In a global market that operates 24/5, the difference between a regulated partner and a risky platform isn't always obvious. That's where we come in.

My 25 years in the forex industry have taken me from the trading desk to forex conferences around the world. I bring that insider perspective to our broker reviews and our Annual Awards. For our 2026 Annual Awards, I stress-tested dozens of top brokers, analyzing and verifying spreads, tested tools and mobile trading apps, and audited regulatory licenses.

Whether you need advanced charting or a beginner-friendly app, this guide cuts through the noise to rank the safest, most reliable forex brokers in the world.

I’ve spent decades navigating the forex industry, both as a professional analyst and an active trader. In that time, I’ve used hundreds of forex trading platforms. I know that choosing a broker requires more than a quick glance at a website, it requires deep due diligence.

That’s why I log into every available platform, hand-verify each broker’s regulatory licenses and Trust Score, and score each broker across 130 data-based metrics and over a dozen scoring categories. The result is a list of the best forex brokers based not on marketing claims, but on actual, verified user experience.

Top picks for the best forex brokers

1. IG. Best forex broker for 2026

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

IG IG

|

|

£1 |

0.91 info |

IG offers the ultimate forex trading package – excellent trading platforms, research tools, high-quality education, comprehensive market research, and an extensive list of tradeable products. This fantastic all-around experience has earned IG my top ranking across dozens of brokers for an astonishing eight years in a row. IG is the best overall forex broker for traders around the world in 2026.

Trust: Founded in 1974, IG is publicly traded (LON: IGG) and regulated in eight Tier-1 jurisdictions, making it a Highly Trusted broker for forex and CFD trading. IG has had our highest Trust Score for seven years running, and remains our pick for #1 Trust Score in 2026.

Forex trading platforms: IG’s flagship trading platform offers an extensive range of tradeable markets along with integrated trading signals and the ability to place trades directly from your charts. IG’s charts on its mobile app are the best I’ve ever tested, packing more functionality than any other mobile chart I’ve tested. If you’re hoping to use MetaTrader, IG offers the full MetaTrader suite (MT4 and MT5) and premium add-ons from FX Blue (though only 76 tradeable instruments are available for MetaTrader at IG). There's no question in my mind – if you want to get the most out of your trading experience at IG, it’s best to go with IG’s proprietary platforms.

Steven's take

"I love IG’s mobile charts. Orders can be updated quickly and easily and risk-reward ratios can be calcualted on the fly. If I want to quickly modify a position in the app, I just open a chart, tap on the stop-loss order, and drag it to a new level."

Steven Hatzakis

Research: IG offers high-quality research content across a variety of formats. I recommend checking out its newer “Trade Live with IG” video series, available direclty on IG’s platform and on YouTube. IG also offers market analysis from its in-house staff, posted throughout the trading week.

Education: IG earned Best in Class honors for Education in 2026, thanks to its selection of high-quality courses, podcasts, videos, and the dedicated IG Academy app. It’s worth noting that IG’s discontinuation of IG Community and the winding down of its DailyFX brand have hurt the broker’s rating for Education in 2026. This is an extremely competitive space in the world of online forex brokers, and some of IG's peers, like Interactive Brokers, AvaTrade, and eToro, have increased both the quality and quantity of their educational content for forex traders in 2026. That said, IG still offers a strong educational program for beginner forex traders.

The IG Trading mobile app charting supports trading from the chart, as well as news overlays and multiple concurrent indicators.

travel_exploreAttention U.S. forex traders:

Check out IG's highly rated offering for US forex traders, now under its new tastyfx brand. Traders at tastyfx gain access to the same platforms and forex trading experience that has made IG my favorite broker for 6 years and counting.

2. Interactive Brokers – Low fees, great for professional traders

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Interactive Brokers Interactive Brokers

|

|

$0 |

0.59 info |

Interactive Brokers (NASDAQ: IBKR) is a highly trusted multi-asset broker with an award-winning range of tradeable global markets. It delivers competitive fees, high-quality research and education, and a modern, institutional-grade trading platform suite.

Commissions: Interactive Brokers offers competitive pricing, aggregating prices from 17 of the world's largest interbank forex dealers. Instead of marking up spreads, Interactive Brokers charges a commission for all forex trades, ranging from $16 to $40 per million round turn ($8 to $20 per side). These low per-trade commissions, combined with low average spreads on pairs such as the EUR/USD, led to Interactive Brokers earning Best in Class honors for Trading Fees in the ForexBrokers.com 2026 Annual Awards.

