My top picks for the most trusted forex brokers

Most trusted forex broker - IG

| Company |

Trust Score |

Tier-1 Licenses |

Publicly Traded (Listed) |

Bank |

IG IG

|

99 |

8 |

Yes |

Yes |

IG is my top choice for the most trusted forex broker in 2025. IG is well-capitalized, publicly traded, and holds dozens of regulatory licenses in major regulatory jurisdictions around the globe. I’ve been reviewing IG for years, and I’ve ranked IG as one of the most trusted brokers in the industry year after year. IG delivers a wide range of markets, innovative trading platforms, high-quality educational content, and competitive trading costs.

IG is authorised by eight Tier-1 regulators, two Tier-2 regulators, and one Tier-4 regulator. IG is authorised by the following Tier-1 regulators: the Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), Financial Markets Authority (FMA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system.

Learn more by reading my IG review.

Highly trusted, publicly traded, Swiss banking services - Swissquote

| Company |

Trust Score |

Tier-1 Licenses |

Publicly Traded (Listed) |

Bank |

Swissquote Swissquote

|

99 |

5 |

Yes |

Yes |

Swissquote is regulated by FINMA and publicly traded on the Swiss Exchange (SWX: SQN). Headquartered in Switzerland, Swissquote offers access to over two and a half million products and operates two banks, which helped the broker earn our 2025 Annual Award for #1 Banking Services. Swissquote was also among the first banks to launch crypto trading and serve as a custodian for Bitcoin investors. Beyond its regulatory strength in Switzerland, Swissquote is licensed in Tier-1 regulatory jurisdictions across the globe.

Swissquote is authorised by five Tier-1 regulators, one tier-2 regulator, and zero Tier-4 regulators. Swissquote is authorised by the following Tier-1 regulators: the Securities Futures Commission (SFC), Monetary Authority of Sinagpore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system.

Learn more by checking out my Swissquote review.

