Top 5 Winners for Range of Investments

Best broker for range of investments - Interactive Brokers

| Company |

Overall Rating |

Tradeable Symbols (Total) |

Forex Pairs (Total) |

Research |

Interactive Brokers Interactive Brokers

|

|

8500 |

90 |

|

As a publicly traded company (NASDAQ: IBKR) and one of the most trusted brokers with over $540 billion in assets and regulated across nine Tier-1 jurisdictions, Interactive Brokers is the ultimate choice for a range of investments, thanks to its vast selection of available markets. For example, if you come across valuable research about a company listed in Asia or the Middle East, most brokers won’t provide access to specialised markets like the Taiwan, Malaysia, or Saudi Arabia stock exchanges. Interactive Brokers does.

Range of investments: In addition to offering a whopping 90 forex pairs, IBKR lets you hold balances in 28 different currencies, and this broad support for account denomination can be a useful tool when you are trading in foreign markets and selling securities that settle in one of those 28 currencies (otherwise, foreign currency conversion fees can quickly add up).

Spreads: Spreads are highly competitive and have low per-trade commissions. The only exception is if you trade less than a standard lot; the minimum commission spent per trade for these lower amounts could be more expensive compared to alternatives. Otherwise, IBKR’s pricing is best in class.

Global markets: Overall, Interactive Brokers has set the bar extremely high offering the widest range of investments available across global markets, making it our top choice in 2025 in this category. With over 150 market centers connected across 34 countries, you can access forex, futures, exchange-traded funds, and other securities, including stocks, CFDs, and cryptocurrency through IBKR's partnership with Paxos and ZeroHash.

Note: Like with any broker, the range of markets and specific products available at IBKR may vary depending on your country of residence, as certain products are not permitted due to regulations in certain jurisdictions.

Learn more about its wide range of available markets at my full review of Interactive Brokers.

Over 3 million financial products via its eTrading account - Swissquote

| Company |

Overall Rating |

Tradeable Symbols (Total) |

Forex Pairs (Total) |

Research |

Swissquote Swissquote

|

|

472 |

80 |

|

As part of the Swissquote Bank Group, Swissquote stands out as a premier choice for traders and investors seeking access to a diverse selection of financial products, with over 3 million financial instruments available. Swissquote is a publicly traded company (SIX: SQN), regulated under five Tier-1 jurisdictions, and holds multiple banking licenses, including in Switzerland.

eTrading account: Overall, Swissquote is a highly trusted broker that offers one of the most extensive ranges of investments available, including stocks, ETFs, and structured products through its eTrading account, making it an excellent choice if you want to access the most markets. Its forex and CFD offering is also available via its eForex account which comes with 80 forex pairs and nearly 500 CFDs, helping to round out its multi-asset offering across these two account types.

Swiss bank account: What further differentiates Swissquote is its integration of banking and brokerage services. You can literally have a Swiss bank account and access global markets from the same login (although its bank accounts are separated from brokerage accounts).

Crypto: Swissquote also offers extensive cryptocurrency trading through its SQX exchange, which supports 34 digital assets, including staking and crypto lending (available through its EU entity which also holds a banking license in Luxembourg).

