Top picks for CFD brokers

Best broker for trading CFDs – IG

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

Average Spread EUR/USD - Standard |

IG IG

|

|

£250.00 |

19537 |

0.98 info |

IG is a highly trusted, well-regulated broker that is my choice for the best broker for trading CFDs in 2025. IG boasts an extensive selection of over 17,000 tradable markets as well as competitive pricing and a world-class trading platform suite.

CFD platform selection: Traders at IG can place CFD trades on its web platform and its award-winning mobile trading app (IG took home honors for the #1 Mobile App in the ForexBrokers.com 2025 Annual Awards). Also available is IG’s L2 Dealer direct market access (DMA) platform; L2 Dealer provides both Level 1 and Level 2 pricing, with the latter offering a more in-depth view of the market by granting access to the exchange order book. Traders at IG also gain access to its ProRealTime charting package, a trading platform that includes charting software allowing users to trade directly from charts.

It’s worth noting that IG also offers the popular MetaTrader 4 platform, though it doesn’t support as many CFDs as its other platforms. Integrated trading signals from PIA First and Autochartist are also available at IG, as well as analysis from third-party provider TipRanks.

Range of tradeable instruments: IG offers forex, CFDs, exchange-traded turbos, options, and futures, alongside other derivatives, including over-the-counter (OTC) options, across its global entities and brands (product offering may vary based on your country of residence). A true multi-asset broker, IG offers a staggering selection of CFDs that spans global markets and various asset classes.

Account types: IG offers market maker execution as well as agency execution on its commission-based Forex Direct account. This just means that you can choose the best method for your trading needs, regardless of your CFD trading strategy. One standout feature for CFD traders is IG’s advanced order types, including guaranteed stop-loss orders (GSLOs) across its CFD offering (for an added premium).

Pricing: IG’s active trader program can help you realize deep discounts on trading costs, depending on your monthly trading volume. It’s worth noting that share CFDs at IG incur a per-trade commission, unless you are spread betting (which is only available to UK residents). For instance, per-trade commissions at IG can range from 0.1% for UK shares to 2 cents per share for US stocks, with a minimum commission charge ranging from 10 EUR to 10 GBP or 15 USD, depending on the market.

Execution capabilities: IG is able to handle significant volume and execute large orders across across all account types, making it a great choice for retail traders, professionala, and even financial institutions that need CFD liquidity.

Best web-based trading platform for CFD traders – Saxo

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

Average Spread EUR/USD - Standard |

Saxo Saxo

|

|

$0 |

70000 |

1.1 info |

Saxo is a long time multi-asset broker that caters to the needs of investors and traders across global markets. Saxo boasts an absolutely massive range of over 70,000 products that can be traded across its SaxoTraderGO and SaxoTraderPRO platform suite.

Extensive selection of CFDs: Saxo offers one of the largest selection of CFDs of the 60+ forex brokers I review. A true multi-asset broker, Saxo also offers underlying shares, exchange-traded turbos, futures, options, ETFs, mutual funds, bonds, and over the counter (OTC) forex and options trading. Many of these asset classes can be traded as CFDs at Saxo, across global markets and with competitive trading conditions.

Fractional shares on CFD indices: Saxo offers fractional share trading on CFD indices, with the ability to purchase 0.01 of the default contract size for the index. Saxo also offers portfolio-based margin which can enhance the potential leverage and thus the risk/reward ratio – though this iis reserved for clients designated as professional traders. Check out my guide to the best high-leverage forex brokers to learn more about leverage can be used when trading forex and CFDs.

