Capital.com Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Capital.com stands out for its high-quality research, strong educational content, and innovative web platform, making it a great choice for both beginners and experienced forex traders.

Capital.com features competitive pricing and a respectable range of tradeable instruments (including crypto CFDs – though these aren't available to retail traders in the U.K.), but holds fewer regulatory licenses and offers a narrower range of markets than the top forex brokers in the industry.

-

Minimum Deposit:

$20 -

Trust Score:

87 -

Tradeable Symbols (Total):

3007

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Capital.com pros & cons

Pros

- High-quality educational articles and courses.

- Newsroom-grade research articles.

- Average spreads of 0.67 pips on the EUR/USD during April 2024 makes Capital.com and excellent choice for low cost forex trading.

- Good variety of video content for market analysis.

- eQ patented AI trade bias detection system.

- Dedicated Investmate educational app’s game-like design makes learning fun.

- Capital.com offers 111 cryptocurrency CFDs (not available in the U.K. for retail clients), within its respectable range of over 3000 tradeable symbols.

- Offers rebates to active traders in regions where permissible.

- Ability to drag-to-modify orders from within charts, and a close all button for quick trading is great for active traders.

Cons

- MetaTrader 5 is not available.

- Lacks additional licenses in Tier-1 regulatory jurisdictions (outside of the U.K.’s FCA and Australia’s ASIC).

- Price alerts are available within Capital.com's mobile app – but not on its web platform.

- News headlines in Capital.com web platform are limited compared to more active streaming.

- Cash equities were recently discontinued, and replaced by 1X, a non-leveraged CFD offering with no overnight carry costs but a limit of 20K GBP in max positions.

Overall Summary

| Feature |

Capital.com Capital.com

|

|---|---|

| Overall Rating |

|

| Trust Score | 87 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Capital.com safe?

Capital.com is considered Trusted, with an overall Trust Score of 87 out of 99. Capital.com is not publicly traded and does not operate a bank. Capital.com is authorised by three Tier-1 regulators (Highly Trusted), one tier-2 regulators (average trust), zero Tier-3 regulators (Average Risk), and two Tier-4 regulators (High Risk). Capital.com is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system . Learn more about Trust Score or see where the different Capital.com entities are regulated.

| Feature |

Capital.com Capital.com

|

|---|---|

| Year Founded | 2016 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 3 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

Investment products

Capital.com offers CFDs across a variety of popular asset classes that include 2,732 shares CFDs, as well as 20 indices CFDs, 125 forex CFDs, 111 crypto CFDs, 19 commodities CFDs, and nearly a dozen thematic indexes. Spread betting is only available for U.K. residents.

Cryptocurrency: Capital.com was featured among our top picks for best crypto trading platforms. Note that crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except for Professional clients).

| Feature |

Capital.com Capital.com

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 3007 |

| Forex Pairs (Total) | 125 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Fees

Overall, pricing at Capital.com is slightly better than the industry average. Capital.com offers a universal account option that is available to retail traders, as well as a professional account for those who qualify as elective professional traders (note: professional clients do not receive the same regulatory protection as retail traders).

Trading costs: Capital.com lists 0.67 pips as its dynamic spread for the EUR/USD – which we confirmed to be its average spread for the month of April 2024 (0.6712 to be precise). This low average spread, lower than the industry average, makes Capital.com a great choice for low-cost forex trading.

| Feature |

Capital.com Capital.com

|

|---|---|

| Minimum Deposit | $20 |

| Average Spread EUR/USD - Standard | 0.67 |

| All-in Cost EUR/USD - Active | 0.67 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

With dedicated mobile apps for both trading and education, Capital.com has you covered whether you’re a beginner or an experienced trader. MetaTrader loyalists can also use the MT4 app or opt for Capital.com's proprietary mobile app.

Apps overview: Capital.com offers three mobile trading apps: its proprietary Trading app, the Investmate app for education, and the MetaTrader 4 (MT4) app – all of which are available for iOS and Android from the Apple App Store and Google Play store, respectively.

