Top picks for TradingView brokers

Best broker for TradingView – IG

| Company |

Platform & Tools |

TradingView |

Average Spread EUR/USD - Standard |

Tradeable Symbols (Total) |

IG IG

|

|

No |

0.98 info |

19537 |

IG is my pick for the best forex broker in 2025 that supports integration with TradingView. Traders at IG benefit from its industry-leading execution and market access as well as TradingView’s powerful charting and technical analysis tools. IG’s overall high ranking across nearly every category helps to make it our top choice for forex traders using TradingView.

Market access and integration: With IG, traders gain access to over 19,000 instruments, including 13,000 CFDs across markets such as forex, indices, commodities, stocks, and cryptocurrencies.

Tight spreads and low costs: IG offers competitive pricing, with spreads on the EUR/USD averaging under a pip (based on our latest data). This low pricing, combined with its ability to handle large orders across its account types, makes IG an excellent choice for all types of traders.

Educational resources and research: IG provides comprehensive resources for traders of all experience levels, including detailed courses, with quizzes and progress tracking. In addition, market research is top-notch at IG, thanks to its TV-quality video production (which includes IGTV) and numerous news and analysis articles from its in-house staff and third-party providers.

Learn more about why IG is our consistently top-ranked broker at my full IG forex review.

Largest selection of markets to trade - Interactive Brokers

| Company |

Platform & Tools |

TradingView |

Average Spread EUR/USD - Standard |

Tradeable Symbols (Total) |

Interactive Brokers Interactive Brokers

|

|

Yes |

0.59 info |

8500 |

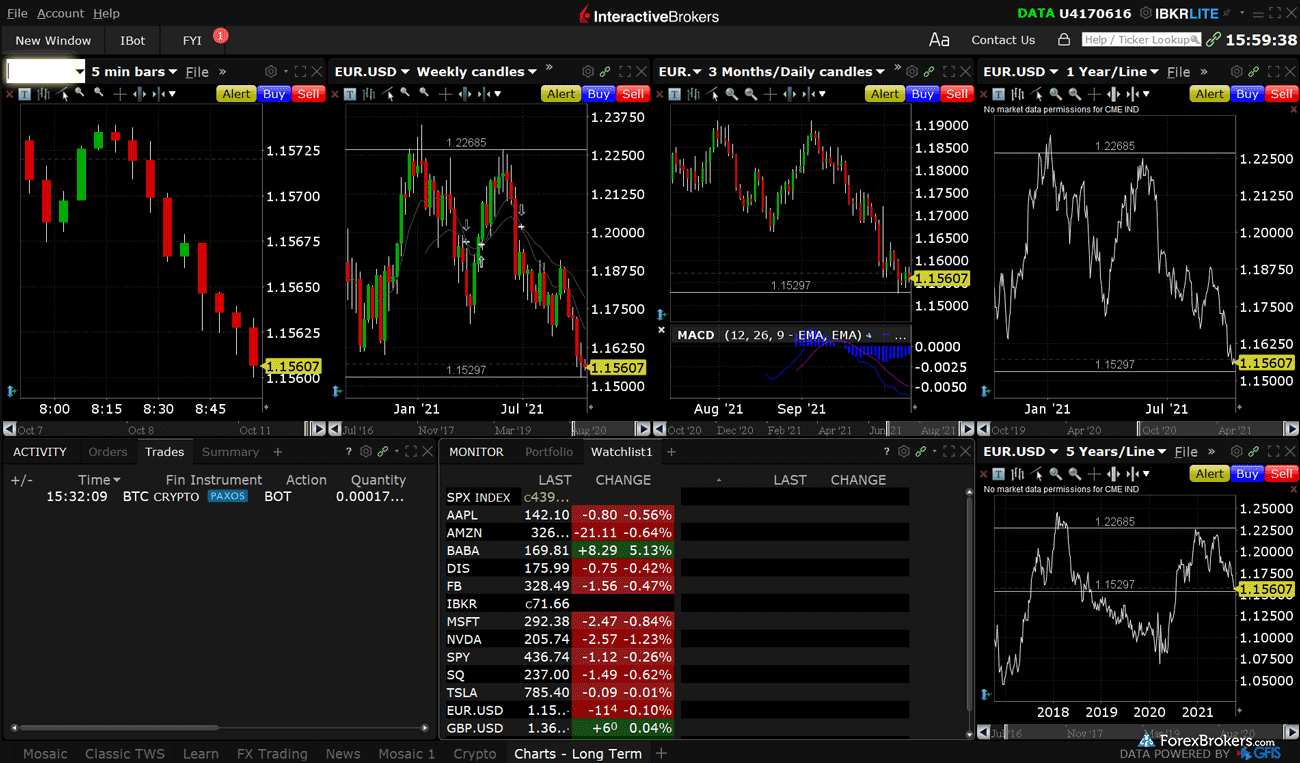

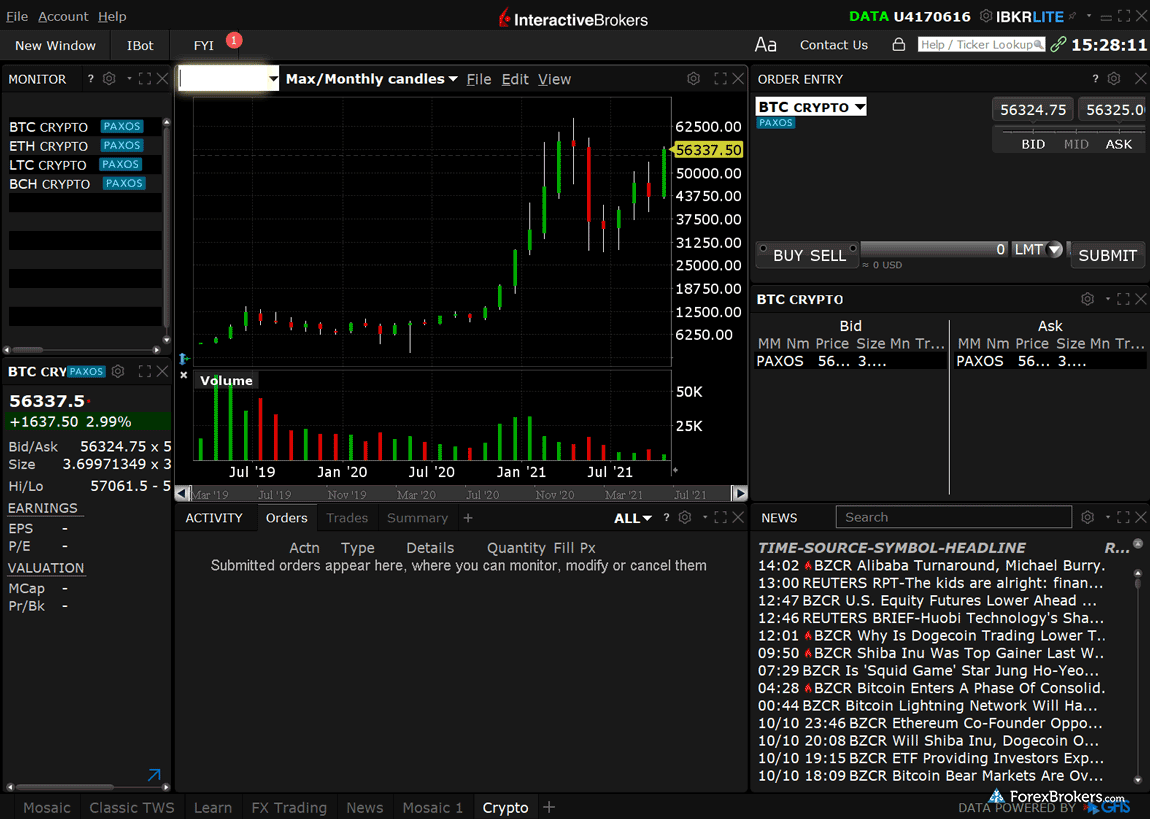

Interactive Brokers (IBKR) offers unmatched access to a vast range of global markets, making it the best choice for multi-asset traders using TradingView. Known for its institutional-grade tools, IBKR’s integration with TradingView brings advanced functionality to the platform’s diverse user base, including the ability to use TradingView’s Pine Script language.