Highly trusted broker, operates three regulated banks- Saxo

| Company |

Trust Score |

Tier-1 Licenses |

Publicly Traded (Listed) |

Bank |

Saxo Saxo

|

99 |

7 |

No |

Yes |

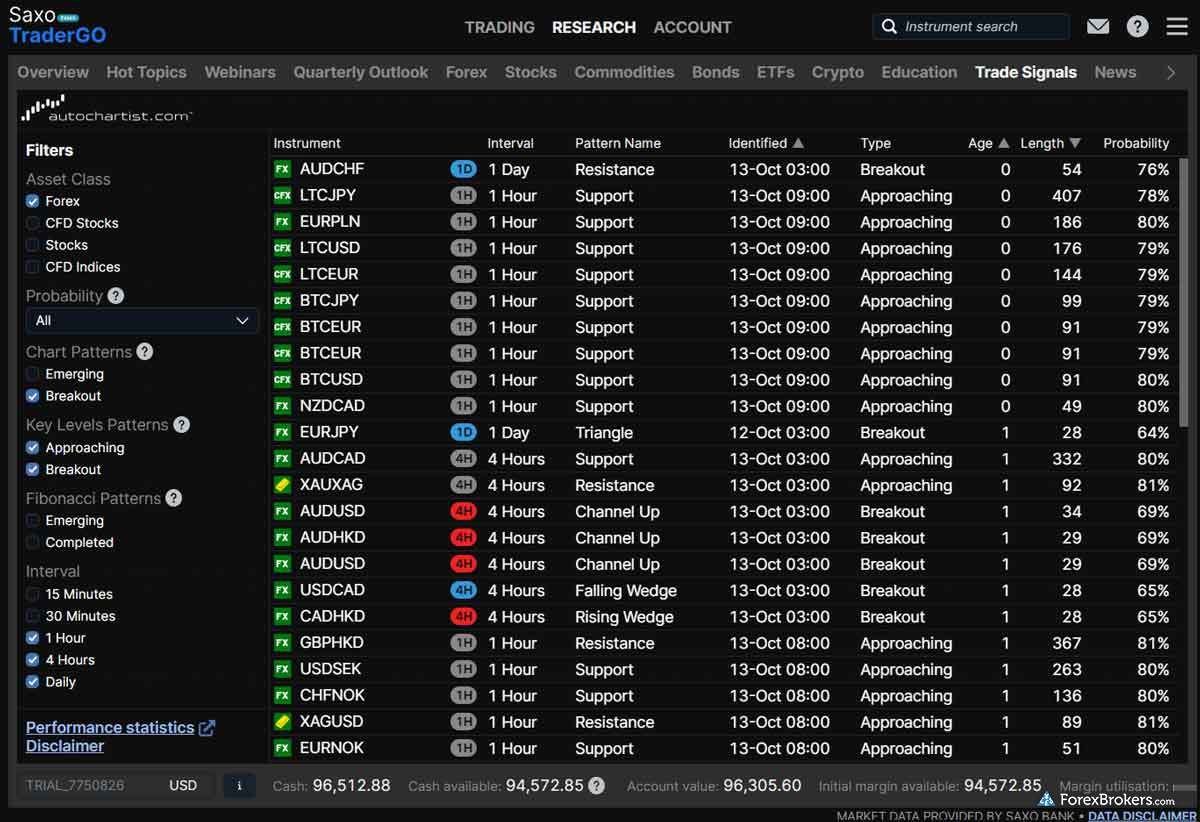

Saxo, founded in 1992, holds numerous licenses from reputable jurisdictions around the world and operates three fully regulated banks. Saxo also offers access to over 70,000 instruments, including crypto derivatives, micro-futures, and forex options. Saxo’s award-winning SaxoTraderGo platform suite offers advanced order types, including algorithmic orders and risk management features, and includes everything that traders might need to navigate the market.

Saxo is authorised by seven Tier-1 regulators and one Tier-2 regulator. Saxo is authorised by the following Tier-1 regulators: the Australian Securities & Investment Commission (ASIC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system.

Learn more about why I think Saxo is an excellent choice for forex traders by reading my Saxo review.

