Best Forex Brokers in India for 2025

Trading forex is increasingly popular in India, but it’s also heavily regulated, and the path to trading forex in India isn’t always straightforward. This guide will map out how best to get started trading forex in India and list my top picks for the best brokers to choose when doing so.

As a general rule, it's best to use a broker regulated in your country of residence. However, due to restrictions on locally regulated financial institutions in India, the only way for local citizens to speculate in the forex market is to use a foreign broker — such as those on our list — that accepts clients who reside in India.

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Best Forex Brokers India

To find the best forex brokers in India, I tested all brokers that accept new customers from India. My review process includes robust fact-checking and thousands of hand-collected data points; here are my picks for the best forex brokers in India for 2025 from around the world:

India Forex Brokers Comparison

Compare forex and CFD brokers that are authorised in India, side by side, using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers and includes brokers who accept residents of India as clients.

| Company | Accepts IN Residents | SEBI Regulated | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating |

Interactive Brokers Interactive Brokers

|

0.59 | $0 |

|

||

IG IG

|

0.98 | £250.00 |

|

||

FOREX.com FOREX.com

|

1.4 | $100 |

|

||

AvaTrade AvaTrade

|

0.93 | $100 |

|

||

XM Group XM Group

|

1.6 | $5 |

|

||

Admirals Admirals

|

0.8 | $100 |

|

||

FP Markets FP Markets

|

1.2 | $100 AUD |

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

||

FxPro FxPro

|

1.51 | $100 |

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

||

BlackBull Markets BlackBull Markets

|

0.71 | $0 |

|

||

Vantage Vantage

|

1.30 | $50 |

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

1.2 | $20 |

|

||

HFM HFM

|

1.2 | $0 |

|

||

Questrade Questrade

|

N/A | $250 |

|

||

ActivTrades ActivTrades

|

0.98 | $0 |

|

||

Trade Nation Trade Nation

|

0.6 | $0 |

|

||

Moneta Markets Moneta Markets

|

1.38 | $50 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

||

Spreadex Spreadex

|

0.81 | $0 |

|

||

easyMarkets easyMarkets

|

0.8 | $25 |

|

||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FAQs

Is forex trading legal in India?

Yes, forex trading is legal in India but comes with strict limitations. Even with SEBI-regulated brokers, Indian traders cannot engage in spot forex trading. The Reserve Bank of India (RBI) also does not allow clients to engage in leveraged forex transactions from a margin account. However, forex trading is allowed through exchange-traded futures and options, as approved by SEBI in 2008.

For example, Interactive Brokers offers exchange-traded currency derivatives but not traditional spot forex due to these restrictions. Physical currency exchange is legal (but highly regulated) when done with a SEBI-regulated broker, and otherwise illegal if done without being regulated.

That said, when retail traders are speculating on the price of forex by using currency pairs using CFDs, no physical currency is delivered, and thus many foreign brokers can accept clients from India even if they don’t hold regulatory status with the SEBI.

If you choose to use a foreign broker, ensure they are highly regulated, as the Reserve Bank of India (RBI) has warned against unregulated brokers. Additionally, be aware that the Central Bank of India has restrictions in place that can make it difficult to deposit and withdraw funds with foreign forex brokers that are not regulated by SEBI.

Long story short

Forex traders in India will have a hard time trading non-deliverable spot forex from a margin account unless they use an international forex broker that accepts Indian residents. Many foreign brokers accept clients from India even if they don’t hold regulatory status with the SEBI.

How do I trade forex in India?

To trade forex as a resident of India, you will either be working with a SEBI-regulated broker that offers exchange-traded currency derivatives or with a foreign broker (preferably regulated and trustworthy) that offers retail forex from a margin account.

I’ve put together some important first steps to take if you want to get started trading forex in India:

- Decide whether you want to trade off-exchange forex – also known as over-the-counter (OTC) – from a margin account with a foreign forex broker, or if you prefer exchange-traded currency derivatives (i.e. a listed product).

- Choose your forex broker; make sure it’s highly regulated to reduce your chances of falling victim to a scam broker.

- Consider the available payment methods, and choose the method that will serve you best for depositing and withdrawing funds from your broker.

- Open and fund a live brokerage account with an amount you can afford to risk, and then practice trading with a demo account to learn the trading platform software and mobile trading app.