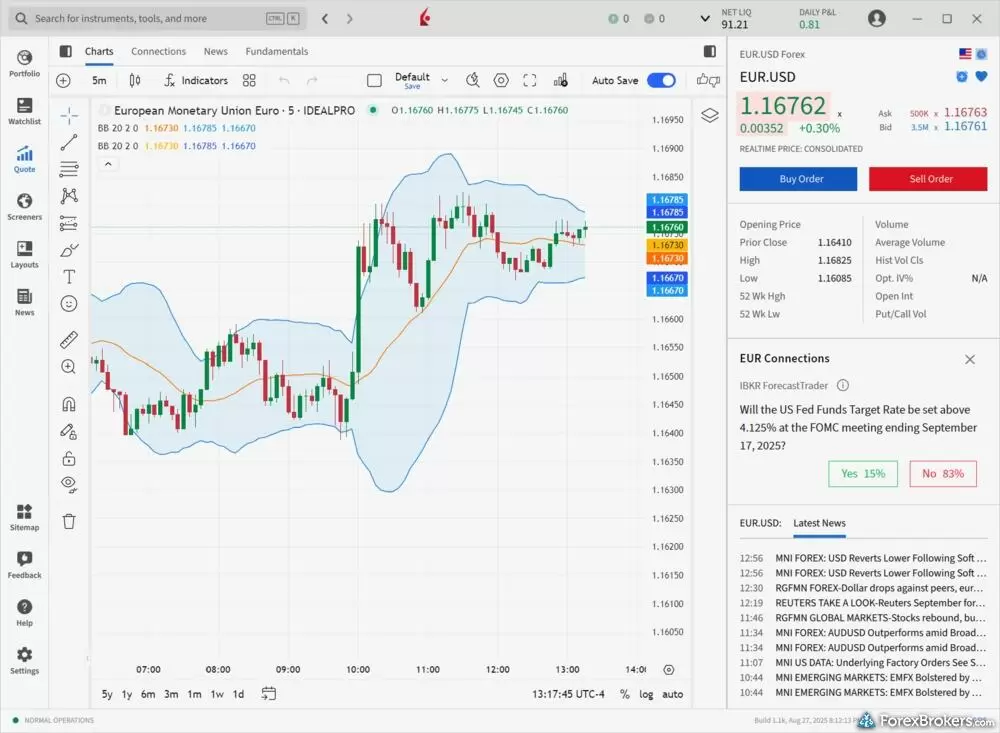

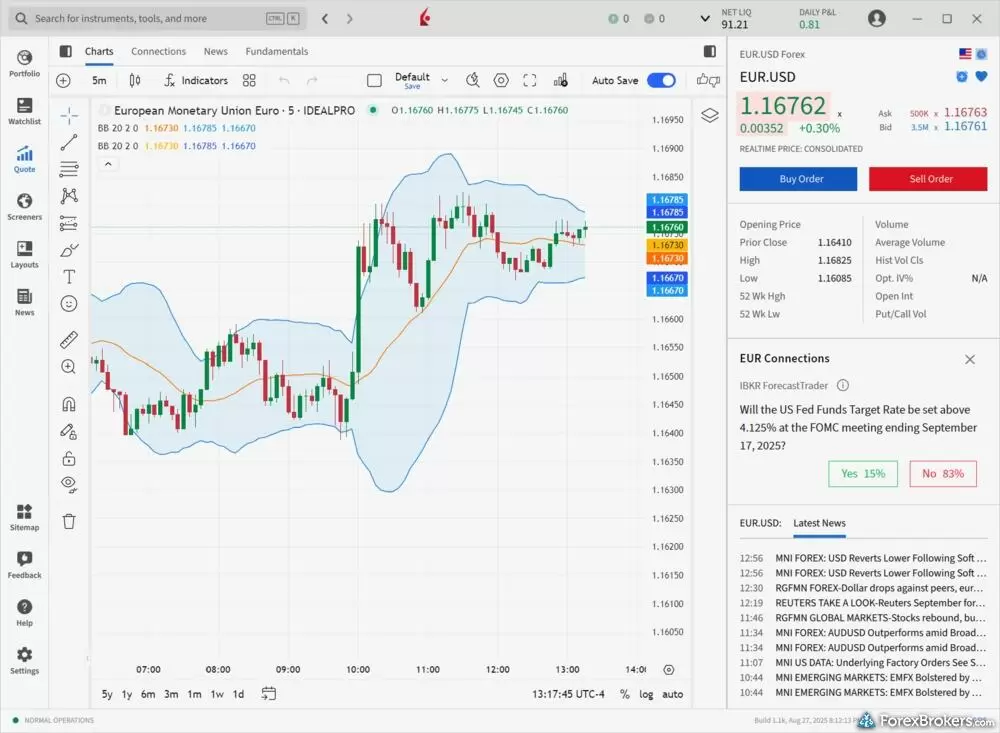

Forex trading platforms: Interactive Brokers’ impressive suite of trading platforms includes its flagship Trader Workstation (TWS), the web-based Client Portal, and the IBKR Desktop platform, along with three dedicated mobile trading apps.