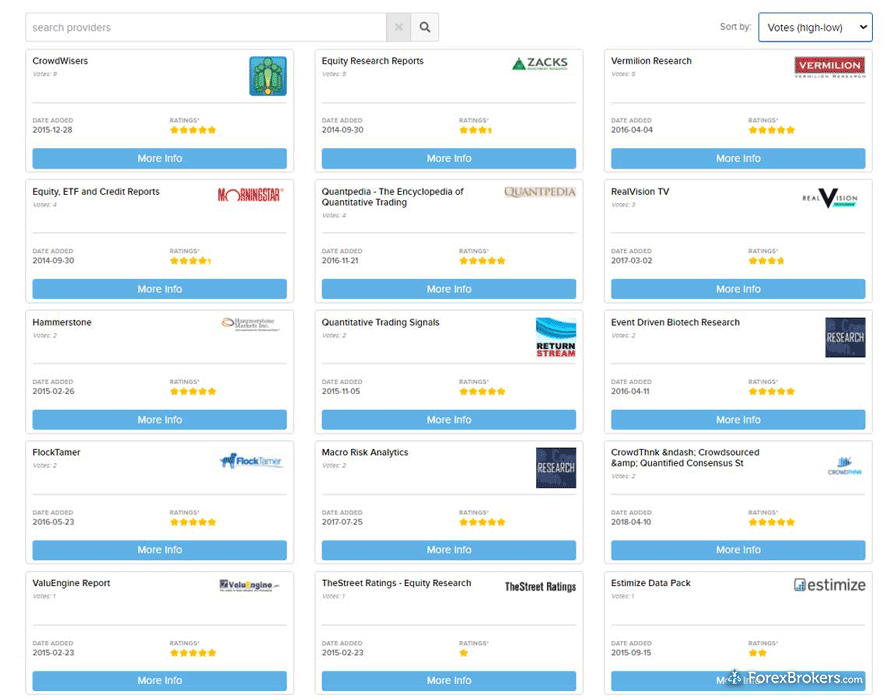

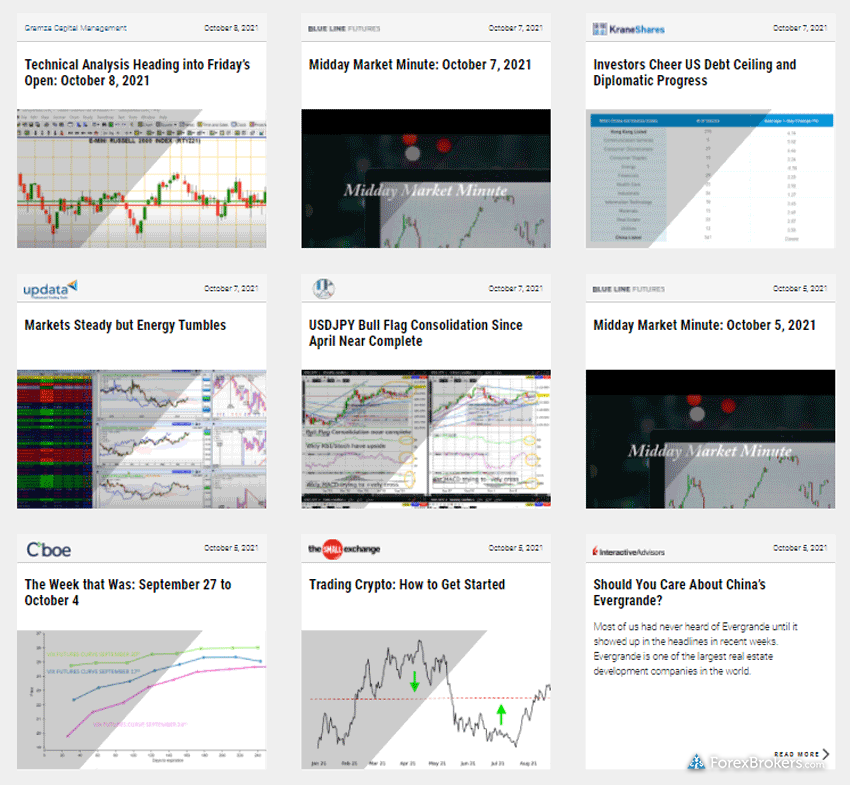

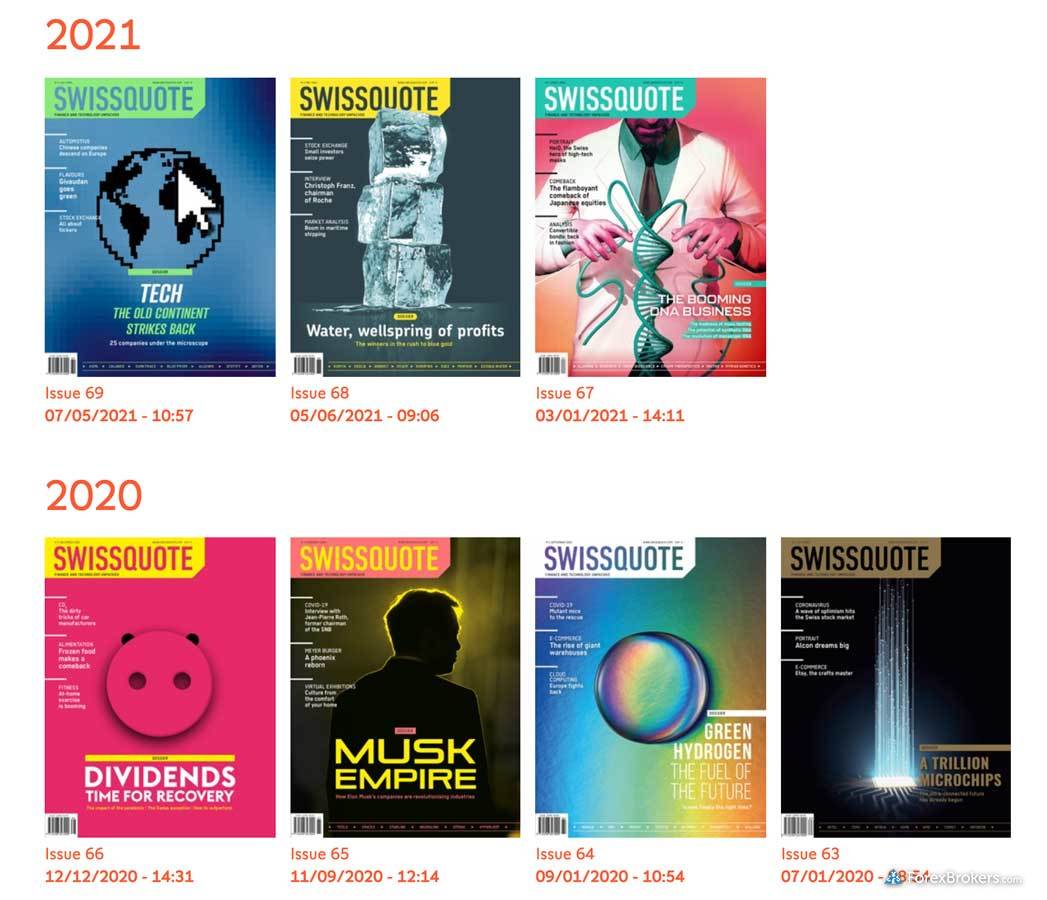

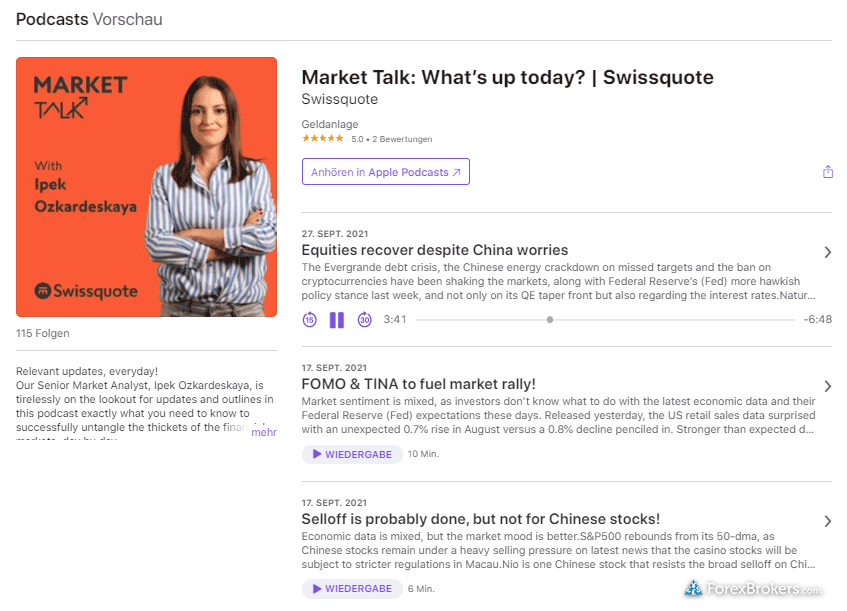

Research: For traders who value quality research, Swissquote provides great in-house content, alongside third-party providers including Trading Central and Autochartist. Its Autochartist integration of trading signals into its CXFD platform won ForexBrokers.com's 2024 Award for Best New Trading Tool. While its pricing is on the higher end, the depth and breadth of Swissquote’s investment options coupled with its renowned reputation for security, make it a great choice for those seeking a comprehensive trading solution and don't mind paying a bit extra for the added benefit of trading with a Swiss bank.

Discover more about its full range of investments at my in-depth review of Swissquote.