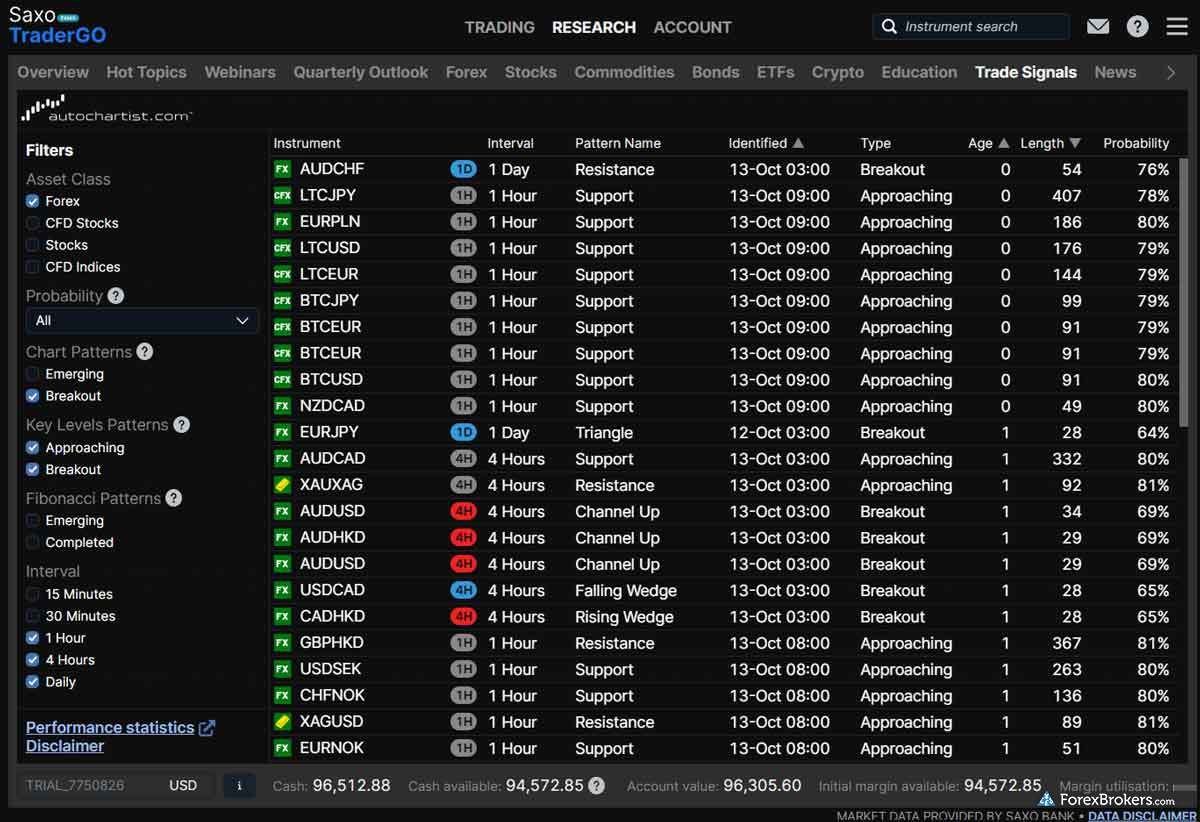

Quality research, and integrated trading signals: One of the main reasons Saxo is among my top choices for CFD trading has to do with the quality of its research across such a wide range of tradable CFDs, and integrated trading signals within its platform suite. Saxo’s high quality research and integrated trading signals can make it more efficient to find and act on trading opportunities and to analyze news events in relation to market price movements.

Order execution capabilities: Whether you are a retail, professional, or even an institutional client, Saxo’s ability to handle large trading volumes makes it a great choice for CFD traders.

CFD pricing and commissions: Saxo is not a discount broker for low-budget investors; there can be a minimum commission spend depending on the trade size (i.e. minimum $1 for U.S. stock CFDs. That said, there is the potential for competitive pricing when executing larger orders. Average spreads can drop even further for VIP and Platinum account holders. For instance, fees for stock CFD drop from $0.02 for Classic account holders to $0.015 for Platinum account holders, and down to $0.010 for VIP account holders.

