Top picks for spread betting platforms

Best spread betting platform - IG

| Company |

Overall Rating |

Spread Betting |

Average Spread EUR/USD - Standard |

United Kingdom (U.K.) (FCA Authorised) |

IG IG

|

|

Yes |

0.98 info |

Yes |

Why I chose IG: IG offers the most comprehensive spread betting experience with 19,500+ markets, advanced trading tools, and tax-efficient trading for U.K. and Ireland residents, backed by its industry-leading reputation and FCA regulation.

Reputation: Founded in 1974, IG is publicly traded on the FTSE 250 (LON: IGG) and regulated in eight Tier-1 jurisdictions, including the FCA in the UK. Its long-standing reputation and robust regulatory framework provide traders with unparalleled trust and security.

Comprehensive product range for spread betting: IG offers a huge selection of over 19,500 tradeable instruments, including forex, indices, commodities, shares, and cryptocurrencies. This makes IG a top choice for traders seeking extensive market coverage for spread betting, whether you're a beginner or a seasoned professional.

Exceptional trading platforms: IG’s flagship web platform and mobile app are feature-rich, offering advanced charting, integrated trading signals, and research tools, including trading from the chart. With its user-friendly design and cutting-edge functionality, IG caters to both casual traders and active investors. IG’s web platform and mobile app are among my favorites, packed with a plethora of features in a modern and streamlined user interface.

Tax-efficient spread betting: For residents of the U.K. and Ireland, IG’s spread betting platform offers a tax-efficient way to trade with competitive spreads and advanced risk management tools. This, combined with IG’s decades-long track record, makes it an excellent choice for spread bettors.

Learn more about its features and platforms in my full review of IG.

Excellent pricing and customisable platforms - CMC Markets

| Company |

Overall Rating |

Spread Betting |

Average Spread EUR/USD - Standard |

United Kingdom (U.K.) (FCA Authorised) |

CMC Markets CMC Markets

|

|

Yes |

0.61 info |

Yes |

Why I chose CMC Markets: CMC Markets stands out for its low-cost spread betting, deep liquidity, and highly customizable Next Generation platform, making it ideal for traders who demand precision and flexibility.

Reputation: With over three decades of experience, CMC Markets is publicly traded (LON: CMCX) and authorized by five Tier-1 regulators, including the FCA. Its robust regulatory framework ensures the safety and security of client funds.

Wide range of markets to spread bet: CMC Markets provides access to nearly 12,000 tradeable instruments, many of which are available for spread betting, including forex, indices, commodities, shares, and cryptocurrencies. With one of the largest product offerings globally, CMC Markets caters well to those who desire flexibility in the instruments available for spread betting.