Outstanding platform suite with 70,000 products to trade - Saxo

| Company |

Overall Rating |

Tradeable Symbols (Total) |

Forex Pairs (Total) |

Research |

Saxo Saxo

|

|

70000 |

190 |

|

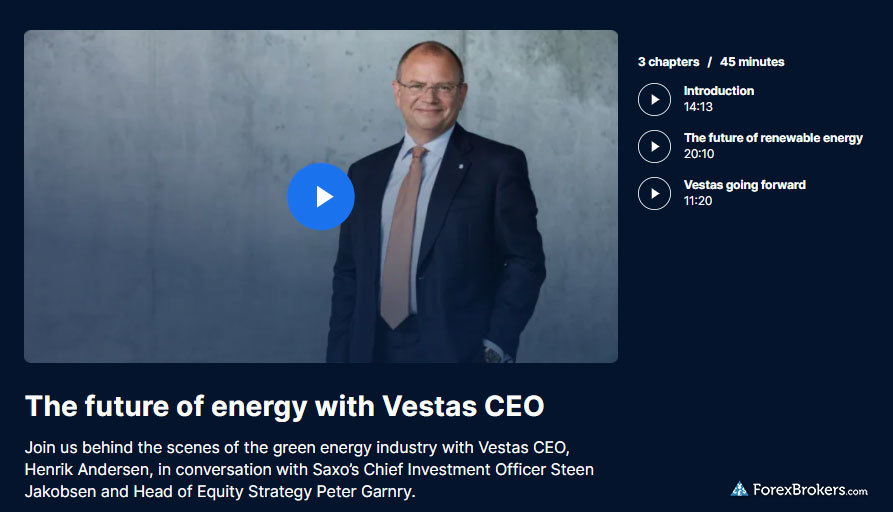

Saxo is part of Saxo Bank Group with over $120 billion in assets as of its latest annual report and is one of the most trusted brokers we review. Saxo is regulated across nearly a dozen jurisdictions, holds three banking licenses, and provides over 70,000 financial products spanning nearly every asset class. Saxo is a fantastic choice for choosing a multi-asset broker with a vast selection of investment products available within its highly-ranked platform suite.

Platforms & tools: The SaxoTraderGO web and mobile app sync perfectly with its SaxoTraderPRO desktop software, providing a consistent user experience across devices. One feature that stands out for Saxo when it comes to its range of investments is the ability to quickly switch instrument types straight from the order ticket. For instance, if you are trading the EUR/USD spot market, you can switch to an options contract for that market in one click. On that note, Saxo provides non-deliverable forwards (NDFs) alongside forex futures, as well as exchange-traded notes (ETNs), exchange-traded funds (ETFs), underlying securities, and stock CFDs.

Pricing and research: Saxo’s pricing is competitive, including on its standard account, with even higher discounts available on its VIP and Platinum accounts which require $1 million and $200,000 portfolios, respectively. Another area where Saxo excels is research, ranking as our top broker in this category in 2025. With access to a broad range of investments, the availability of high-quality research further solidifies Saxo as a great choice.

Head on over to my full Saxo review to learn more about its offering.

Excellent platform for active traders and beginners - IG

| Company |

Overall Rating |

Tradeable Symbols (Total) |

Forex Pairs (Total) |

Research |

IG IG

|

|

19537 |

97 |

|

IG scores at the top or close to the top of nearly every category we cover, helping to make it the best overall in our annual awards year-over-year.