Best choice for professional CFD traders – Interactive Brokers

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

Average Spread EUR/USD - Standard |

Interactive Brokers Interactive Brokers

|

|

$0 |

8500 |

0.59 info |

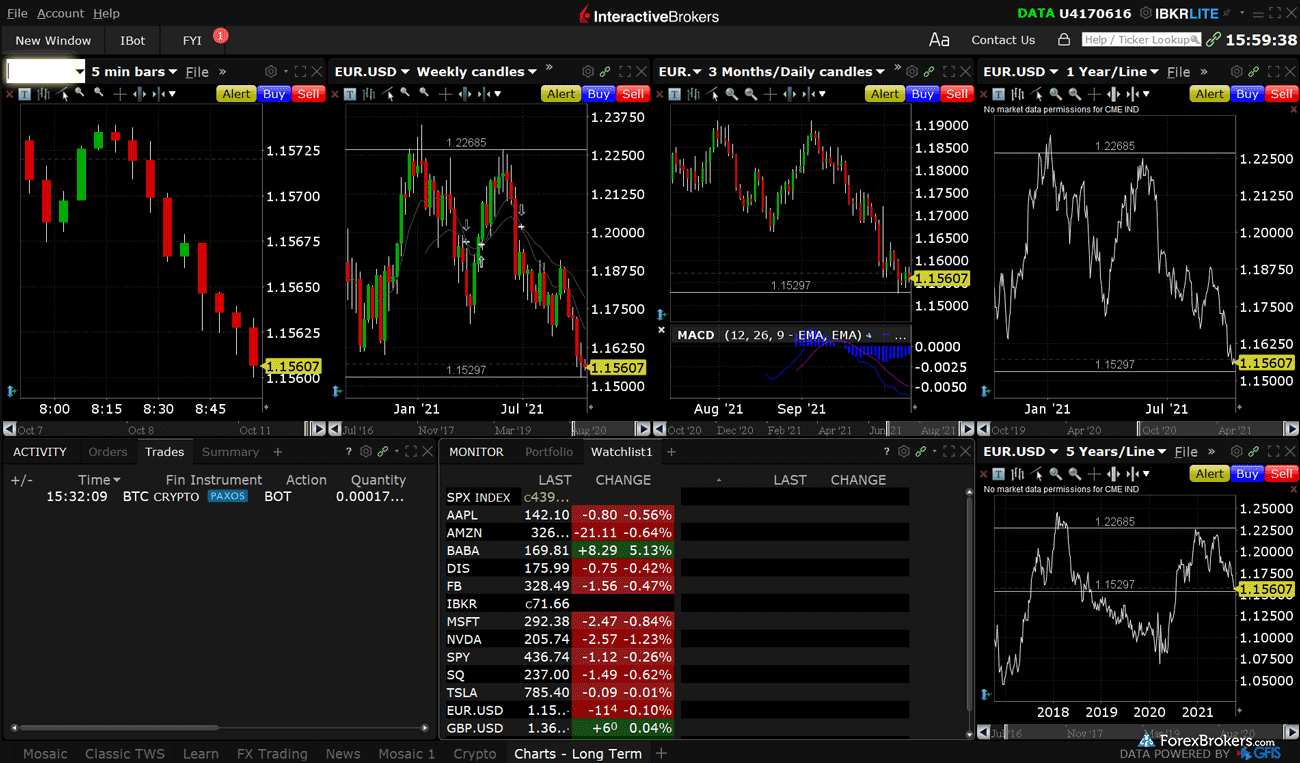

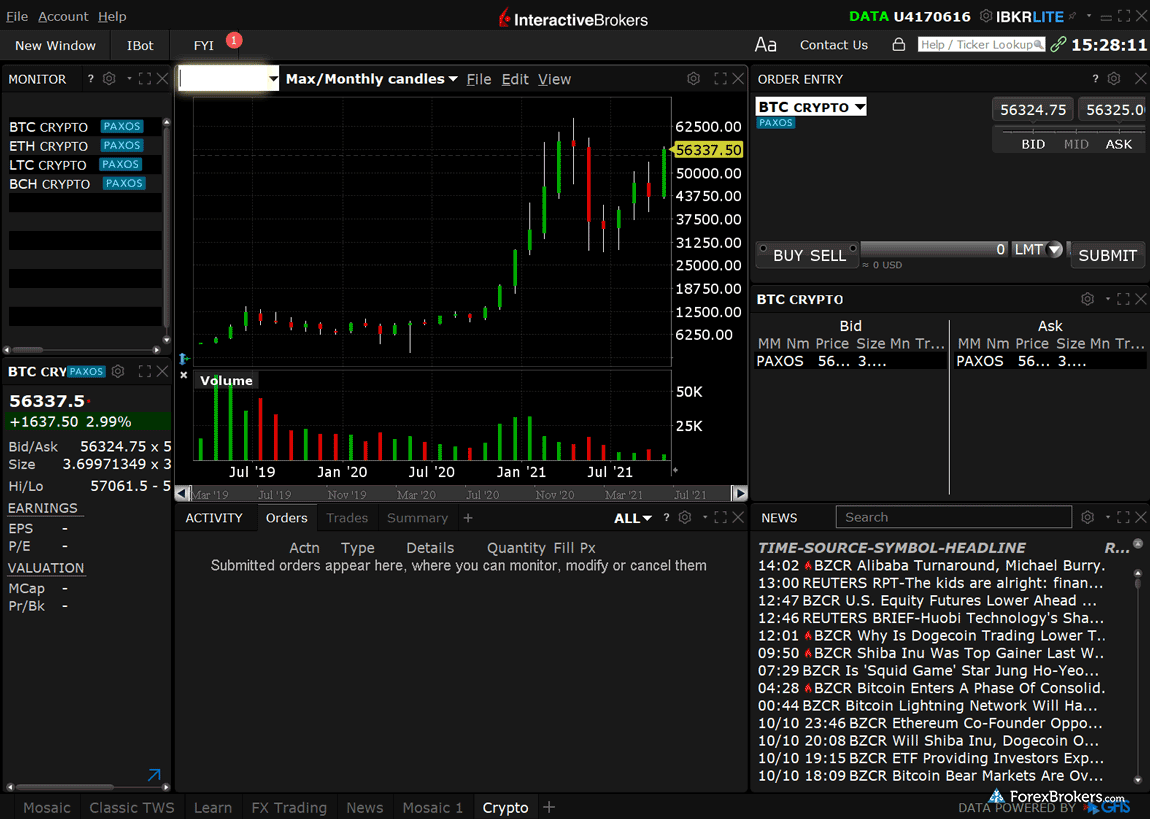

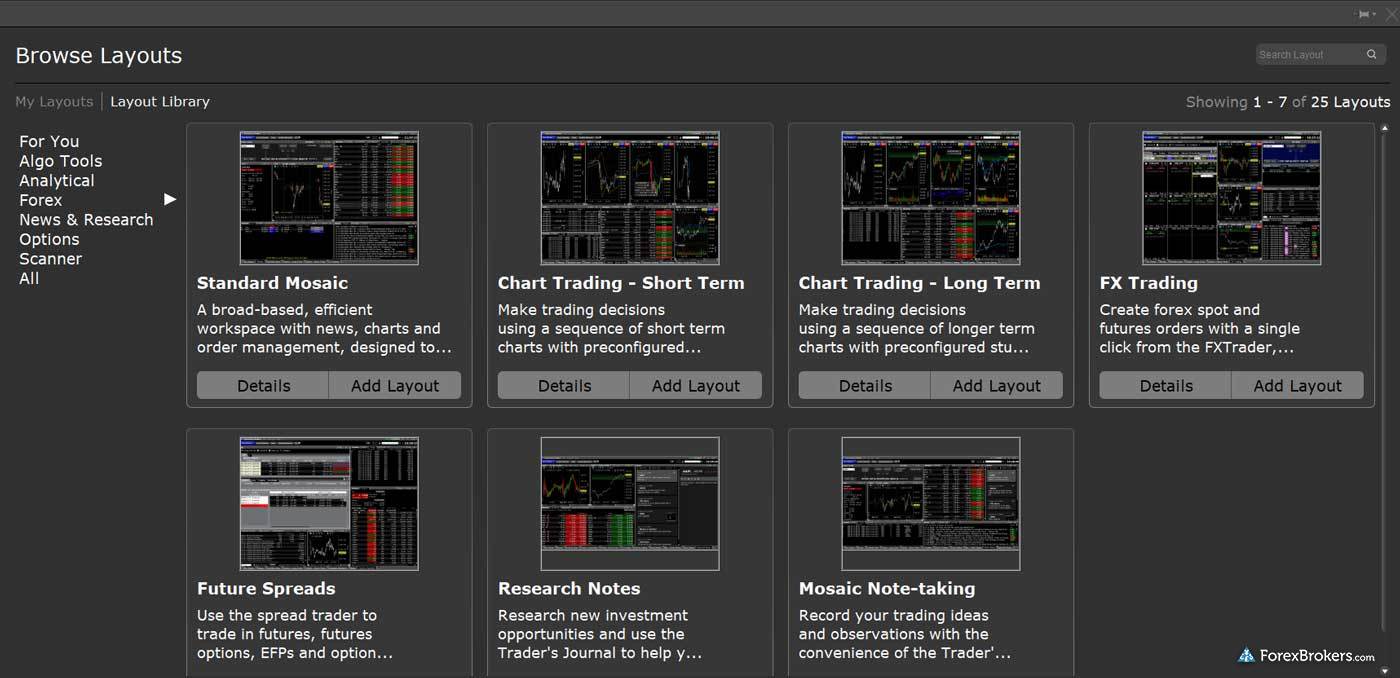

In 2025, I ranked Interactive Brokers in first place for our Range of Investments category due to the sheer number of available markets and global exchanges. It should come as no surprise that Interactive Brokers is also a great choice for CFD trading, even if its range of CFDs is not as extensive as IG or Saxo. Interactive Brokers covers the most popular CFD markets and caters equally well to beginner and advanced traders, thanks to its variety of platforms, ranging from basic to highly advanced.