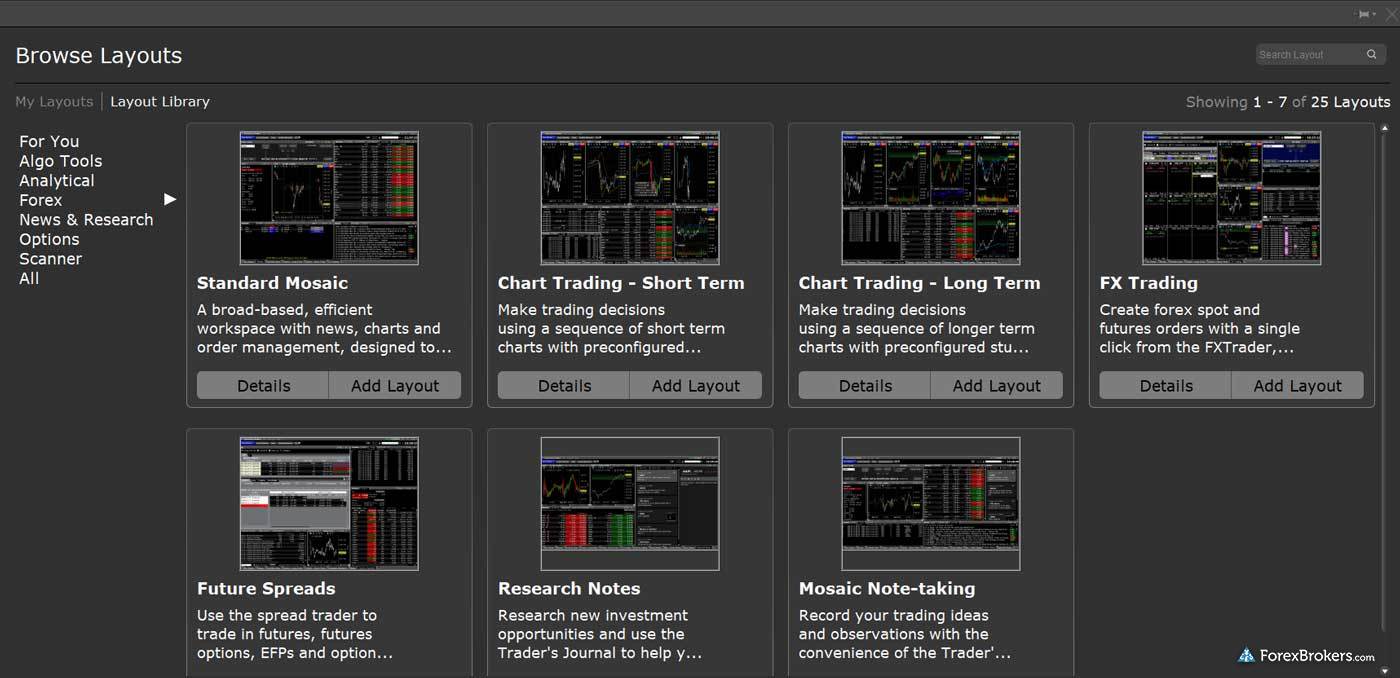

Cross-platform integration: IBKR's web-based platform, Client Portal, features charts powered by TradingView that allow traders to select from 98 indicators and add as many as 8 at a time. Beyond its use for charting, TradingView is also available on a standalone basis at IBKR to use as a dedicated trading platform.

