Top 5 winners for forex trading software in 2025

Best forex trading software suite – Saxo

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

Saxo Saxo

|

|

$0 |

70000 |

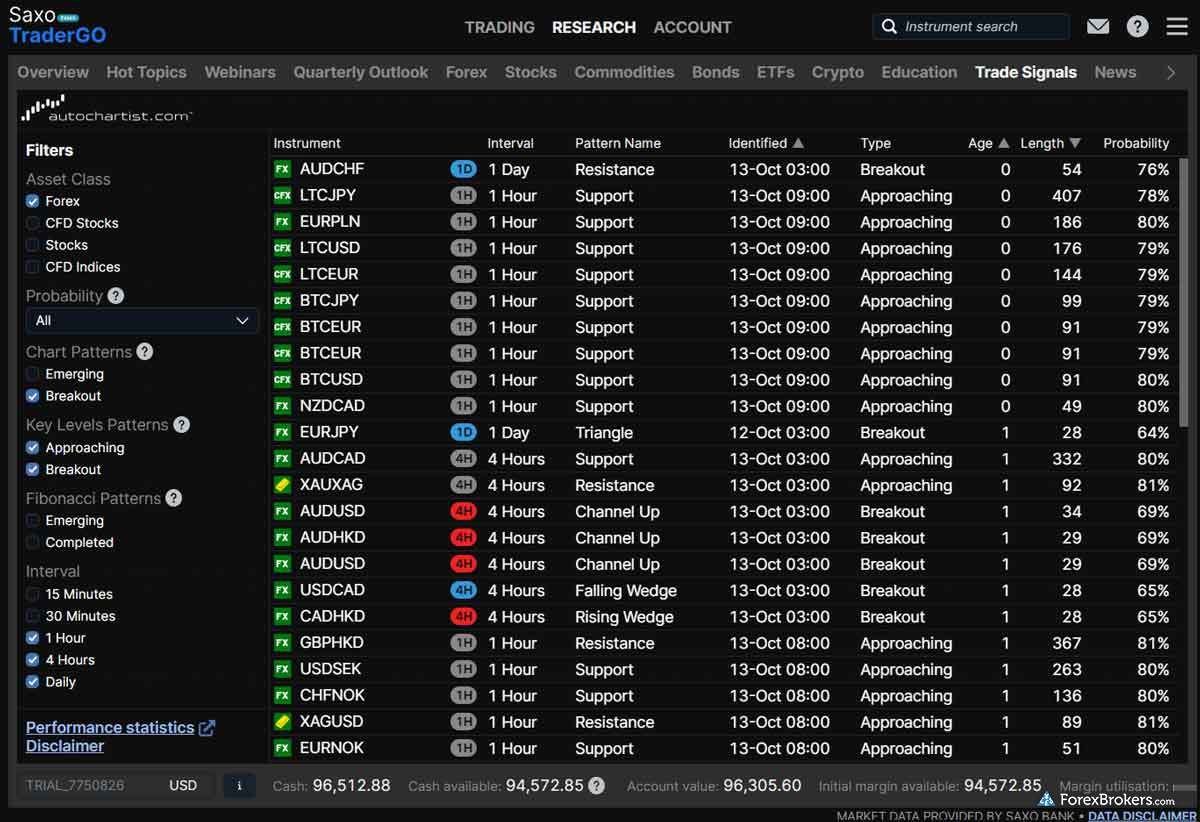

Saxo’s ultra-modern platform suite combines intuitive design with functional organization, creating a compelling trading platform suite that grants access to a vast selection of nearly 70,000 instruments. Consisting of the web-based SaxoTraderGO and desktop-based SaxoTraderPRO platforms, Saxo's platform suite delivers advanced trading and charting capabilities. The platform is designed to bring the most important tools and features within reach without making the experience cluttered or confusing.

In addition to cross-device synchronization across web and mobile, the user experience is also consistent across web and desktop versions, ensuring you can switch devices with minimal interruption. Saxo also offers comprehensive, high-quality research, including integrated trading signals that are convenient to consume directly within its platforms.

SaxoTraderPRO provides professional-grade tools for active traders, including multi-screen support, and level II order books. Saxo’s platforms cater to traders of all skill levels, but they truly shine for those seeking cutting-edge features and customization options.