Note: For this review I focused on Capital.com’s MT4 and Investmate app. I was unable to install the Trading app due to a country restriction imposed by the developer. For a look at its stock trading app for forex trading, read the review of Capital.com on our sister site, StockBrokers UK.

Ease of use: The MT4 mobile app is offered by nearly all brokers due to its user-friendly interface, and the variety of features that come standard with MetaTrader. The MT4 mobile app makes viewing and managing positions simple and easy, but it doesn’t support algo trading – for that you’ll need the desktop app.

Charting: MT4’s mobile charts are user-friendly and allow for dozens of indicators. Useful functions such as drawing trend lines and changing the time frame are straightforward, and chart tap is as easy as tapping and holding to enable the quick pie menu.

Trading tools: MT4’s economic calendar is powered by its Tradays app, which requires a separate installation that launches from within the MetaTrader app. To access the MetaTrader community features in the app, you’ll need to log into the MQL5 community.

Other trading platforms

Capital.com offers three trading platform suites: MetaTrader 4 for desktop and mobile, Capital.com’s proprietary trading app, and the TradingView web platform. TradingView is known for its powerful charting capabilities and is used by technical analysis enthusiasts across the world; learn more by reading our TradingView guide.

Capital.com offers the no-frills MT4 experience straight from the developer, without any noteworthy add-ons that would help Capital.com stand out from the best MetaTrader brokers.

Platforms overview: The MetaTrader 4 suite is available at Capital.com for macOS and Windows operating systems, alongside the web version that can be accessed via any modern browser. Capital.com’s proprietary platform is an easy-to-use web-based trading platform, that comes loaded with a great balance of features.