Interactive Brokers offers more in-house built platforms than any other brokers I reviewed for ForexBrokers.com in 2026. My personal favorite is IBKR Desktop, which offers a simplified user experience while still delivering a good balance of features for both beginner and intermediate traders. It’s worth noting that IBKR’s GlobalTrader doesn’t support forex trading, but event contracts on popular currency pairs are available.

My layout on the IBKR Desktop platform includes a chart of the EUR/USD pair, a trading panel, and news headlines from Reuters.

Research and Education: IBKR offers a growing selection of research, including streaming news headlines from top-tier sources and market analysis provided by in-house staff. No other forex broker I review offers a wider range of third-party sources for research. Its vast, university-grade selection of educational materials available via the IBKR Campus won our 2026 Annual Award for #1 Education, and is exceptional for traders and investors of all experience levels.

3. Saxo – Best Research and #1 Desktop Platform

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Saxo Saxo

|

|

$0 |

1.0 info |

Saxo has recently lowered the minimum deposit requirement for its entry-level Classic account to $0, making it easier for a wider range of traders to access its excellent forex trading platforms, phenomenal research, and 70,000+ tradeable instruments.

With a $0 minimum deposit requirement for its entry-level Classic, Saxo has made it easy for a wide range of forex traders to access its excellent trading platforms, phenomenal research, and 70,000+ tradeable instruments. Saxo’s high-quality research in a variety of formats earned our 2026 Annual Award for #1 Research.

Trust: Founded in 1992, Saxo operates multiple regulated banks and is licensed in seven Tier-1 jurisdictions, earning a Trust Score of 99 and a “Highly Trusted” distinction.

Commissions: Saxo provides traders with excellent all-around pricing. For active traders (and those with large forex account balances), Saxo offers competitive pricing in its Platinum and VIP accounts, which require a $200,000 and $1 million balance, respectively. It’s worth noting that average spreads at Saxo for the EUR/USD pair improved year over year, by about 1/10th of a pip across its three account types, including its Classic account.

Forex trading platforms: The entire Saxo client experience is absolutely brilliant. Alongside access to 70,000 tradeable instruments, Saxo's flagship SaxoTraderGo platform is terrific and includes everything traders might need to navigate the market, securing our 2026 Annual Award for #1 Desktop Platform. Saxo also offers access to TradingView, the globally popular platform with advanced forex charting capabilities.

I’ve been a huge fan of Saxo’s platform suite (both SaxoTraderGO and SaxoTraderPRO) for many years. Saxo has been a pioneer in this space, and has a long history of producing sophisticated, easy-to-use trading platforms. That said, while it’s still one of my favorites, my only grievance is the inability to drag-to-modify orders within its charts, which hinders its usability for active trading (and trading on the go within the mobile app).

SaxoTraderGO's mobile charts depict multiple concurrent indicators and trend lines when trading EUR/USD.

4. FOREX.com – Great platforms and education

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

FOREX.com FOREX.com

|

|

$100 |

1.00 info |

Backed by StoneX Group Inc. (NASDAQ: SNEX), a Fortune 100 company with over $7.8 billion in client assets, FOREX.com delivers a highly trusted, feature-rich trading experience and access to 5,500+ tradeable instruments.

Platforms: FOREX.com's flagship Advanced Trading desktop platform and Web Trading platform feature charts powered by TradingView and versatile trading tools. Both MetaTrader 4 and MetaTrader 5 are available to clients in the U.S. and Canada, rounding out an impressive platform suite that caters to forex traders of all levels.

Pricing: Spreads on the broker’s Standard account tend to run higher than what you’ll find at some of the top low spread brokers (like Tradu, Interactive Brokers, and Capital.com), but active traders can access competitive pricing through FOREX.com’s RAW Spread account, which offers spreads as low as 0.13 pips (plus commission).