Unrivaled market access: IBKR provides connectivity to over 130 global exchanges, allowing traders to access the widest variety of instruments, including forex, stocks, options, futures, and more. TradingView’s features, such as multi-timeframe analysis, custom indicators, and backtesting, are further enhanced when combined with IBKR’s extensive research tools and resources.

Low costs and tight spreads: With spreads as low as 0.59 pips on the EUR/USD (based on recent average spread data), low commissions, and transparent pricing, IBKR is great for low-cost trading. That said, it can be an expensive option if you trade less than one standard lot at a time, due to the minimum $2 commission per trade.

More generally, Interactive Brokers is a great choice for traders who wish to use TradingView because it is a highly trusted, well-capitalized broker in addition to the vast selection of markets, platforms, and trading resources it offers. Read more at my full review of Interactive Brokers.

Excellent research and a vast selection of markets – Saxo

| Company |

Platform & Tools |

TradingView |

Average Spread EUR/USD - Standard |

Tradeable Symbols (Total) |

Saxo Saxo

|

|

Yes |

1.1 info |

70000 |

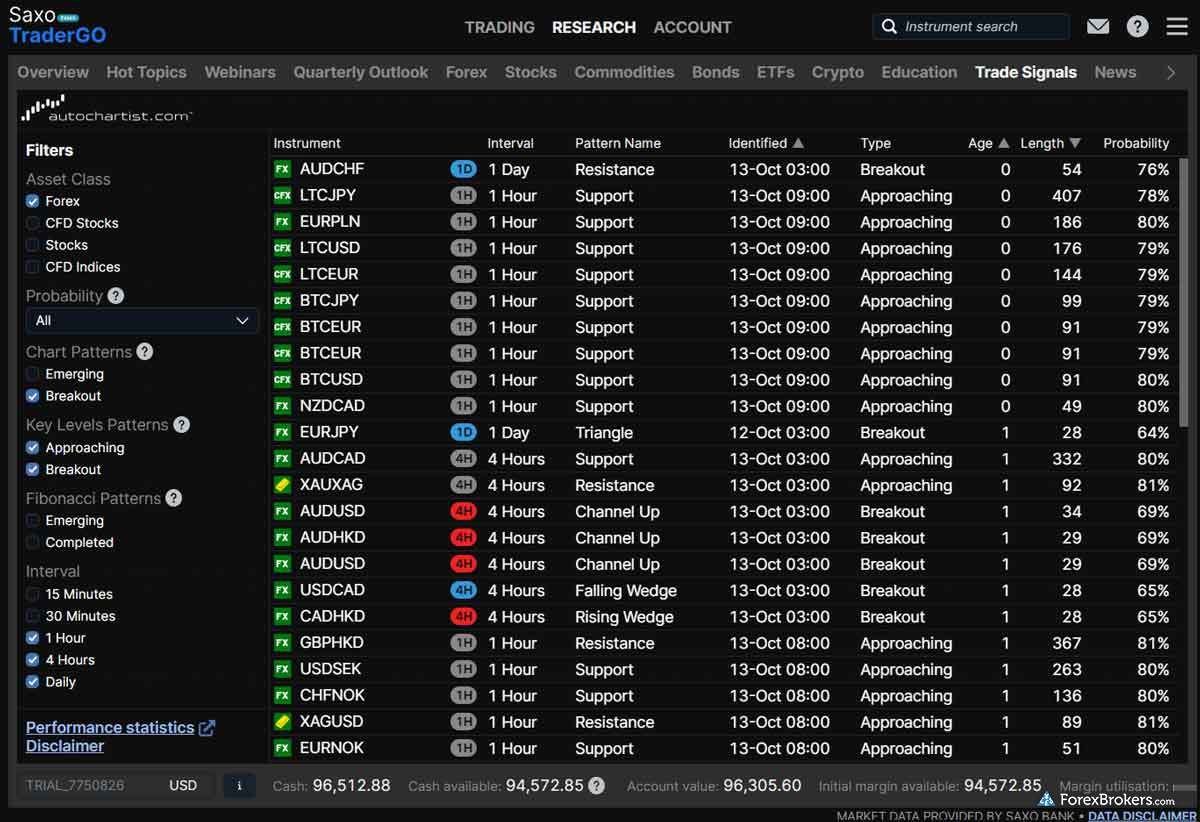

Saxo is again a top pick among the best forex brokers in 2025 for TradingView. Saxo continues to stand out due to its significant range of tradable instruments, robust order execution policies, high Trust Score, and world-class market research.