Highly trusted, regulated in nine Tier-1 jurisdictions - Interactive Brokers

| Company |

Trust Score |

Tier-1 Licenses |

Publicly Traded (Listed) |

Bank |

Interactive Brokers Interactive Brokers

|

99 |

9 |

Yes |

No |

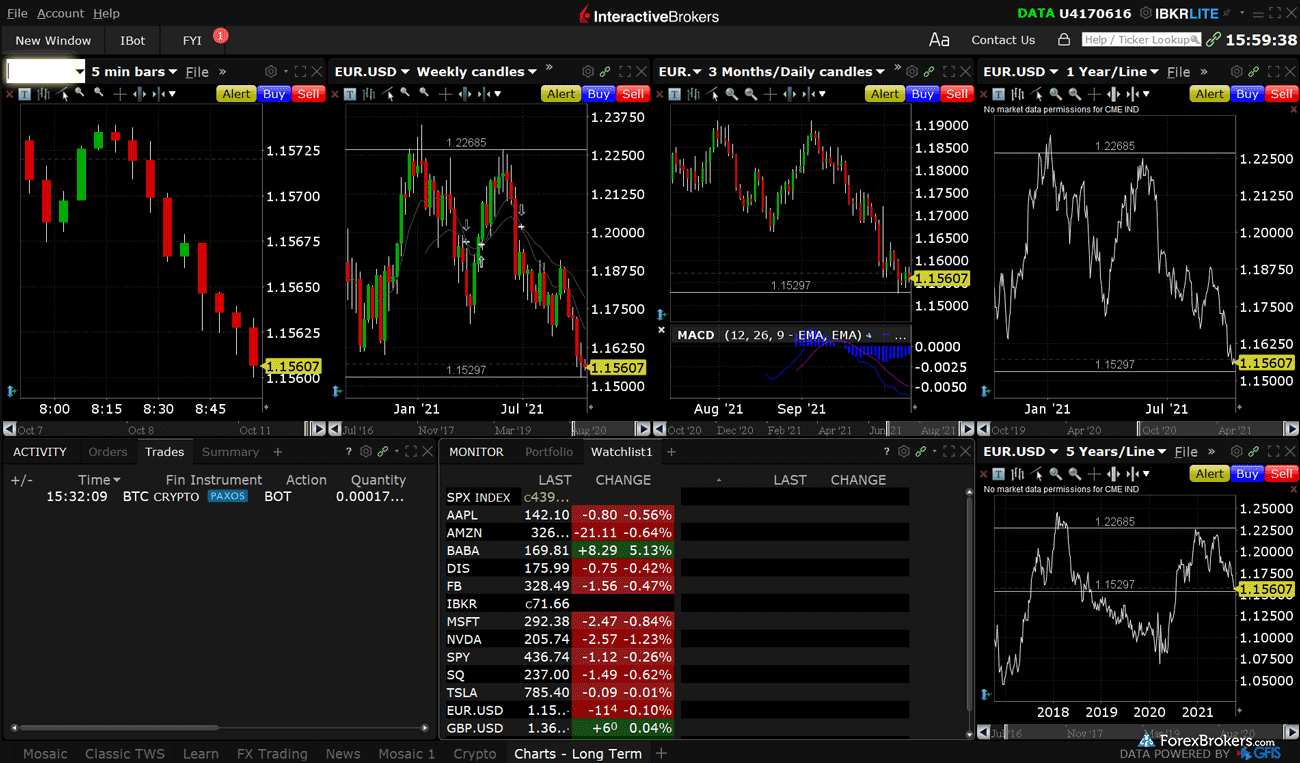

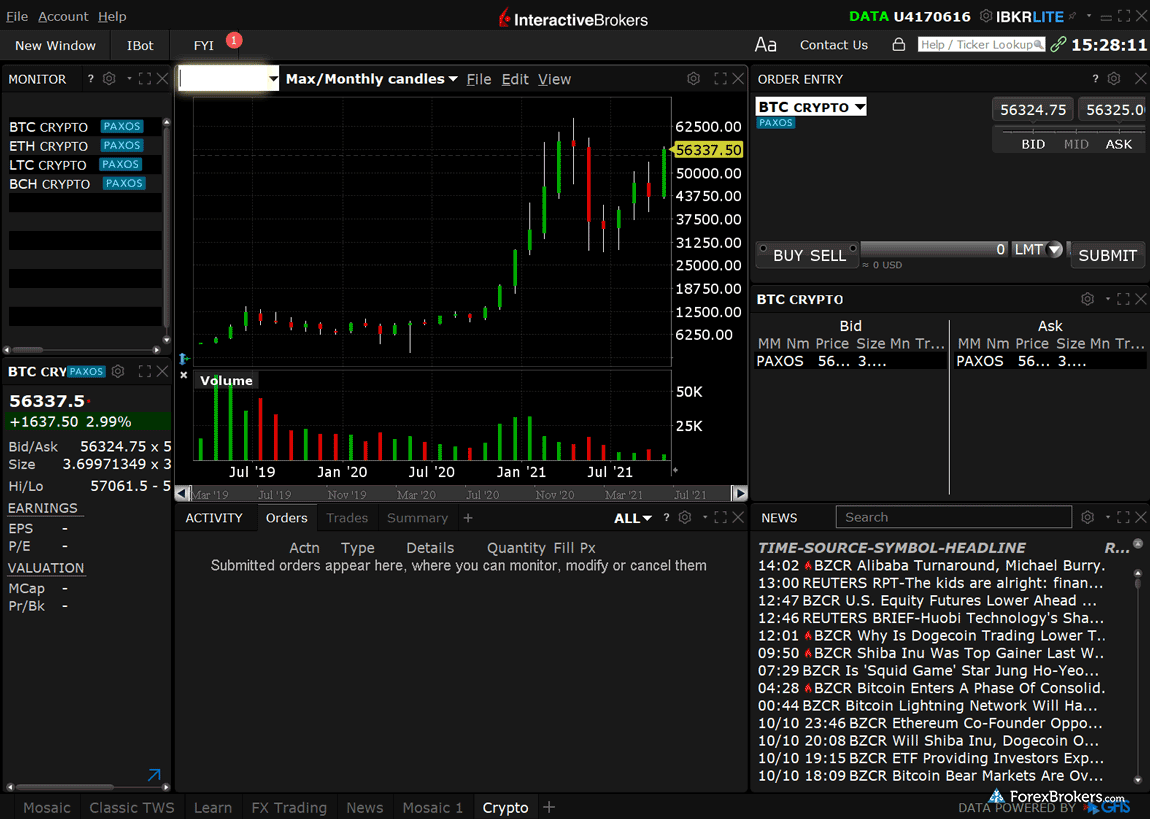

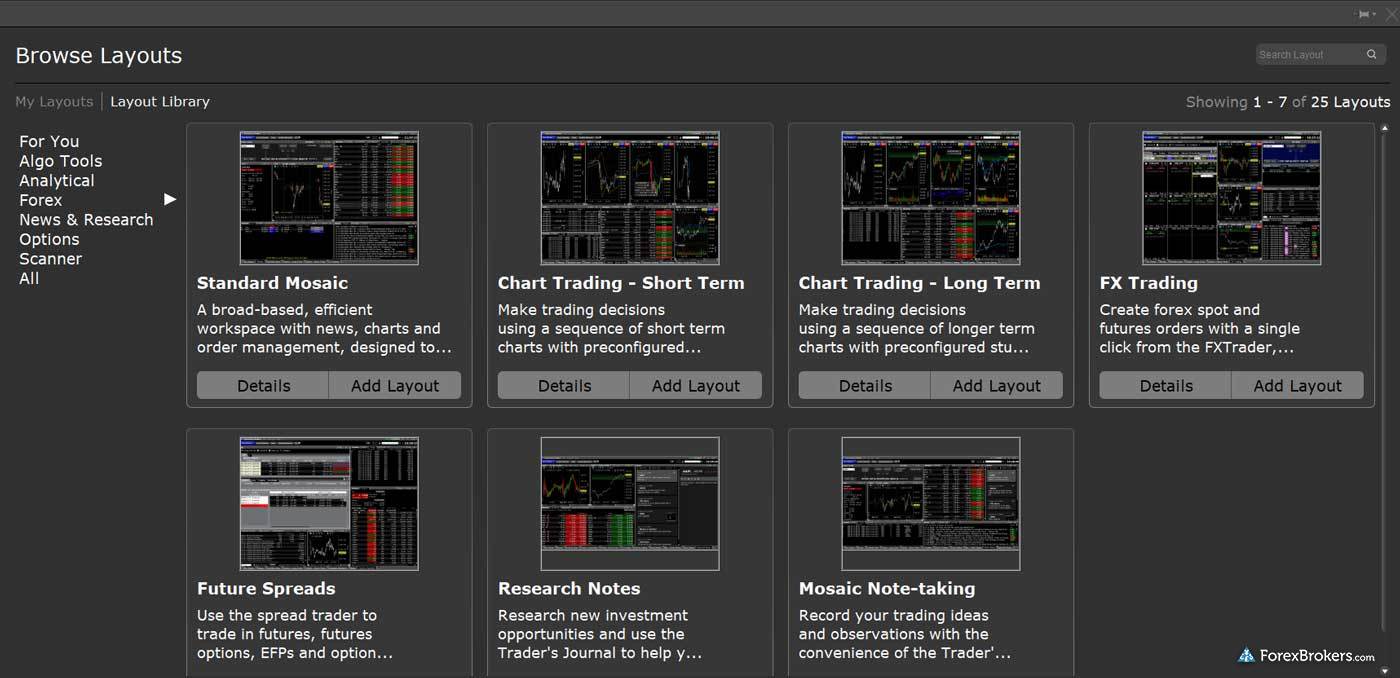

Founded in 1977, Interactive Brokers is publicly traded (NASDAQ: IBKR) and regulated in a staggering nine Tier-1 jurisdictions. Interactive Brokers is a highly trusted and well-capitalized broker, with a Trust Score of 99 and over USD 540 billion in client equity, catering to over 3.1 million clients.

Interactive Brokers is authorised by nine Tier-1 regulators and one Tier-2 regulator. Interactive Brokers is authorised by the following Tier-1 regulators: the Investment Industry Regulatory Organization of Canada (IIROC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), Central Bank of Ireland (CBI), Swiss Financial Market Supervisory Authority (FINMA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system.

Learn more by checking out my Interactive Brokers review.

Highly trusted, publicly traded forex broker - FOREX.com

| Company |

Trust Score |

Tier-1 Licenses |

Publicly Traded (Listed) |

Bank |

FOREX.com FOREX.com

|

99 |

7 |

Yes |

No |

FOREX.com's parent company, StoneX, is publicly traded (NASDAQ: SNEX) and widely regulated across the globe. FOREX.com offers an extensive product offering, excellent platform options and trading tools, and an impressive selection of in-house and third-party market research. In 2024, FOREX.com introduced prediction markets thanks to its partnership with Kalshi, providing traders the opportunity to speculate on economic and political events, such as the U.S. presidential election.

Though pricing is not its strongest feature (unless you are an active trader), FOREX.com still delivers a great experience to traders of all experience levels, and continues to grow as a multi-asset broker catering to forex traders and beyond.

FOREX.com is authorised by seven Tier-1 regulators, one Tier-2 regulator, zero Tier-3 regulators, and one Tier-4 regulator). FOREX.com is authorised by the following Tier-1 regulators: The Australian Securities & Investment Commission (ASIC), Monetary Authority of Singapore (MAS), Financial Conduct Authority (FCA), Canadian Investment Regulatory Organization (CIRO), Japanese Financial Services Authority (JFSA), Commodity Futures Trading Commission (CFTC) , and regulated in the European Union via the MiFID passporting system.

Learn more by reading my FOREX.com review.

Compare the most trusted forex brokers

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.