Selection of CFD markets: Interactive Brokers offers over 6,000 CFDs across 18 major stock exchanges across the globe. The broker’s criteria for CFD inclusion is based on companies that have at least $500 million in free float-adjusted market capitalization and an average daily trading volume of at least $600,000 worth of their shares. What I like about this model is that you end up avoiding smaller stocks in terms of market capitalization, which have the potential to carry higher risks.

CFD pricing: Another advantage of using Interactive Brokers for CFD trading is that its pricing of stock CFDs, for example, is identical to the exchange-quoted price, as can be verified in its platform when comparing DMA share pricing with stock CFD pricing. Forex trading is also part of Interactive Brokers CFD offering, and like most brokers it can be traded from within the same platform and account (provided you have added the Forex CFDs trading permission from the account management section in your IBKR account).

Professional and institutional clients: Interactive Brokers is an excellent choice for professional and institutional CFD clients, partly because of the many possible configurations of its TWS platform. If you are a professional CFD trader or hedge-fund manager looking for deep CFD liquidity, IBKR can accommodate (execute) large orders while delivering competitive discounts for active traders – depending on your monthly trading volumes.

Compare the best CFD brokers

FAQs

What are CFDs?

CFDs are tradeable instruments that track the price of underlying securities or assets. A CFD trade occurs when a trader enters into a contract with their broker to buy or sell a particular underlying asset or security at a specific price. In doing so, the trader aims to speculate on price fluctuations that may occur in the window of time between when the contract is agreed upon and entered into force, and when it expires (or when the trade is closed).

request_quoteOwnership of underlying assets

When you purchase an asset like company stock, you become the owner of those actual shares. When purchasing a CFD, however, you never own the underlying asset.