Algorithmic trading at Saxo: TradingView opens up the gate to algorithmic trading via the use of alerts and the Pine Script language, which is otherwise not available at Saxo unless you connect via their API. This makes Saxo an attractive broker to use with TradingView because of its ability to execute large orders, including by running Pine Script code within the TradingView platform.

Pricing and fees: While Saxo is not a discount broker and usually has a minimum trade size or commission that could be a hurdle for budget investors, it still delivers low average spreads for forex trading and provides transparency in its costs and execution statistics. In addition, if you plan on holding positions for the longer term, the custody fees at Saxo can be waived when you opt into its securities lending program. Last but not least, Saxo offers deeper discounts on its Platinum or VIP accounts, which can be a great money saver for active traders who meet the volume or deposit requirements to qualify.

Traders at Saxo can use their existing brokerage accounts and platform logins with the TradingView platform, granting them access to the same vast numbers of forex pairs, CFDs, stocks, and thousands of other symbols across Saxo’s wide range of global markets. Learn more by reading my in-depth review of Saxo.

FAQs

What is TradingView?

TradingView is a popular trading platform that delivers a range of powerful charting functions, robust analysis tools, and engaging community features. TradingView allows traders to track various assets (such as forex, stocks, crypto, derivatives, and other securities) using integrated watchlists, follow other users and community members to see their trading ideas and chart setups, and trade a variety of assets thanks to its integration with a growing number of brokers.

Available to traders across a wide range of asset classes, TradingView has become immensely popular (TradingView’s site boasts “60M highly engaged users a month”) and is enjoying adoption across the globe by some of the biggest brokers in the industry.

I first started using TradingView ten years ago. In those days, it was a simple charting application. It has since evolved into a fully-loaded trading platform for web, mobile, and desktop, and now delivers a growing list of features, tools, and integrated social media applications that helped it win our 2024 Annual Awards for #1 Trading Platform Provider and #1 Charting Technology Provider.

For more details on every feature that the platform offers, check out the comprehensive TradingView review on our sister site, StockBrokers.com.

query_statsReal-world example:

Back in 2017, I used TradingView to create a chart that analyzed pricing trajectories of Bitcoin when it was at ~$4,000. With the platform’s integrated social media capabilities, I was able to easily share my TradingView chart on my Twitter profile.

Which forex brokers offer integration with TradingView?

Here is a list of forex brokers that offer TradingView in 2025, based on data pulled from our independently researched database of the top forex brokers. This list is ordered by our latest ratings and rankings:

Do I need a broker for TradingView?

Yes, you’ll need a broker that supports TradingView integration if you want the ability to execute trades, track your orders, and/or manage your positions from within the TradingView platform. That said, if you are only using TradingView to conduct technical analysis, use charts, and/or discover trading ideas from the TradingView community, then you won’t necessarily need the platform to be connected to a broker.

In my view, however, it just makes more sense to have your TradingView platform connected and integrated with your forex broker. If you want to move quickly to take advantage of a trading opportunity, for example, having to switch platforms to a different (unsupported) broker can be an unnecessary impediment.

reportChoose a regulated forex broker

Looking for a forex broker that supports TradingView integration? Choosing a well-regulated, properly licensed forex broker can help traders and investors avoid scam forex brokers. My educational series about financial scams has helpful tips for identifying common forex scams.

How do I connect a broker to TradingView?