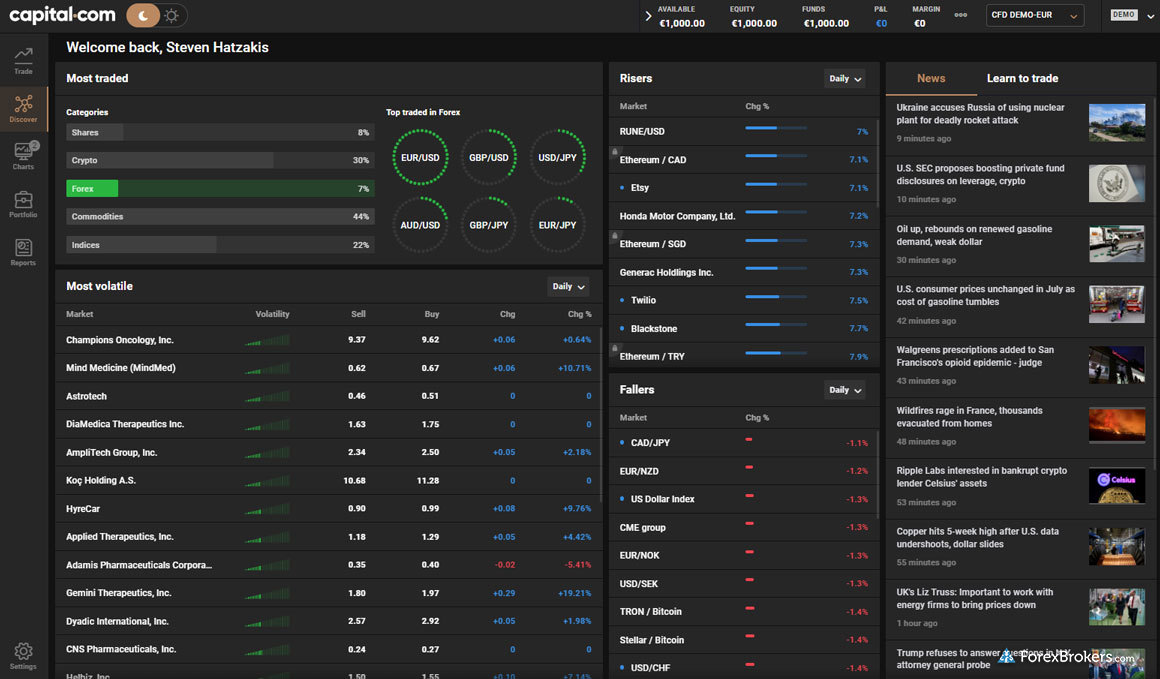

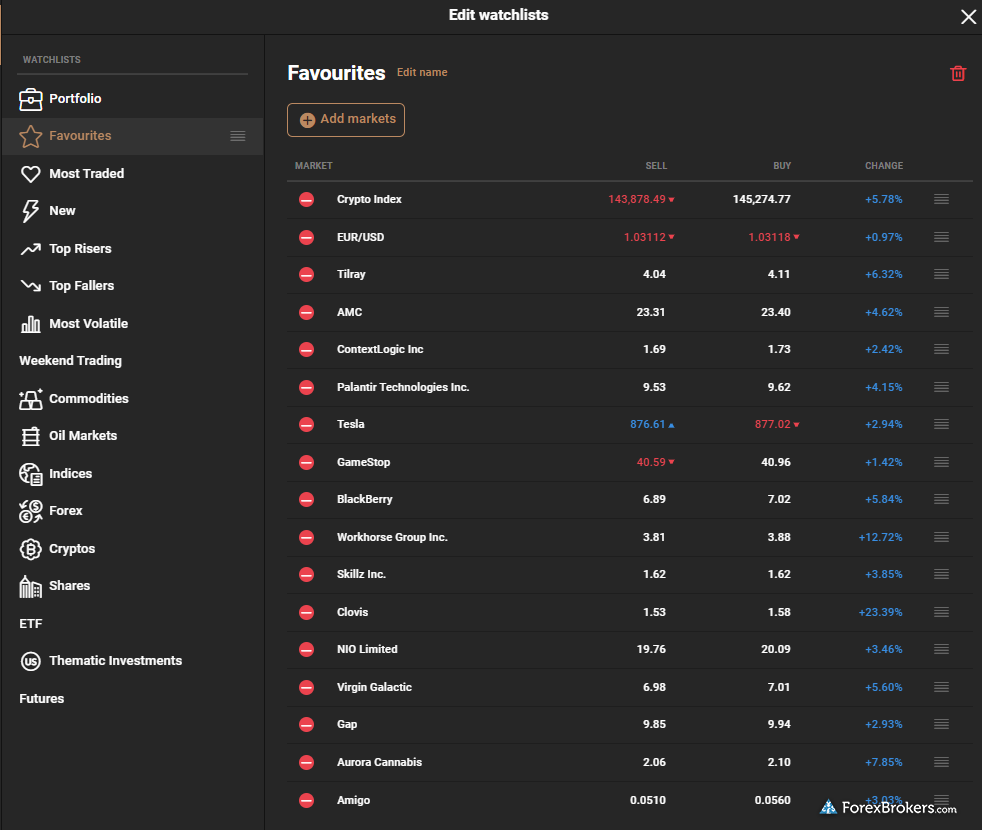

I found the discover tab to be useful for taking a broad view of the market – to see the most traded, most volatile, and the risers and fallers at a glance. There are also pre-defined watchlists that can be customized and at least ten thematic indices – from e-sports to electric cars to cryptocurrencies.

Overall, the Capital.com web platform is a great choice for nearly all types of traders, balancing ease of use with a variety of rich features. It ranks closely behind platform offerings from the best forex brokers in this category. Two features that I appreciate in the Capital.com platform include a button for quickly closing all existing positions on a given asset and the ability to drag-to-modify your orders from within charts, which are convenient features for active traders.