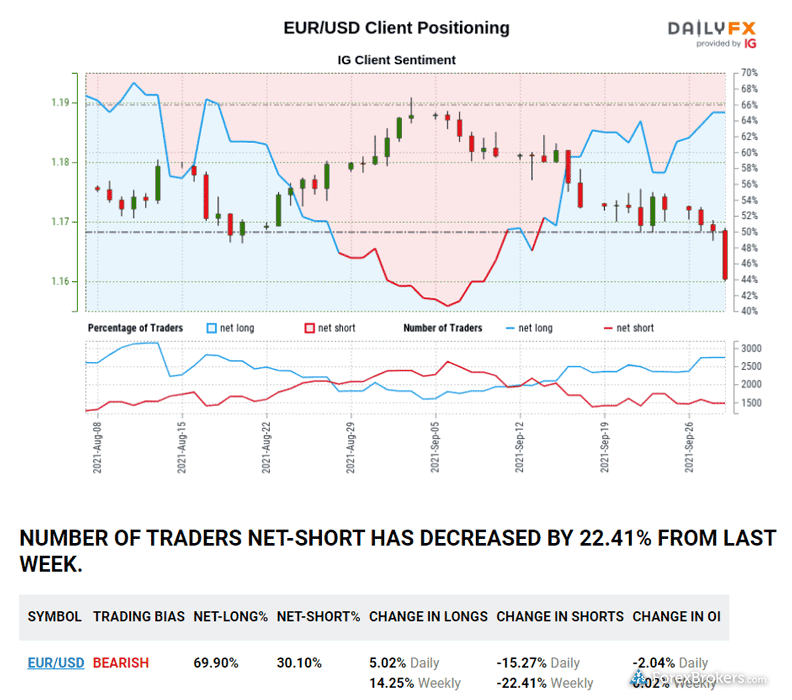

Range of investments: It’s no surprise then that IG also offers one of the widest ranges of investments, including nearly 20,000 CFDs, exchange-traded options, securities, and derivatives across the U.S. and Europe. IG is also the number one most trusted broker holding more regulatory licenses than any broker we review, is publicly traded (LON: IGG), and operates a bank in Switzerland.

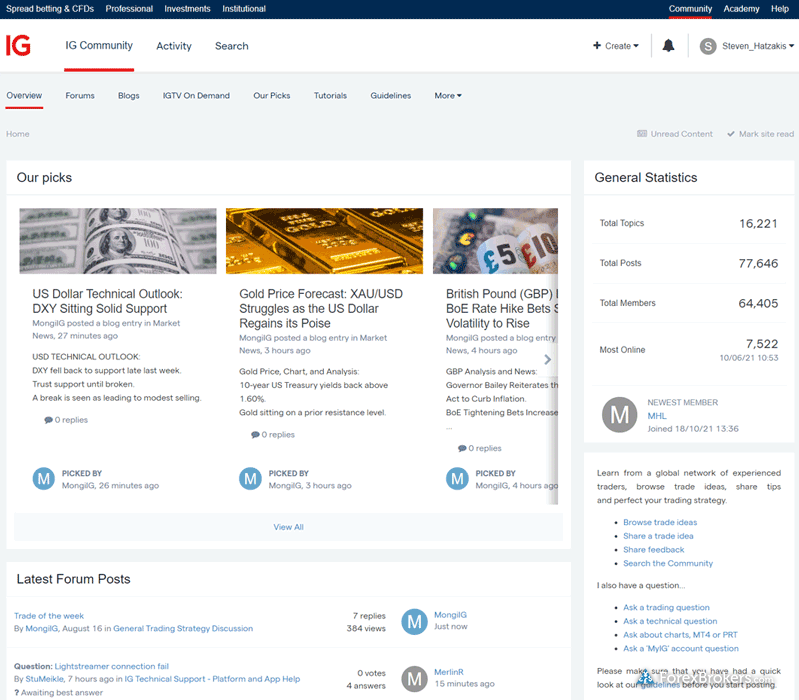

User-friendly platforms: One of the key reasons IG stands out, whether you’re an active trader or a beginner, is its seamless integration of a user-friendly web and mobile app, complemented by comprehensive educational content. Its web platform is industry-leading with integrated trading signals and trading from charts, and its mobile app provides many of the same capabilities with highly advanced charting across both. Meanwhile, educational resources are equally in-depth at IG, whether you are taking a course, reading material from the IG Community, or using the dedicated IG Academy app.

Research: Last but not least, IG delivers high-quality research across its IGTV broadcasting with in-house analysts covering global markets, including video and articles throughout each day which complement the platform and trading experience.

Delve deeper into what makes this broker my overall pick for 2025 at my comprehensive IG review.

Broad access to US and international markets - Charles Schwab

| Company |

Overall Rating |

Tradeable Symbols (Total) |

Forex Pairs (Total) |

Research |

Charles Schwab Charles Schwab

|

|

40000 |

73 |

|

Charles Schwab is one of the largest brokers globally with over $8.5 trillion in assets, 35 million customers, and is a highly-trusted brand that is publicly traded (NYSE: SCHW), holds several banking licenses, and is regulated in multiple tier-1 jurisdictions.

Range of investments: Schwab’s flagship web platform offers access to U.S. regional exchanges while the Schwab Global account offers a variety of international markets, allowing you to denominate your account in 12 different currencies based on the markets you wish to trade. For forex and futures trading, Schwab offers the thinkorswim platform, which lets you access more than 65 currency pairs and advanced order types combined with powerful charting capabilities.

Research and education: Finally, Schwab provides an extensive selection of research and educational content through its Schwab Network, with broadcast-quality broadcasting and an almost endless stream of webinars and articles each day. This high-quality content can help complement your trading, whether you are just getting started or already an advanced trader.

Learn more about its full market offering at my complete review to Charles Schwab for forex trading.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.