- Identify your trading goals and work towards developing a trading plan. Consume as much educational content as you can (your broker is usually a good place to start) to make informed choices about how to structure your trading plan.

- Test your trading strategy with live funds, using an amount that you can afford to risk.

When testing trading strategies, make sure to focus on the percentage returns before scaling your strategy to take on higher potential risk/reward levels.

How much money do I need to trade forex in India?

You can trade forex with as little as $100 (roughly 8,745 Indian Rupees) if you are using a forex broker based outside of India that offers micro contracts. In this case, your broker will need to accept Indian residents as clients, and will ideally be highly regulated in trusted jurisdictions.

Forex trading in India is limited to exchange-traded currency derivatives and futures, so the amount of money you’ll need to trade forex in India will be dictated by the contract sizes available for trading on the National Stock Exchange (NSE) and the amount of margin required to open a position. You’ll also need to be aware of your broker’s minimum deposit requirements.

Example forex trade in India with the NSE

Let’s say you wanted to open a position for a EUR/INR forex futures contract on the NSE through your broker. With a February 2025 contract priced at 90.35 INR per euro, you’d need 2,845 INR (roughly 32 euros, as of February 2025) for the margin requirement to open one lot.

What are the best forex trading platforms in India?

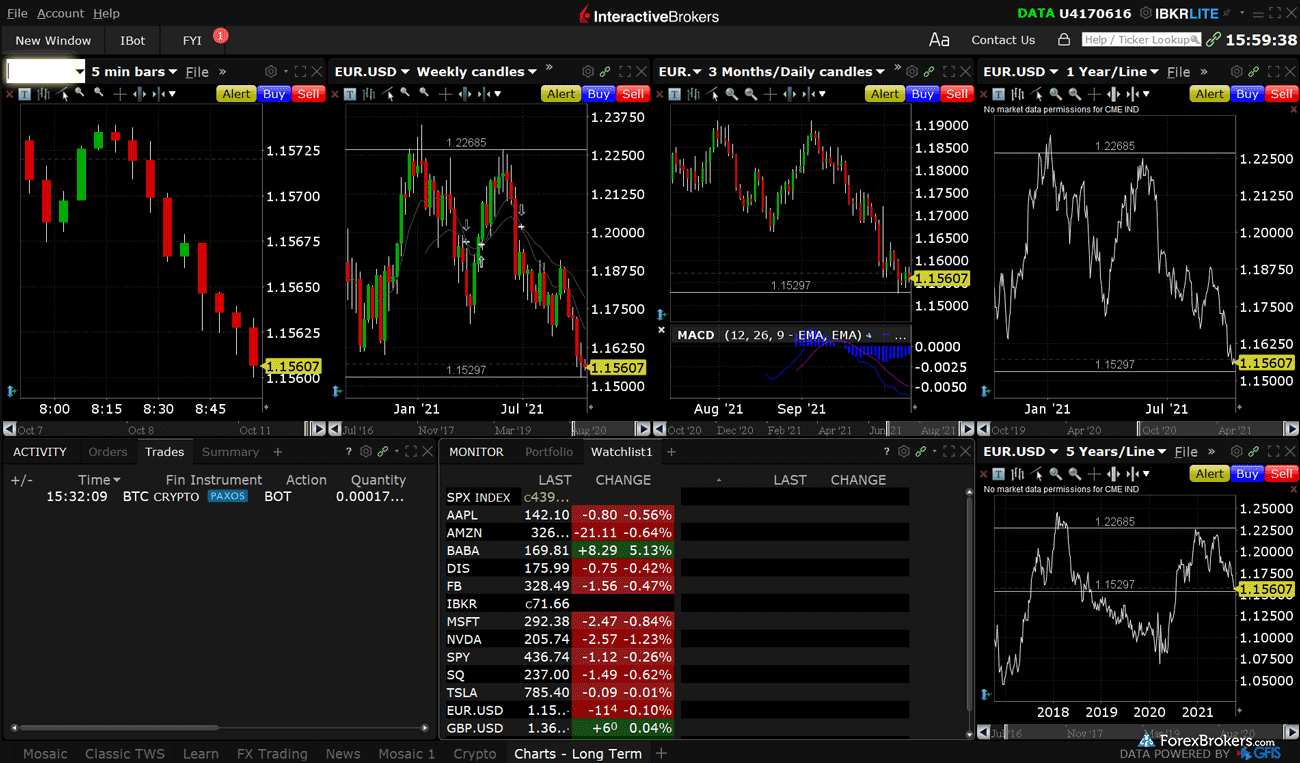

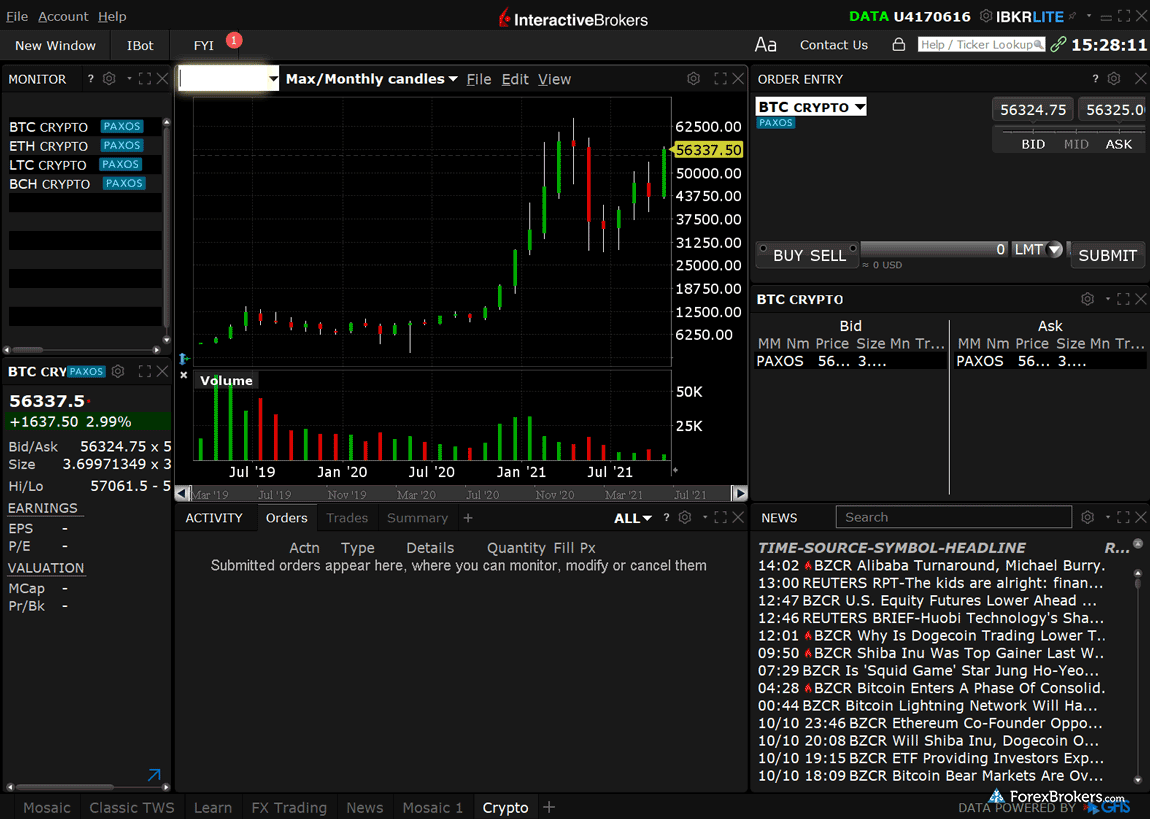

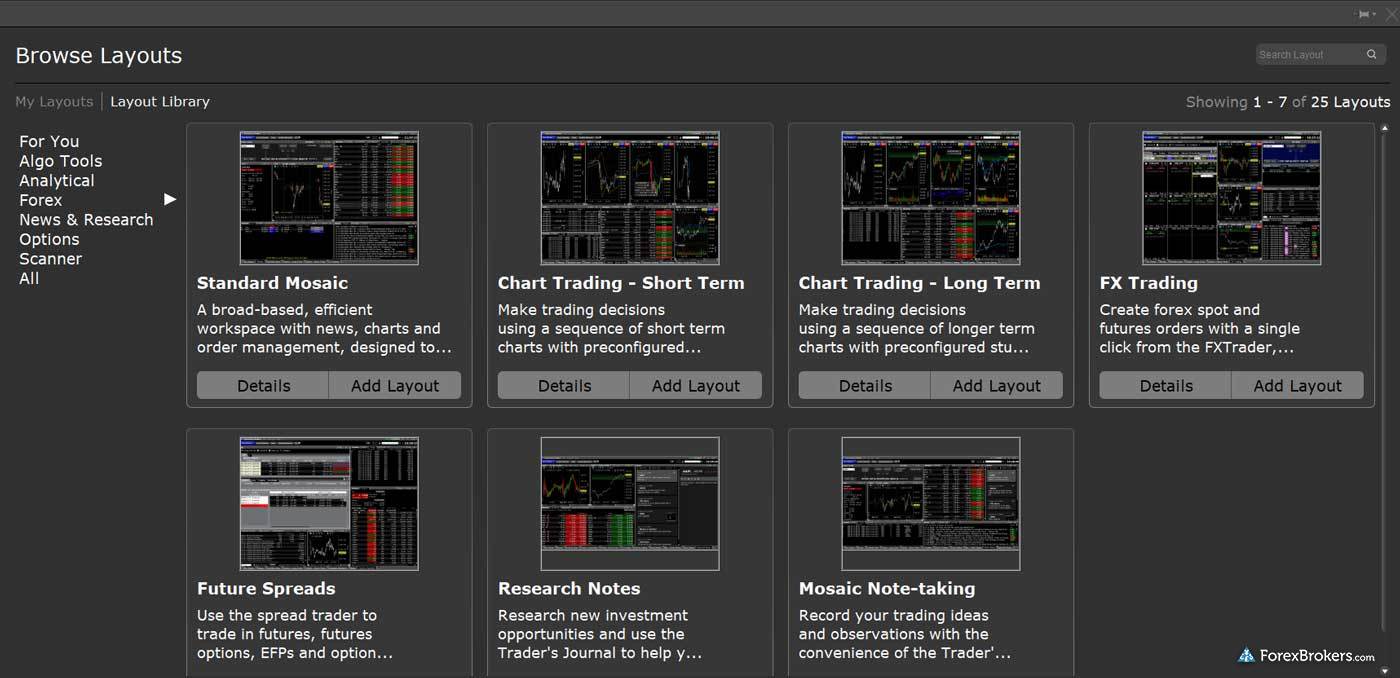

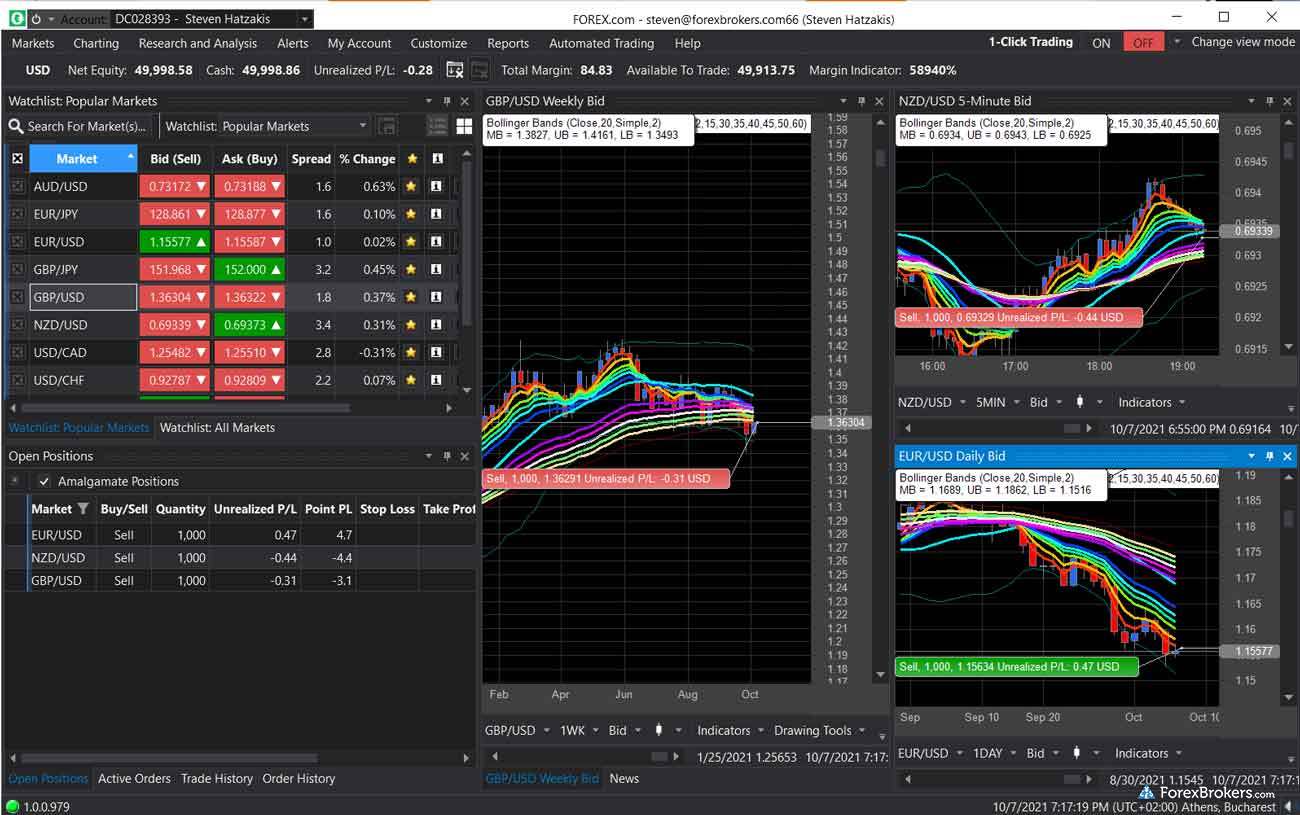

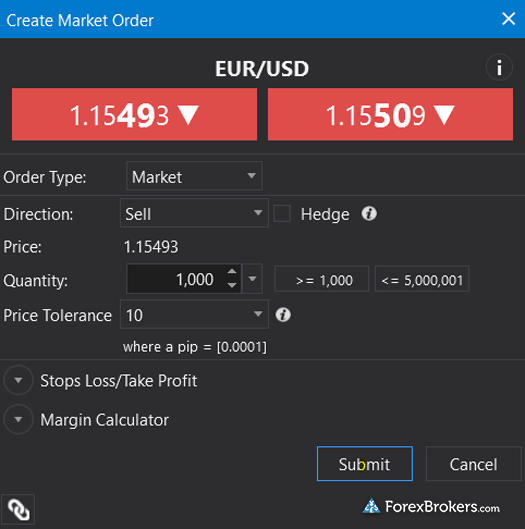

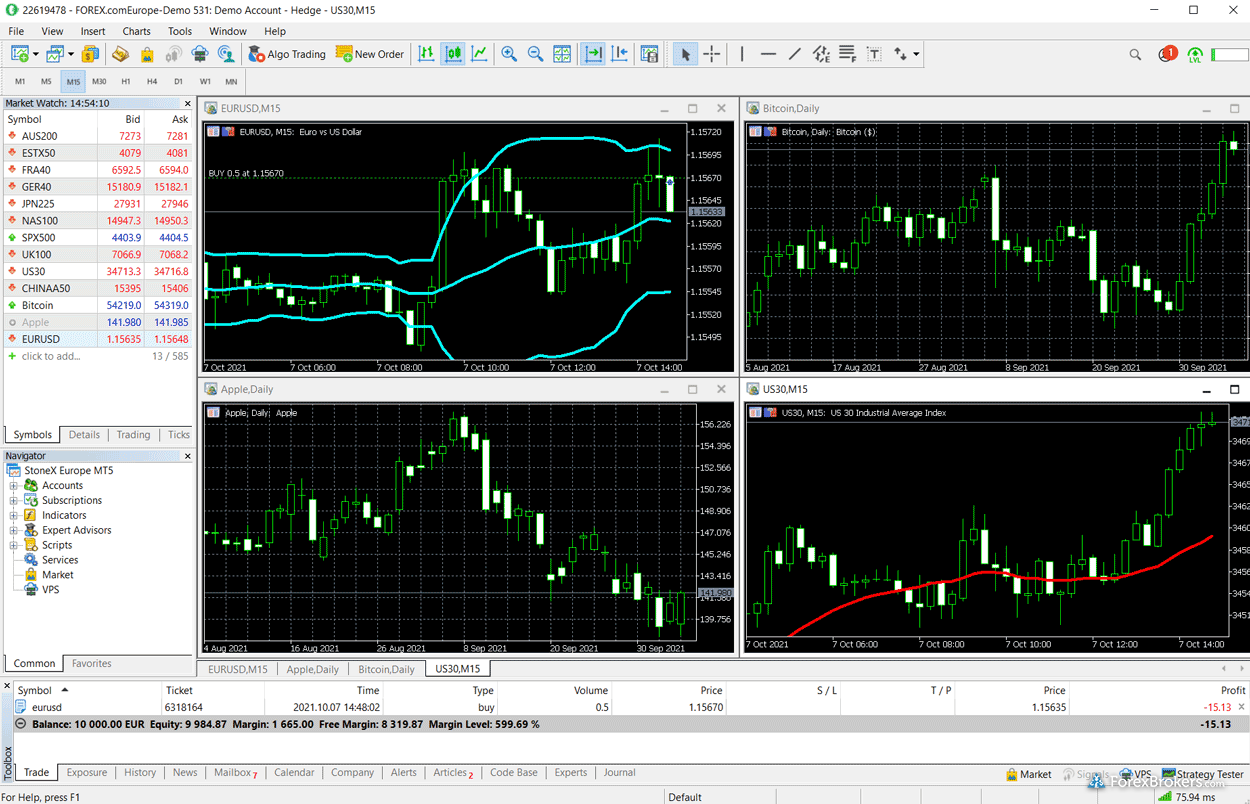

Interactive Brokers, IG, and FOREX.com provide the three best forex trading platforms in India.