In the video below, I take a tour of Capital.com's easy-to-use web platform:

Charting: The MetaTrader platform suite is known for its robust easy-to-use charts. Zooming in and out and rearranging windows and tabs is a breeze on MT4. It also supports the ability to drag and drop from the default list of nearly 50 indicators. The Capital.com web platform stands out in its own right with rich features and a variety of tools, such as pre-defined watchlists that act as screeners to scan the market, along with sentiment data and integrated research from Refinitiv.

| Feature |

Capital.com Capital.com

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 83 |

| Charting - Drawing Tools (Total) | 18 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 11 |

Market research

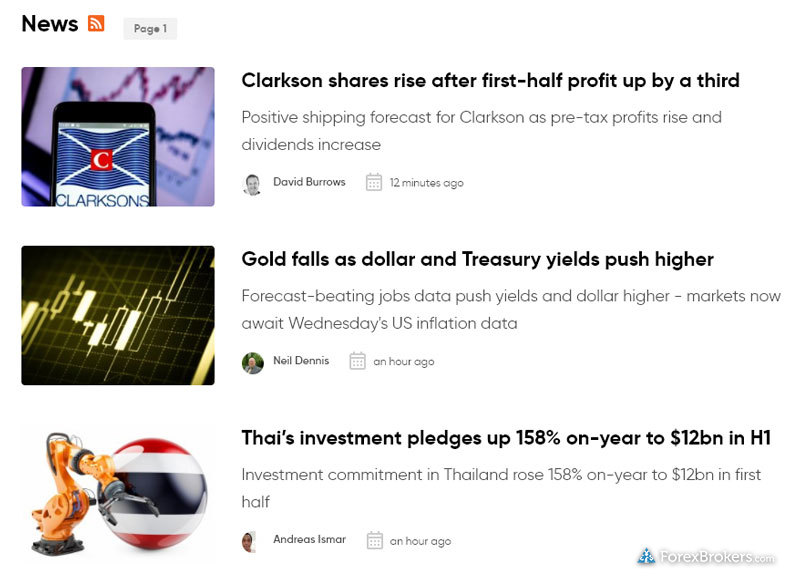

Capital.com’s market commentary is well-organized, offering various theme-specific playlists on YouTube and on its website. It also offers detailed articles under its news and analysis section which I found to be rich with information. From technical analysis to commentary about economic fundamental data points, Capital.com’s robust research offering exceeds what I’d expect to find with the average broker. The only downside is that there are few news headlines within the Capital.com platform.

Research overview: Capital.com offers research alongside its educational content from within the Capital.com TV section of its website where videos are arranged into playlists.

Market news and analysis: The research videos found in the Market Outlooks section are well made, including the weekly outlook and content for specific symbols. Likewise, the articles that Capital.com publishes on its website are well-written, link to sources, and often include charts and analysis – comparable to what you would find in a newsroom publication. Overall, I was impressed.

Refinitiv Research Reports: While not applicable for forex symbols, the integrated research reports from Refinitiv allow you to analyze thousands of share CFDs in greater detail from within the Capital.com web platform. I found the integrated Refinitiv Stock Report to be highly detailed, and delivered 12 pages of data when I used it.

| Feature |

Capital.com Capital.com

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

Education

Capital.com has a solid array of educational materials that includes articles, videos, and a comprehensive lesson program, making it an excellent choice for beginners. This educational program includes 28 lessons spread across five courses, and ends with a final test designed to gauge your progress and your financial knowledge. I found its Investmate app to be even more impressive. It adopts a style influenced by gaming, which allows you to learn at your own pace while tracking your progress.

Learning center: Capital.com has at least 72 educational videos on its YouTube channel – some of which are embedded in its web platform. It also features ten written guides that I found to be informative and rich with detail, that focus on individual topics such as CFD trading and trading psychology. Several of these guides have sub-articles that dive into even greater detail, explaining various terms and concepts beyond what you would find in an investor glossary. Overall, Capital.com’s strong educational offering is right up there with the best brokers in this category.

Investmate: Several brokers, such as IG, have created apps strictly dedicated to educating traders, and Investmate is Capital.com’s answer to this industry trend. Investmate is a great example of a mobile app that makes education its prime focus, while still ranking highly for ease of use and providing a smooth user experience.

Room for improvement: Capital.com’s educational content would benefit from an expansion of its lesson program. Including more content and offering the ability to organize that content by experience level would further elevate this already-impressive educational tool.

| Feature |

Capital.com Capital.com

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

As a relative newcomer, Capital.com has proven it can deliver high-quality research and educational content, along with an excellent web trading platform that offers a decent range of markets. For our 2025 Annual Awards, Capital.com finished best in class for Ease of Use, Commissions & Fees, TradingView, and Crypto Trading. It also won our Industry Award for #1 Most Cryptos.