Learn more by reading my Saxo review.

Excellent web and mobile platforms - IG

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

IG IG

|

|

£250.00 |

19537 |

IG’s trading platform suite for web and mobile delivers a comprehensive and powerful experience, making it an excellent choice for forex traders of all skill levels. The web platform is highly customizable, featuring advanced charting tools with 33 indicators and the ability to trade from charts, including via integrated trading signals.

IG's platform is designed to handle the needs of both beginners looking for the basics and more advanced professional traders seeking precision tools. For instance, the drag-to-modify stop-loss and limit orders on charts is a fantastic feature for active day traders.

IG also does a phenomenal job integrating news headlines and IGTV in its platform, alongside TipRanks, integrated trading signals from Autochartist and PIA First (Acuity), and customizable screeners, ensuring that traders have access to plenty of research when making trading decisions.

Check out my IG review to learn more.

Widest range of markets and growing platform suite - Interactive Brokers

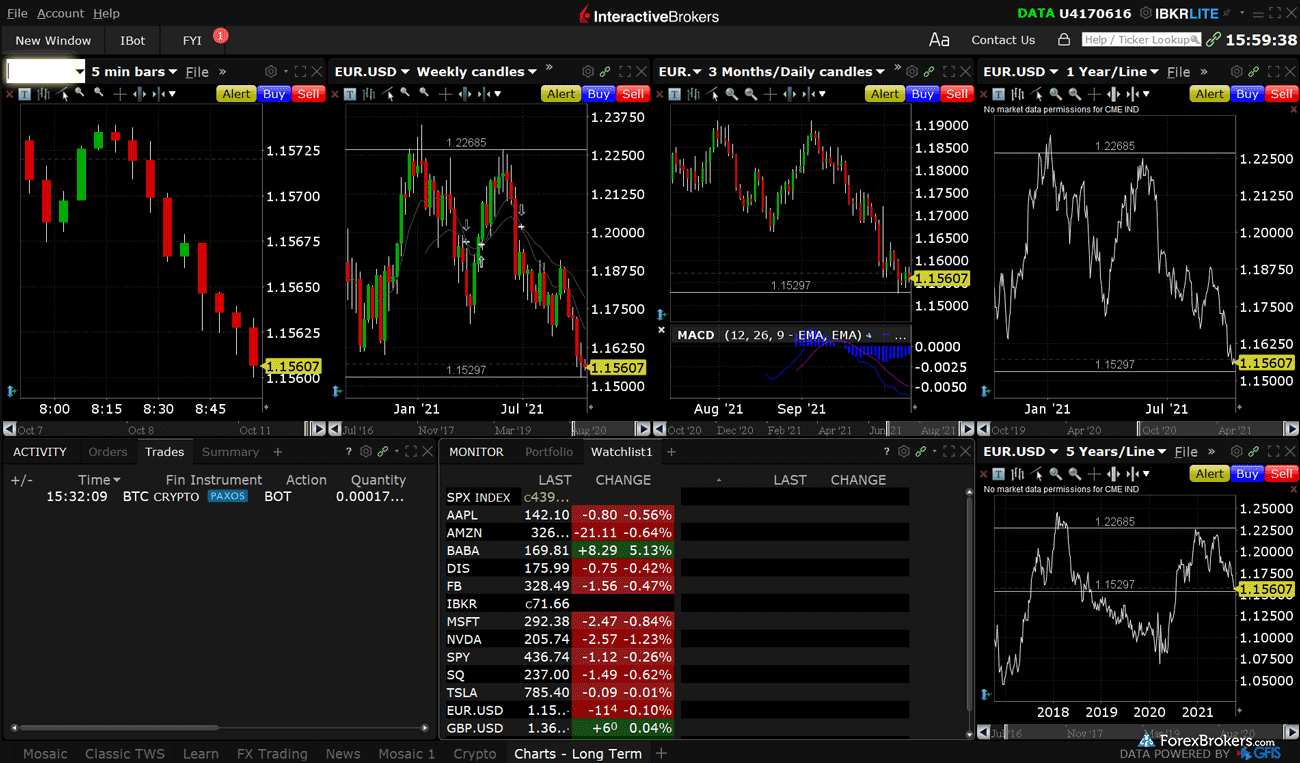

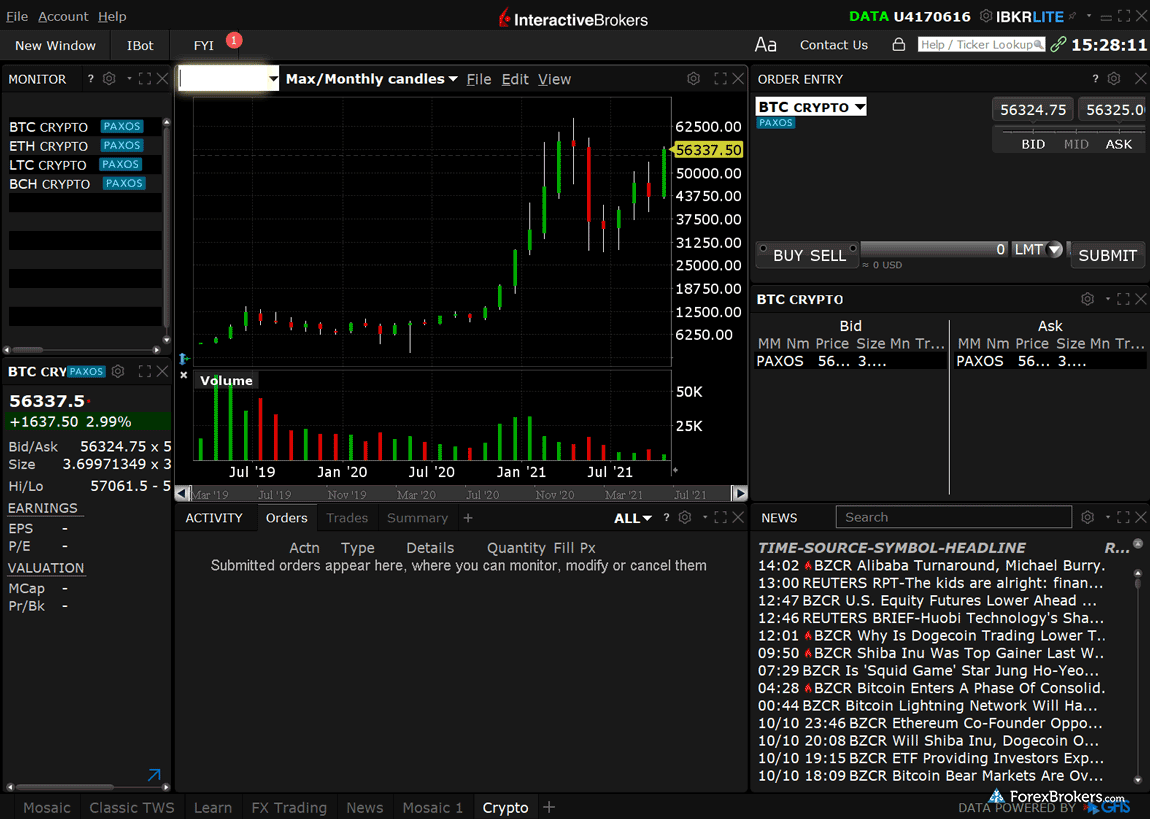

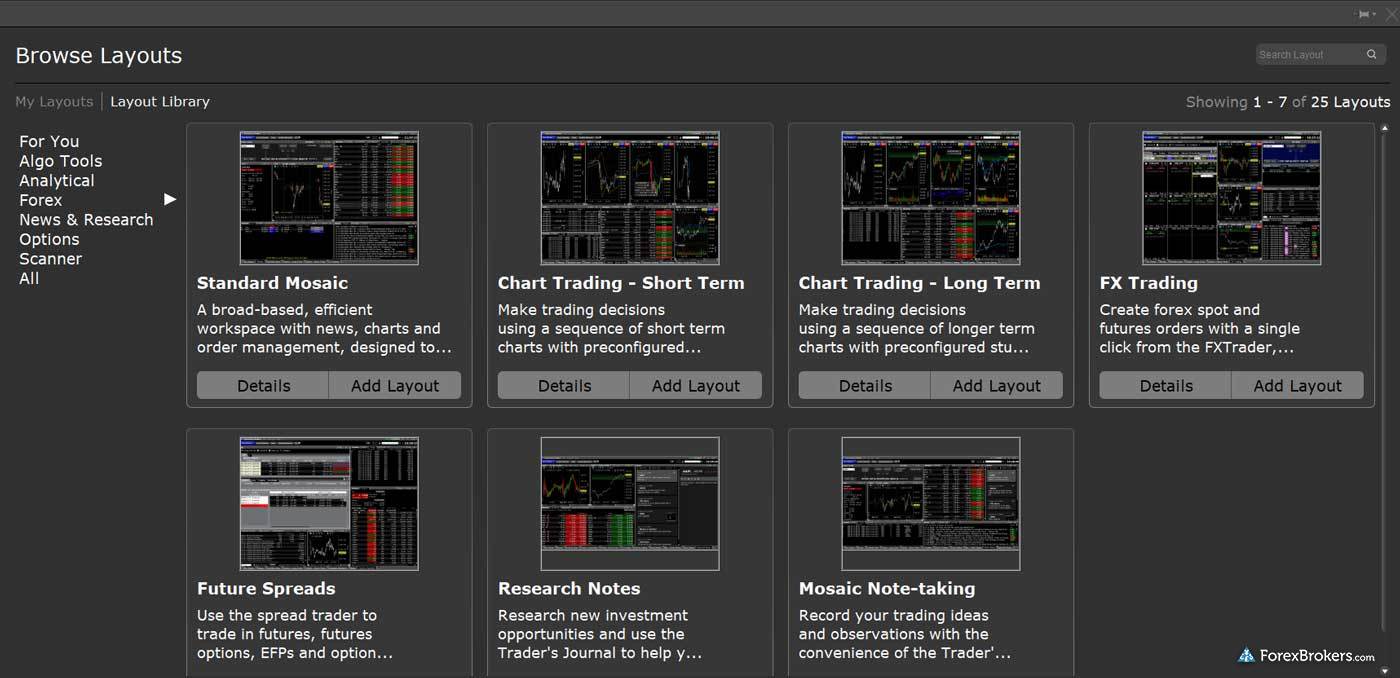

Interactive Brokers delivers a professional-grade trading experience tailored for advanced traders and institutional clients, and in recent years has also optimized its offering with the addition of new platforms that cater more to everyday retail traders. For more advanced investors, IBKR’s flagship Trader Workstation (TWS) platform offers a comprehensive suite of tools, including advanced charting with 127 studies, complex order types, and access to 91 forex CFDs and 105 cash forex pairs. These features make TWS ideal for executing sophisticated strategies, though it may feel overwhelming for beginners.

For traders seeking ease of use, the newly launched IBKR Desktop platform bridges the gap by combining user-friendly navigation with advanced functionalities. Additionally, IBKR offers seamless integration with TradingView, empowering both manual and algorithmic traders with robust charting tools and analysis capabilities. With ultra-tight forex spreads averaging 0.19 pips on EUR/USD, and a low-per trade commission, IBKR aggregates prices from 17 interbank dealers, delivering competitive pricing for high-volume traders.

Overall, Interactive Brokers stands out for its global market access, connectivity to over 150 market centers across 34 countries, and a growing platform ecosystem for traders demanding advanced features and comprehensive research tools.

Learn more by checking out my Interactive Brokers review.