Connecting TradingView to your forex broker of choice is relatively simple. In order to do so, however, you’ll need to have a live trading account with a compatible broker that offers TradingView. To get started, just log into the TradingView web platform and open the chart view. Then, you simply navigate to the Trading Panel section and select your supported broker of choice (you’ll need an existing broker account login).

How much does TradingView cost?

TradingView offers a free default version of the platform, as well as various paid versions that offer greater flexibility and a wider range of features. TradingView’s paid versions include Essential (which starts at $14.95 per month), Plus ($29.95 per month), and Premium ($59.95 per month). These upgraded plans deliver a host of benefits that aren’t available with the free version, such as a greater level of customization and an increase in the number of available indicators, charts, and saveable chart layouts.

Other perks include an ad-free experience, custom time intervals, and alerts that don’t expire. My personal feeling based on nearly a decade of experience with this software is that unless you are a hardcore TradingView user or a professional trader, the free version of the TradingView software should work just fine.

How do you paper trade on TradingView?

The best way to paper trade (practice trading without risking real money) on TradingView is to open a free demo account with a compatible broker that offers the TradingView platform. Once your demo account is set up, you can either log in to the broker’s version of the TradingView platform or connect to your broker directly through TradingView’s Trading Panel tab.

Demo accounts are a great tool that can help you learn more about how your broker’s trading platform works without risking any of your real trading funds. I’ve always recommended that beginner forex traders use demo (or, virtual) accounts to practice trading before moving on to a live forex trading account with a trusted forex broker.

schoolNew to forex trading?

Check out our beginner’s guide to forex trading for tips and tricks for beginner forex traders and to see our picks for the best forex brokers for beginners.

Is TradingView good for trading forex?

TradingView can be an excellent platform for conducting technical analysis on forex pairs and for discovering technical trading opportunities shared within TradingView’s community. Originally, TradingView’s functionality was limited to its charting and community features, but it has since evolved to include the features and tools that you’d expect from a full-service trading platform like MetaTrader or cTrader. As a result, more forex traders gravitate towards using TradingView each year, and the number of forex brokers that support the TradingView platform continues to increase.

In this video, I give a high-level overview of the popular TradingView platform. I demonstrate how to seamlessly resize TradingView charts and how to search for instruments from a variety of brokers:

Several brokers post trading ideas or technical analysis from their in-house analysts within TradingView. As an example, Pepperstone posted the following chart depicting a banking ETF following the collapse of Silicon Valley Bank (SVB) in the U.S.:

Is TradingView free for forex trading?

Yes, TradingView is free when you are using it with a compatible broker. That being said, the TradingView features available with your broker will almost certainly be limited to what is provided with the free version of the TradingView platform.

Does TradingView support automated trading?

No, TradingView does not natively support algorithmic trading or the ability to automatically place trades in your brokerage account. I would like to see TradingView add native support for algorithmic trading – this seems like a logical next step now that dozens of the best forex brokers offer the ability to connect to the TradingView platform ecosystem.

That said, there are various workarounds to this limitation using Alerts. Pine Script supports backtesting and can be used for coding trading strategies. If you want to forward-test, you can use a custom solution (or third-party software such as PineConnector) that allows you to send generated Alerts as signals to a MetaTrader account. I have done this successfully, but the latency was high and affected performance negatively.

Does TradingView support backtesting for forex?

Yes, TradingView allows for backtesting indicator-based strategies using the platform’s Strategy Tester tab. This feature provides an overview of the backtest that displays a performance summary and a list of trades that demonstrate how the strategy would have performed on the chart’s time horizon. By default, there are 23 Strategies to choose from, and you can choose to create your own scripts or select scripts that have been shared by TradingView’s community.

While TradingView does support backtesting, I personally recommend using MetaTrader for backtesting – especially if you want to use historical data. MetaTrader 5’s Strategy Tester allows for highly complex backtesting with advanced settings and support for multi-threaded backtests in 64 bits.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.