Expanding its list of licenses in more Tier-1 jurisdictions will help win more trust, and increasing its range of markets will bring it closer to matching up with the best forex and CFD brokers.

About Capital.com

Founded in 2016, the Capital.com brand caters to more than 610,000 registered clients for the Capital.com group, and has group entities authorised and regulated locally in the U.K. by the Financial Conduct Authority (FCA) and in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), in Australia by the Australia Securities and Investment Commission (ASIC), in the Seychelles by the Financial Services Authority (FSA) of Seychelles, in the United Arab Emirates by the Securities and Commodities Authority (SCA), and in the Bahamas by the Securities Commission of the Bahamas (SCB).

Can you withdraw from Capital.com?

Yes, but keep in mind that the method you originally used to deposit funds at Capital.com may affect what options are available to you for withdrawing funds. The country from which you deposited your funds can also be a factor; if you send funds from a bank account in one country, you’ll have to withdraw funds back to that same country and to that same account (or another bank account under your name, after verifying ownership). These factors can also affect the timing of your withdrawal, which can range from less than 24 hours to as much as five business days (not including any potential delays from your bank or provider on the receiving side).

These kinds of restrictions and limitations (when withdrawing funds) are commonplace at all legitimate brokerages that are regulated in top-tier jurisdictions, and are put in place – in part – to prevent money laundering.

The following payment methods are supported at Capital.com:

- Visa, Mastercard, and Maestro.

- Apple Pay.

- Bank transfer (wire or SEPA transfer).

- Neteller.

- Skrill.

- Google Pay.

- PayPal.

Using PayPal with your forex broker

Check out our PayPal guide to learn more about using PayPal to deposit funds with your forex broker, and to see our picks for the best forex brokers that accept PayPal.

Note: The payment methods available to you will depend on your country of residence and the related Capital.com entity that holds your account.

As with any broker, withdrawal requests can be rejected under certain circumstances, such as when trying to withdraw to an unsupported payment provider, by exceeding the per-transaction volume limit, or by failing to provide relevant supporting documents for your withdrawal method. A request can also be rejected if you attempt to withdraw too little (withdrawals must be greater than 50 USD, or your currency equivalent, at Capital.com).

Is Capital.com legal in the US?

Capital.com cannot currently accept U.S. clients, because it doesn’t yet hold the required U.S. license (as a Forex Dealer Member with the CFTC), despite being authorized and regulated in other jurisdictions in which the broker can accept non-U.S. residents. If you are a U.S. resident, you must only trade with a broker that is licensed in the U.S. Check out our international search tool to find out about your specific country of residence and whether Capital.com can legally accept your account.

ForexBrokers.com 2025 Annual Awards

For the ForexBrokers.com 2025 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Range of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Copy Trading, Ease of Use, MetaTrader, TradingView, Algo Trading, Crypto Trading, and Professional Trading.

ForexBrokers.com also recognized brokers that demonstrated excellence and innovation with our exclusive Industry Awards.

Category awards

| Rank #1 | Streak #1 | Best in Class | Best in Class Streak | |

| Commissions & Fees | 3 | |||

| Crypto Trading | 4 | |||

| Ease of Use | 4 | |||

| TradingView | 1 |

Industry awards

| Rank #1 | Streak | |

| #1 Most Cryptos | 1 |

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Capital.com Regulation Capital.com YouTube channel

Popular Forex Guides

- Best Forex Trading Apps for 2025

- Best Brokers for TradingView of 2025

- Best Forex Brokers for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- Best Copy Trading Platforms for 2025

- Compare Forex Brokers

- Best Forex Brokers for Beginners of 2025

- International Forex Brokers Search

- Best Low Spread Forex Brokers for 2025

More Forex Guides

Popular Forex Broker Reviews

Compare Capital.com Competitors

Select one or more of these brokers to compare against Capital.com.

Show all