Research and education: FOREX.com's award-winning Trading Academy stands out for its detailed interactive courses, suitable for all experience levels. Research has improved significantly year over year, with quality daily market updates and integrated Trading Central modules.

5. CMC Markets – Low spreads on FxActive account

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

CMC Markets CMC Markets

|

|

$0 |

1.3 info |

CMC Markets (LSE: CMCX) delivers an exceptional trading experience with Best-in-Class pricing and over 12,000 tradeable instruments available on its award-winning Next Generation platform.

Range of investments: CMC Markets also offers the most currency pairs of any broker we review, with 158 pairs quoted both ways for a total of 282. The Next Generation platform impresses with powerful charting featuring 80 technical indicators, pattern recognition tools, and seamless integration with Reuters news and client sentiment data.

Platform suite: In addition to offering the full MetaTrader suite and TradingView, CMC's mobile app ranks among the best in the industry. I’ve been a long-time fan of CMC’s mobile app and NextGeneration web platform; I continue to be impressed by its modern interface and smooth user interface. With CMC, you’ll also gain access to the full MetaTrader suite and TradingView (which is now fully integrated into NextGeneration platform). Following its acquisition of StrikeX, CMC Markets now offers 24/7 crypto trading.

Other forex brokers I tested

6. Charles Schwab – Powerful thinkorswim platform

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Charles Schwab Charles Schwab

|

|

$0 |

1.27 info |

Charles Schwab is a highly trusted industry leader offering professional-grade forex trading exclusively on its award-winning thinkorswim platform. Ideal for advanced traders, it delivers powerful charting, commission-free pricing, and massive multi-asset access alongside robust research.

However, the platform can be intimidating for beginners. Forex availability is limited to U.S. forex traders and requires a steep 10,000-unit minimum trade size. With limited forex-specific education, Schwab is best suited for experienced investors prioritizing safety and sophisticated analysis.

7. XTB – Well-rounded offering and xStation 5 platform

| Company |

Overall Rating |

Minimum Deposit |

Commission per trade (EUR/USD) - Standard account |

XTB XTB

|

|

$0 info |

N/A |

XTB is a highly trusted multi-asset broker that earned Best in Class honors for Beginners. Publicly traded and regulated by top-tier bodies like the FCA, XTB stands out for its excellent customer service and its user-friendly, proprietary xStation 5 platform.

Users gain access to a massive range of markets, including forex, CFDs, and crypto, along with outstanding educational content. However, MetaTrader is not supported, and pricing is merely average. XTB is an ideal choice for new traders seeking an intuitive, all-in-one experience.

8. City Index – Broad range of CFD markets and platforms

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

City Index City Index

|

|

£100.00 |

1.4 info |

City Index is a highly trusted global broker (Trust Score 99) backed by StoneX Group, ideal for traders who value premium proprietary tools over the lowest possible costs.

Its flagship Web Trader platform and mobile app are excellent, featuring TradingView charts and the award-winning "PlayMaker" risk management tool. Users get access to a massive 13,500+ tradeable symbols and solid education with progress tracking. However, pricing is average, putting it slightly behind low-cost leaders for price-sensitive traders.

9. eToro – Best broker for copy trading

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

eToro eToro

|

|

$50-$10,000 |

N/A |

eToro is a pioneer in the social trading space. Its standout CopyTrader feature allows beginners to automatically mirror the moves of experienced investors . Users also gain access to a massive range of crypto and stocks.

However, active traders may find eToro pricier than average due to higher spreads. Lacking advanced algorithmic support, it is best suited for casual traders and crypto enthusiasts rather than high-volume professionals.

10. FXCM – Great for algorithmic trading

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

FXCM FXCM

|

|

Starts from $50 |

0.9 info |

FXCM specializes in algorithmic and automated trading. A subsidiary of Jefferies Financial Group, it excels with robust API support, Python integration, and its professional-grade Trading Station platform.

However, the offering is narrow, with fewer than 500 tradeable symbols and no MetaTrader 5 support. While pricing is merely average for standard accounts, FXCM remains a top choice for advanced traders focused on automated strategies and technical analysis.

FAQs

What does a forex broker do?

A forex broker is a company that is licensed (or considered exempt) by a national regulator to grant you — as a retail or professional client — the ability to place forex trades (buy or sell foreign currencies), by way of an online trading platform or over the phone (known in the industry as voice broking). An online broker may offer you the underlying currency, or a non-deliverable spot contract or derivative such as a contract for difference (CFD) depending on any relevant country-specific regulatory restrictions. It's important to only use brokers that are properly regulated to reduce your risk of falling victim to a forex scam.