Great charting on web and mobile - CMC Markets

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

CMC Markets CMC Markets

|

|

$0 |

11925 |

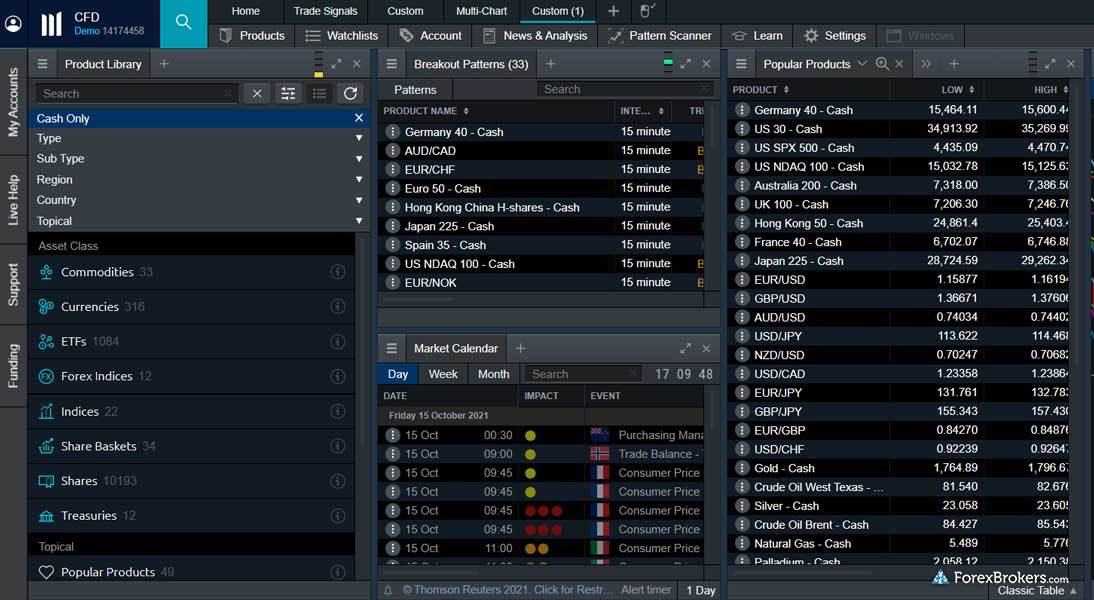

CMC Markets' Next Generation platform offers a robust, customizable trading experience. Traders have access to nearly 12,000 tradeable instruments, including 158 forex pairs and a variety of CFDs. The platform boasts advanced features such as 80+ technical indicators, 40 drawing tools, and Breakout and Emerging Patterns tools, catering to both novice and advanced traders. Mobile users benefit from a best-in-class app that mirrors the desktop platform, featuring integrated research tools, an economic calendar with notifications, and seamless watchlist syncing.

Pricing is a standout feature at CMC Markets, with tight spreads starting at 0.5 pips all-in cost on EUR/USD for FX Active accounts. Active traders can also take advantage of Alpha rebates, offering discounts of up to 20% based on trading volume. Additional tools like Guaranteed Stop-Loss Orders (GSLOs) provide added risk protection, while the broker’s low-cost pricing model ensures its competitiveness in the market.

CMC Markets complements its platforms with exceptional research and education, including in-house content like CMC TV, the Opto podcast, and articles tailored to all experience levels. While the lack of MT5 and automation capabilities on the proprietary platform may be drawbacks, CMC Markets' feature-rich tools, low costs, and regulatory safeguards make it a top choice for traders.

Read my CMC Markets review to learn more.

Excellent desktop and mobile app - Charles Schwab

| Company |

Overall Rating |

Minimum Deposit |

Tradeable Symbols (Total) |

Charles Schwab Charles Schwab

|

|

$0 |

40000 |

Charles Schwab offers a robust forex trading experience powered by the thinkorswim platform, a standout choice for multi-asset trading. Designed for more sophisticated traders, thinkorswim delivers advanced charting with 374 indicators, customizable strategies through thinkScripts, and a forex-specific layout, along with support for trading stocks, options, and other derivatives, including futures. The platform’s ability to handle complex order types, such as “Blast All” or “1st Trigger Sequence,” supports traders employing advanced strategies.

For mobile trading, Schwab provides the thinkorswim mobile app, offering access to forex trading alongside other asset classes. The app provides a similar experience to the desktop, albeit with fewer features, yet still comes with powerful charting tools, including tick charts, and watchlist synchronization. With its focus on equities, Schwab's forex spreads are not its best feature, averaging 1.35 pips for the EUR/USD (based on our most recent data).

Schwab’s strength lies in its size and trust factor, and integration of banking and brokerage services, making it an excellent all-in-one financial solution. While its forex research and tools are still developing, its highly trusted status and thinkorswim platform make Schwab a solid option for traders seeking reliability and platform versatility.

Read my Charles Schwab review to learn more.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.