As the price of the underlying asset fluctuates, the CFD trader will experience either an unrealized profit or an unrealized loss (or neither, if the price remains flat). Profits are only realized if the trade is closed while the position is still profitable (losses work under the same principle – if the trade is unprofitable when closed, the loss becomes realized).

For example, if a trader buys a CFD on the EUR/USD pair and the contract price moves higher than the initial purchase price, the unrealized profit will be the difference between those two prices (minus any applicable trading costs).

A quick note about losses: It’s important to remember that realized losses can worsen in the event of a margin call, or a gap in a stop-loss order. This added risk exists because CFDs are traded from within a margin account, which has the potential to incur a negative balance due to the use of leverage.

How are CFDs different from stocks?

When purchasing a stock through your broker's trading platform, your broker holds the shares (or, share certificates) on your behalf. As the shareholder of record, you gain certain rights and privileges – such as voting and taking part in proxy meetings. You also become eligible to receive potential dividends.

CFD traders do not enjoy any such ownership rights. When you use a trading platform to purchase a CFD, you do not own (or take delivery of) the actual underlying asset. CFDs are tradeable derivative instruments that reflect the price of an underlying asset – such as stocks.

sticky_note_2Note:

Some CFD brokers may offer you the ability to receive dividends in an attempt to mimic the trading of real (underlying) stocks.

Leverage: Though some traders can use a certain degree of leverage when trading shares (pattern day traders in the U.S., for example, can access up to 4:1 leverage), in most cases leverage is not available when trading cash equities (stocks). CFDs operate differently. CFD traders in the EU, for example, can access up to 5:1 leverage (reminder: CFDs are not available for trading in the U.S. or for U.S. residents). Check out my guide to the best high leverage brokers.

Risk: Though it’s unlikely to see your portfolio plummet to zero when trading or investing in traditional underlying stocks, this is not true with share CFDs. CFDs are tradeable instruments that carry extreme risk; most retail CFD traders lose money. Leverage introduces additional risk that isn’t present when trading underlying stocks. When trading CFDs, it’s possible to lose your entire balance (or even go into the negative, in some cases).

How do I choose the best CFD platform?

There's a wide variety of CFD platforms on the market, and choosing one to suit your individual trading needs can be a daunting task. It's an important decision, so I've put together a list of the most important factors to consider when choosing a CFD trading platform:

- Regulation: You should always make sure that your forex broker is licensed and regulated by reputable regulatory jurisdictions. Dealing with unlicensed brokers increases your risk of falling victim to forex scams. Read my educational series to learn more about how to avoid forex scams.

- Markets: It's important to verify the range of markets and tradeable instruments offered by your broker for CFD trading. Individual trading needs and strategies will vary, but ideally you want a broker that provides access to a wide range of assets and asset classes, such as forex, stocks, commodities, indices, and cryptocurrencies like bitcoin.

- Fees: It's a good idea to do some research into the commissions and fees that are charged by CFD brokers. These may include spreads, commissions, overnight fees, swap rates, inactivity fees and withdrawal fees. I recommend looking for a broker that offers competitive and transparent pricing. Check out my guide to the best zero spread brokers to see some of my top picks for lower cost forex and CFD brokers.

- Platform: I always recommend using a demo account (also known as virtual or paper trading accounts) to evaluate the quality and usability of the broker's trading platform without risking your trading funds. This way, you can test if the broker's CFD trading platform is user-friendly, reliable, and secure. You'll also want to look for the availability of advanced features such as indicators, reliable news feeds, risk management options, and charting tools (check out my guide to forex charts to learn more).