If you specifically want a broker that is also regulated in India, Interactive Brokers is a top contender, as it is a member of the National Stock Exchange, Bombay Stock Exchange and the Securities Exchange Board of India, or SEBI. However, due to regulatory restrictions, Interactive Brokers does not offer forex or CFDs in India. If your interests lie in stock trading on the other hand, Interactive Brokers remains an excellent choice due to its access to local stock exchanges in India and 90 international markets, including bonds, stocks and ETFs (including some forex-related exchange-traded products, such as listed currency derivatives).

IG is my top pick for Indian citizens who are looking for a forex broker that offers both forex and CFDs, and also accepts residents of India as clients. The only drawback is that it is not directly regulated by SEBI like Interactive Brokers.

Finally, FOREX.com provides an all-round great multi-asset offering. It also excels for beginning forex traders with their Trading Academy, which won our Annual Award for #1 Interactive Educational Experience the year that it launched. This makes it a great option for beginning Indian traders first learning how to trade forex.

What are the best apps for forex in India?

After evaluating forex brokers that accept clients from India, I’ve concluded that the following brokers provide the best mobile apps for forex trading. All of these brokers provide mobile trading apps that feature advanced charting, a rich variety of sophisticated trading tools, and an easy-to-use platform:

- IG - IG Trading mobile app, IG Academy.

- Saxo - SaxoTraderGo mobile app.

- Interactive Brokers - IBKR mobile app and Impact app.

- FOREX.com - FOREX.com mobile app.

- AvaTrade - AvaTradeGo mobile app and AvaOptions mobile app.

- IC Markets - MT4, MT5 and cTrader mobile apps.

- Capital.com - Capital.com mobile app, Investmate app, and MT4.

Like to trade forex on the go? Check out my in-depth guide to mobile forex trading here, where I’ve tested and scored the forex trading apps of over 40 of the top forex brokers.

Article Resources

Securities and Exchange Board of India, Wikipedia page

Compare India Brokers

Popular Forex Guides

- International Forex Brokers Search

- Best Copy Trading Platforms for 2025

- Best Low Spread Forex Brokers for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- Best Forex Brokers for Beginners of 2025

- Best Forex Brokers for 2025

- Best Forex Trading Apps for 2025

- Best Brokers for TradingView of 2025

- Compare Forex Brokers

More Forex Guides

Find the best forex brokers in the Asia-Pacific region

Asia

- Best Forex Brokers in India for 2025

- Best Forex Brokers in Indonesia for 2025

- Best Forex Brokers in Malaysia for 2025

- Best Forex Brokers and Trading Apps in Pakistan for 2025

- Best Forex Brokers in Philippines for 2025

- Best Forex Brokers in Russia for 2025

- Best Forex Brokers in Singapore for 2025

- Best Forex Brokers in Thailand for 2025

- Best Forex Brokers in Turkey for 2025

Oceania

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.