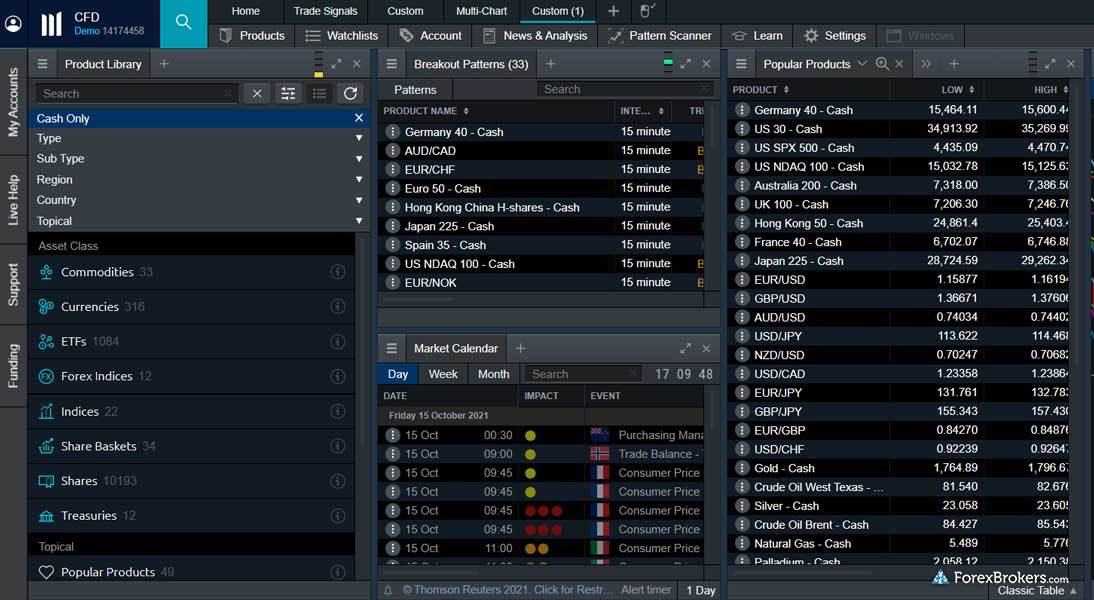

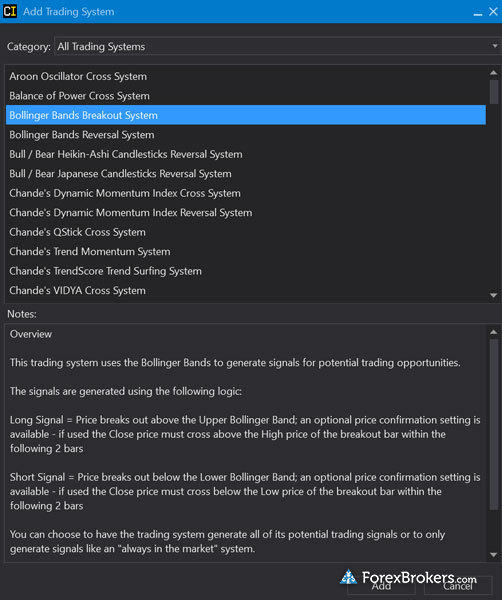

Powerful proprietary platform: The Next Generation web platform stands out with 80 technical indicators, 40 drawing tools, and advanced charting features. Its rich customization options and market-leading tools make it ideal for serious traders seeking precision and efficiency. I’m a big fan of the charts in Next Generation, and the level of customizations available.

Competitive pricing: CMC Markets offers consistently low spreads, averaging just 0.61 pips for EUR/USD based on collected spread data. Its FX Active program provides commission-based pricing, reducing costs for high-volume traders, while its Alpha rebates deliver additional perks for active investors (the offer varies by region).

Explore more about its pricing and range of investments in my in-depth review of CMC Markets.

Excellent range of investments for spread betting - City Index

| Company |

Overall Rating |

Spread Betting |

Average Spread EUR/USD - Standard |

United Kingdom (U.K.) (FCA Authorised) |

City Index City Index

|

|

Yes |

1.4 info |

Yes |

Why I chose City Index: With 13,500+ instruments, tax-efficient spread betting, and innovative tools like PlayMaker, City Index is a top choice for traders looking for market variety and strong risk management features.

Reputation: City Index is part of the publicly traded StoneX Group (NASDAQ: SNEX), a Fortune 100 company, which holds regulatory licenses in seven Tier-1 jurisdictions, making it one of the most trusted brokers we review.

Diverse investment choices for spread betting: With access to 13,500 tradeable instruments, including forex, indices, commodities, and cryptocurrencies, City Index caters to both retail and professional traders. Spread-betting options provide tax efficiencies for U.K. traders, while forex options and forwards broaden trading opportunities.

Comprehensive platform offering: City Index’s proprietary Web Trader platform is feature-rich, offering advanced tools and integrated research. Its flagship PlayMaker tool, which received our #1 Risk Management Tool award the year it launched, provides traders with valuable insights for managing their positions effectively. Personally, I found PlayMaker to be highly innovative and forward-thinking when it comes to performance analytics and helping clients better manage their risk/reward ratios.

Strong educational content: City Index’s Trading Academy and reality-show-style video series deliver an engaging approach to trader education. Beginner and intermediate traders can benefit from progress tracking, quizzes, and a variety of learning formats.

Discover more about its tools and available instruments in my complete review of City Index.

FAQs

Is spread betting legal?

In places where proper regulation is in place, such as in the U.K. where it is tightly regulated by the Financial Conduct Authority (FCA), spread betting is legal. However, the legality of spread betting may vary based on your country of residence, the location of your broker, and any other applicable regulations. The United States, for example, does not allow the trading of either spread betting instruments or CFDs for its residents.

One thing to note is that U.K. and Ireland-regulated brokers will only let you trade these products if you are a resident of those respective countries, otherwise, CFDs may be the only similar equity available to you if you reside outside those jurisdictions where spread betting is legal.

Note: U.K. residents can still choose to trade CFDs rather than spread betting, depending on their objectives. The main difference, besides tax treatment, is the way prices are quoted: in pounds per point for spread betting compared to pips and points for CFDs.

How is spread betting different from trading CFDs?

While both spread betting and CFDs involve speculation on price movements, spread betting is tax-free in the U.K. and Ireland, while CFD profits may be subject to capital gains tax.

Additionally, spread betting uses "points" to measure profit and loss — usually denoted as pounds per point — while CFDs rely on actual price movements of the underlying asset.

For example, consider the following two trades which are for identical trade size values, but one is a spread bet and the other is a CFD trade in the same underlying asset:

- CFD Trade Example (100,000 EUR/USD): A 50-pip price move equals $500 at $10 per pip.

- Spread Betting Example ($10 per point on EUR/USD): A 50-point price move equals $500 at $10 per point.

Aside from this quotation difference and the tax treatment difference in places such as the U.K. and Ireland, there is essentially nothing else to differentiate between spread betting and CFDs.

What brokers offer demo accounts to practice spread betting?

Most spread-betting brokers offer demo accounts, allowing traders to test their platforms and refine strategies without risking real money. Top-tier brokers like IG, CMC Markets, and City Index provide feature-rich demo environments that closely mirror live trading conditions, making them excellent choices for practicing spread-betting strategies.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IG

IG

CMC Markets

CMC Markets

City Index

City Index

Capital.com

Capital.com

OANDA

OANDA

AvaTrade

AvaTrade

FXCM

FXCM