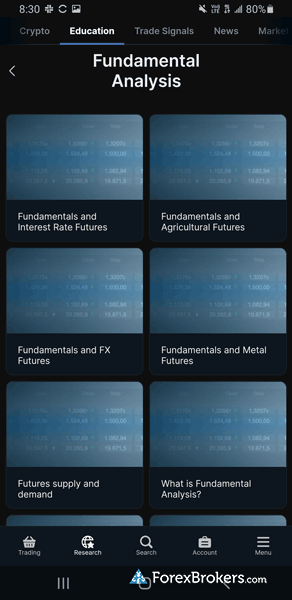

- Educational resources: The best way to start out as a CFD trader is to find a broker that offers a bunch of beginner-friendly educational resources. Most brokers provide some level of trader education, but the best forex and CFD brokers produce high-quality video content, articles, and webinars by an in-house production team. Check out my guide to the best free forex trading courses.

How are CFDs different from forex?

The main difference between CFDs and forex (foreign exchange) is that CFDs are a type of instrument, whereas forex is an asset class. CFD traders speculate on price movements for a range of asset classes, but they never take ownership of the underlying assets. Forex traders, on the other hand, can – in some instances – take delivery of actual assets (in this case, currencies).

As a derivative instrument that tracks the price of an underlying asset or security, CFDs are non-deliverable. This means that CFDs are always cash-settled, with no possibility for delivery of any underlying asset.

With certain types of spot forex trading, traders can take delivery of the asset (currency). For example, a trader that buys the EUR/USD with the ability to take delivery of the asset will pay for the transaction in U.S. dollars – and will, in turn, receive euros in their account. By contrast, a CFD trader that buys the EUR/USD cannot take delivery of any currency, and can only close the position by selling an equivalent amount of EUR/USD to exit the trade.

All this being said, CFDs and forex behave similarly in many cases. Most retail forex trades operate much like CFD trades in that they are cash-settled; generally, retail forex traders do not take delivery of any assets or actual currency. Note: Both non-deliverable forex and forex CFDs carry risk, and regulatory protections will vary depending on your jurisdiction and/or country of residence.

Pros & Cons of CFD Trading

Pros

- A wide range of markets is available to CFD traders – including instruments that might not normally be available in your country of residence.

- When trading CFDs, you can go long or short; it’s fairly easy to open a short (sell) position.

- Most CFD trades are executed instantly, which means that there can be less risk of slippage (depending on your trading account and order type).

- Typically, CFD trading platforms have low trading fees and low commissions (relatively speaking).

Cons

- Trading with leverage from a margin account is risky; it’s possible to lose your entire balance while trading CFDs.

- CFD traders incur overnight fees when holding a position overnight (also known as carry charges).

- CFD traders own a contract – there’s no ownership of the asset itself. This means that CFD traders are also ineligible for benefits such a dividends and shareholder rights.

- CFD trades are subject to capital gains tax.

Are CFDs legal in the U.S.?

No, CFDs are not legal in the U.S., and CFD trading is not permitted for U.S. residents. CFDs are considered a derivative in the U.S. and are therefore subject to the licensing requirements of the U.S. Commodity Futures Trading Commission (CFTC). Non-U.S. residents can trade CFDs using most forex brokers' trading platforms – as long as the broker accepts clients from your country of residence.

The CFTC also regulates the spot forex cash market. This means that U.S. residents who want to trade forex are required to do so with a U.S-regulated forex broker (you can find a U.S.-regulated forex broker with our guide to the Best U.S. Forex Brokers).

U.S. residents may not be allowed to trade CFDs, but there are other exchange-traded products offered by U.S. brokers – such as forex, futures, options, and securities – that can provide similar exposure to underlying assets. For example, several U.S. forex brokers offer micro-futures contracts from the CME, which allow traders to speculate on indices, metals, commodities, and forex futures contracts.

Can CFD trading be profitable?

Yes, it’s possible for CFD trading to be profitable. That being said, it’s important to recognize that the overwhelming majority of CFD traders lose money each year. Dozens of CFD brokers publicly share their own statistics that confirm this point; many of the top CFD brokers warn that upwards of 70% of retail CFD accounts lose money each year (in some cases, that number climbs above 80%).

Successful CFD traders are able to show a profit over a large volume of trades, over long stretches of time. They do so by incorporating trading styles that minimize risk and strategies that aim to keep their average losses low relative to their average profits (though this is easier said than done).

