing (or purchasing) both a put and call at the same strike price (or different strike prices) and the same expiration date.

- A spread position is one where you are both the buyer and the writer (seller) of the same type of option, although strike price and expiry dates can be different.

What are exotic forex options?

Some forex options lose value if the underlying spot price touches a barrier level, such as a turbo warrant (known as turbos, or touch brackets).

- For example, if a turbo call option trades at a level below its strike price (i.e., breaking its barrier), it becomes worthless, even if the price recovers before expiration.

- Meanwhile, other forex turbos can have a barrier level that is different than the strike price level. Furthermore, a Turbo may have a barrier that only activates at a specific time, such as after one touch.

Are forex options cash-settled?

Almost all forex options are cash-settled, where no delivery takes place. Thus, it can be convenient to trade these financial instruments in the same way investors trade non-deliverable spot forex (i.e., CFD trading).

Can retail traders buy forex options?

Certain forex brokers will require that you are a professional client to trade options, such as Digital 100’s (binaries). At the same time, other brokers may also offer FX Forwards, in addition to forex options and currency futures, and forex instruments available to retail traders (i.e., CFDs).

Are there risks involved in trading forex options?

All types of forex options trading should be considered high-risk investments. Whether trading out-of-the-money options that have a higher probability of expiring worthless and thus could be deemed “riskier”, or even when trading an option that is deeply in-the-money with lower-probability of expiring worthless. In all cases, forex options are risky, complex financial instruments, and even if you understand them well, they may not be suitable for everyone.

Are forex options profitable?

The profitability of forex options will depend on a variety of factors, such as its strike price relative to the underlying market, the prevailing spread, the scope of any intrinsic and/or extrinsic value remaining in its premium, and the difference between these values when entering the market. The net result will be either a profit, loss, or break-even when factoring in the cost of the trade (i.e. any bid/ask spread, in addition to the changes in the value of premiums).

Here’s an example:

An investor expecting that the EUR/USD will appreciate above 1.1500 may purchase an American-style call option with a strike price of 1.1500. After fees, their break-even point might be 1.1550; this would require that the EUR/USD move higher than that point before expiration for the option to be profitable.

lightbulbFun fact

European-style options can only be exercised upon expiration, not before (though the contract can still be exited early with a profit or loss). Compared to an American-style option, improvements in the underlying price will not always reflect as quickly (or at all) in the value of the options premium, even with all other things being equal (i.e. strike prices, spreads, contract size, etc.).

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IG

IG

Saxo

Saxo

CMC Markets

CMC Markets

Interactive Brokers

Interactive Brokers

Charles Schwab

Charles Schwab

AvaTrade

AvaTrade