Do I need a broker for forex?

Yes, to trade forex you'll need to use a forex broker. You'll need to open a forex account with an online broker and deposit funds (in the form of margin) to enable you to place orders with your broker.

The forex broker's job is to execute your orders — either internally by acting as the principal to your trade (market maker execution) or by sending your orders to another market, thus acting as your agent (agency execution).

Your broker should be regulated and properly licensed in your country of residence (or in a major financial center). We’ve included a few important questions that are worth asking to help determine if your forex broker is trustworthy:

- Does the broker have adequate financial operating capital?

- How long has the broker been in operation?

- Does the online broker hold regulatory licenses in the countries where it operates, and is it in compliance with local laws?

securityFind a trustworthy broker:

ForexBroker.com’s proprietary Trust Score ranks forex brokers based on their reliability and overall trust. We evaluate and track dozens international regulatory agencies; click here to learn more about Trust Score.

How much money do you need to start trading forex?

Beginner forex traders might start trading forex with as little as $100, while it’s not uncommon for professional day traders to have six or even seven-figure trading accounts. The specific amount of money you’ll need for online forex trading will depend on multiple factors, such as your personal financial situation, your trading goals, and your tolerance (or appetite) for risk.

If you are a beginner, you’ll need to determine if online forex trading is suitable for you. Check out my guide to forex trading for beginners to learn more about the basics of forex trading and to find out what beginner tradres should be looking for in a broker.

The next step will be deciding on your trading budget. This is especially important given the risks involved in trading forex from a margin account with leverage. Forex brokers typically offer a range of contract sizes so you can fine-tune the size of your forex trade – which will determine how much risk you are taking for a given profit target.

A micro account with a low margin requirement would make it possible to place forex trades and test a trading strategy with as little as $100 of risk capital. In this case, your potential risk will be limited – but so will your potential rewards. Trading forex with a small amount of risk capital can let you test a new investment methodology, or allow beginner traders who are new to forex trading to learn by trial and error without “breaking the bank.”

Regardless of your trading budget, you'll need to choose a dependable method for depositing and withdrawing funds for your forex account. PayPal has grown in popularity as a way to fund forex trading accounts, due to its extensive international presence and wide range of supported currencies. Head over to our guide to the best PayPal forex brokers to learn more about using PayPal to fund your account, and to see our list of the best forex brokers that accept PayPal.

percentPro tip:

For most beginners, trading forex with an amount of capital that you can afford to lose can be a great way to learn with less risk, and can be of value if you focus on the percentage returns rather than their dollar value.

Which broker is the best for forex?

IG took first place for our 2026 Annual Awards as the best overall forex broker, with 100 available currency pairs and the ability to trade CFDs and forex options, traders have plenty of choices. IG holds nearly a dozen regulatory licenses (and holds the distinction of being the only forex broker regulated in both Switzerland and the U.S.); simply put, IG is one of the most trusted brokers in the industry.

Who is the biggest forex broker in the world?

IC Markets is the largest forex broker by trading volume (data excludes Japan due to the abnormally high trading volumes known to come from Japanese brokers), with an average of $1.35 trillion in monthly forex trading volume during the second quarter of 2025, according to data compiled by Finance Magnates. IC Markets’ pricing and execution makes it an excellent choice for algo traders and high frequency trading.

expand What does it mean to be the biggest forex broker?

What can be considered the largest forex broker may vary depending on the time period used to measure size. Important factors to consider when gauging the size of a forex broker are the assets under management, number of clients, and market capitalization (valuation for public companies).

What are the top 10 forex brokers by trading volume?

Here is a list of the top 10 brokers by forex and CFD trading volume according to data compiled by Finance Magnates during the second quarter of 2025 (data excludes Japan due to the abnormally high trading volumes known to come from Japanese brokers):

- Exness

- IC Markets

- IG

- TMGM

- EC Markets

- Plus500 (offers forex via CFDs)

- Saxo

- CMC Markets

- CFI

- XM

Which forex broker has the best trading platform?

IG has the best forex trading platform in 2026. I've been reviewing IG's award-winning trading platform suite for ten years, and it still manages to impress me, year after year. IG combines platform power with usability better than any other broker I've tested. Its flagship is loaded with features that serve traders of all experience levels, including streaming news and integrated trading signals from Autochartist and PIA First, advanced charting with 30+ technical indicators, and the ability to trade directly from charts with precision. I really like its innovative "Recommended News" feature, which personalizes content based on your trading behavior.