CFD traders need to have a clear and consistent CFD trading strategy and a solid risk management plan. It's also wise to choose the best CFD platform for your individual trading strategy – preferably one that offers a wide variety of tools and features.

Is CFD trading a good idea for beginners?

CFDs might not be the best choice for beginners, due to the extra risk that comes with trading with leverage from a margin account. Trading from a margin account – whether you are trading CFDs, forex, or other instruments or derivative products – is riskier than traditional investing. Trading with leverage can increase the risk/reward potential for your investment capital, and can even result in a negative balance (in rare cases).

If you already have experience with traditional investments like stocks or ETFs and you want to learn how to trade from a margin account, a demo account can be a good place to start. Demo accounts allow traders to experiment and familiarize themselves with trading software without risking any investment capital. The software is largely the same, but the demo account uses virtual funds; a “live” account is one where you fund the account with real money.

schoolCFD trading for beginners

There's a wide range of CFD platforms out there, but not all of them are suited for beginner CFD traders. If you are just getting started out and you're looking for a CFD trading platform, check out my beginners guide for trading forex and CFDs.

What are the best CFD trading platforms?

Saxo’s flagship suite of platforms for trading CFDs is my pick for the best CFD trading platform in 2025. Including SaxoTraderGO for web and mobile and SaxoTraderPRO for desktop, Saxo’s popular platform suite is loaded with trading tools, powerful charting, and cutting-edge research. In my review of Saxo, I describe its suite of platforms as having a “near-perfect balance of ease of use and advanced features.” Whether you use web or mobile with GO or you decide to stick to desktop with PRO, Saxo provides an altogether excellent CFD trading experience.

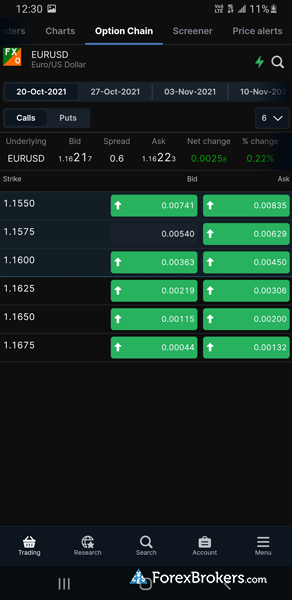

Check out a gallery of screenshots from Saxo's mobile trading app, taken by our research team during our product testing:

I also tested Saxo's SaxoTraderGO web platform and SaxoTraderPRO desktop platform:

I've reviewed over 60 of the best brokers in the industry and tested dozens of CFD trading platforms. In addition to Saxo, check out my top picks for CFD trading platforms in 2025:

What is the best broker for trading CFDs in the UK?

IG holds the crown as the best broker for trading CFDs in the U.K. IG ranks at the top of nearly every category, with multiple trading platforms, powerful research tools, comprehensive financial markets education, and a substantial range of CFD markets and spread betting products. IG is highly trusted across the globe, and holds numerous regulatory licenses – including in the U.K. where it is regulated by the Financial Conduct Authority (FCA).

What CFD brokers charge the lowest fees?

The CFD brokers that charge the lowest fees are typically those that feature the lowest effective spreads. Effective spreads are determined by calculating the broker’s average spreads, and then factoring in any per-trade commissions. In 2025, CMC Markets reigns supreme in this category, with the lowest effective spreads out of our list of the best brokers in the industry.

Here are the top 7 brokers for low-cost CFD trading in 2025:

currency_poundLooking for low-cost forex and CFD brokers?

Check out my guide to the best zero spread brokers to learn about commissions, fees, spreads, and to see my picks for the best low-cost brokers for trading forex and CFDs.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IG

IG

Saxo

Saxo

Interactive Brokers

Interactive Brokers

CMC Markets

CMC Markets

FOREX.com

FOREX.com

City Index

City Index

XTB

XTB