IG also delivers one of the best forex trading apps in the industry, helping it snag our 2026 Annual Award for #1 Mobile App. It features excellent mobile charts that deliver dozens of technical indicators and drawing tools, and the ability to drag-to-modify orders with integrated risk-reward ratios calculated on the fly.

Which forex broker offers the most CFDs?

IG offers the most tradeable CFDs in the industry, with a staggering 17,000+ tradeable CFDs. CFDs, or "contracts for difference," enable traders to speculate whether the price of a stock, forex pair, market index, or commodity will rise or fall – all without taking ownership of the underlying asset. If you’d like to learn more about how CFDs, check out my guide to the best CFD trading platforms.

Which forex broker offers the most currency pairs?

Alongside nearly 10,000 CFDs, CMC Markets offers the most tradeable currency pairs, with 158 pairs that can be quoted both ways (i.e. EUR/USD or USD/EUR), which comes to a total of 316 pairs. CMC Markets won the ForexBrokers.com 2026 Annual Award for #1 Most Currency Pairs (CMC has held a five-year streak for this Annual Award).

Which forex broker is best for professionals?

As a highly-trusted and regulated global brand, Interactive Brokers (IBKR) provides everything professional traders might need, from advanced trading tools and platform features to competitive pricing across a wide variety of markets, as well as connectivity to over 130 global exchanges. In addition to competitive spreads and low commission-based pricing for forex, Interactive Brokers provides more third-party research than any other broker.

Interactive Brokers continues to innovate its forex trading platform offering with its Impact app for environmental, social, and governance (ESG) investing, alongside the related Impact dashboard available in its Trader Workstation (TWS) desktop and WebTrader platforms.

Professional client status: In today's highly regulated forex world, traders who want to maximize their margin leverage must apply and obtain ESMA's professional client status with their broker. Traders designated as Professionals in the EU do not receive negative balance protection and other consumer safety mechanisms such as eligibility for compensation schemes in the event of a broker's insolvency.

biotech Methodology:

To determine a list of the best forex brokers for professional traders, we broke down each broker's active trading program, and compared all available rebates, tiers, and all-in costs. Trading platforms were then tested for the quality and availability of advanced trading tools frequently used by professionals.

How do I choose a forex broker?

Here is a list of three of the most important factors to keep in mind when choosing an online broker for forex trading.

- First, make sure your broker is properly licensed and regulated. The safety of your deposit is always the top priority.

- Next, compare the account offerings, trading platforms, tools, and investment research provided by each broker.

- Finally, read detailed forex broker reviews to compare pricing and product offerings (e.g., number of forex pairs and CFDs available to trade) to find what is most important to your forex trading and investment needs.

compare_arrowsCompare and choose:

Not sure how to go about choosing a forex broker? Check out our Forex Broker Compare Tool to compare dozens of the biggest forex brokers in the industry and analyze their top tools and features. Our Compare Tool is fed by data gathered by our expert researchers for our forex broker reviews, so you can feel confident you have the most up-to-date information at your fingertips.

How do I know if my forex broker is regulated?

It’s important to make sure that your forex broker is highly trusted and properly regulated in order to avoid forex scams. To see an intuitive, comprehensive directory of highly regarded regulatory agencies, check out our Trust Score page. Also, be sure to check out our in-depth reviews of forex brokers – we detail the regulatory status of each individual forex broker across the international forex landscape.

We’ve also put together a step-by-step guide to help you determine if your forex broker is well-regulated:

- Find its license number: Identify the online broker’s registration number from the disclosure text at the bottom of the broker's homepage.

- Confirm the broker’s public profile: Look up the entity name (i.e. the legal company or brand name) on the regulator's website to validate the registration number.

- Confirm regulatory status: We track, rate, and rank forex brokers across over 20 international regulators, and you can find the official websites of the biggest, most important international regulators on our Trust Score page.

- Global availability: Confirm that the broker can accept clients in your country of residence. If the broker lacks regulation in your home country, it’s still worth checking to see if they can legally accept clients from your country (for example, if the broker is regulated in an alternate jurisdiction that is deemed acceptable).

- Verification: Call the phone number or contact the email address listed on the regulators’ forex broker directory if you have any doubts as to the legitimacy of a website or brand purporting to be regulated.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

FOREX.com

FOREX.com

CMC Markets

CMC Markets

Charles Schwab

Charles Schwab

XTB

XTB

Charles Schwab

Charles Schwab

XTB

XTB

City Index

City Index

eToro

eToro

FXCM

FXCM