HYCM (Henyep Capital Markets) Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

HYCM is a trusted brand that offers a straightforward MetaTrader platform experience and a proprietary mobile app. Its Raw account delivers competitive pricing, and traders gain access to third-party modules from Trading Central. That said, HYCM offers a narrow range of symbols to forex and CFD traders and does not accept clients in the EU anymore following the renunciation of its Cyprus license in June 2024.

-

Minimum Deposit:

$20 -

Trust Score:

86 -

Tradeable Symbols (Total):

1199

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

HYCM pros & cons

Pros

- The HYCM Trader mobile app now supports full trading capabilities.

- Offers at least 20 video courses from MTE-Media that are grouped by experience level on the HYCM Academy website.

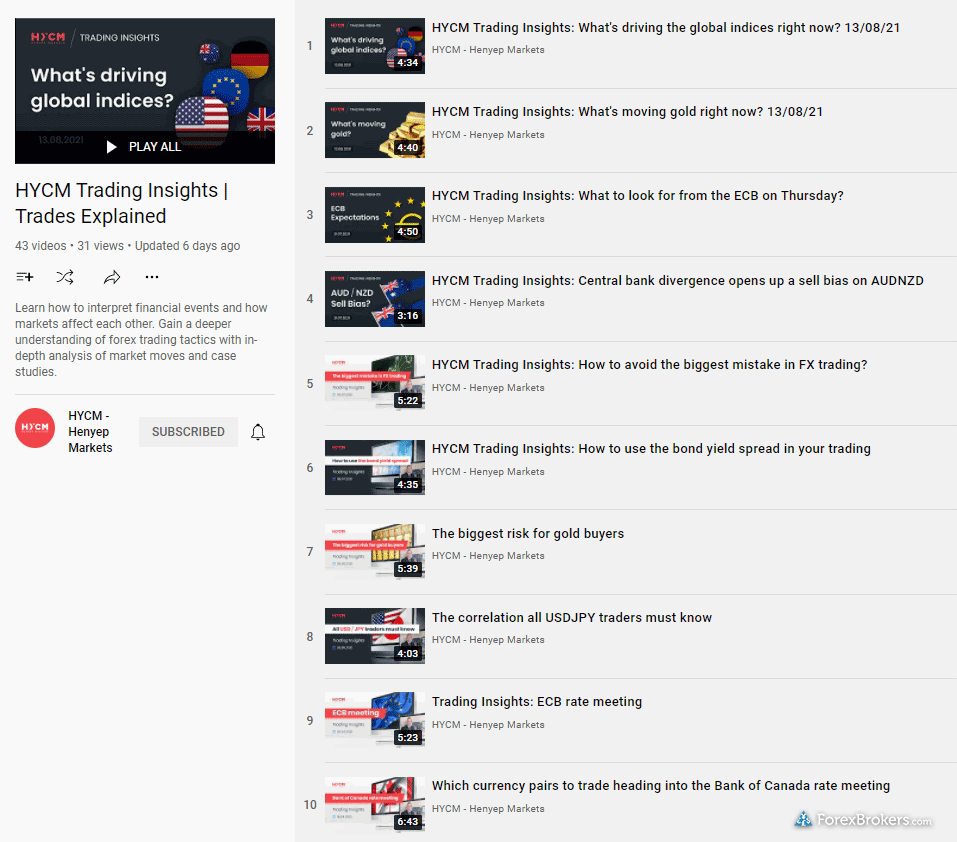

- HYCM's YouTube channel offers a catalog of webinars.

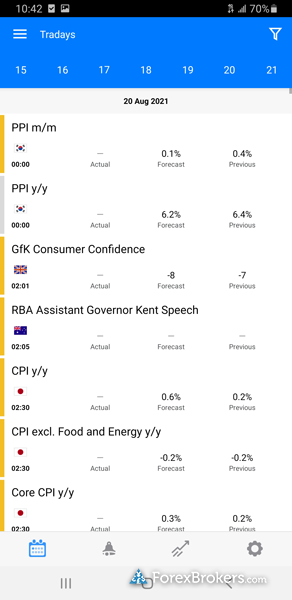

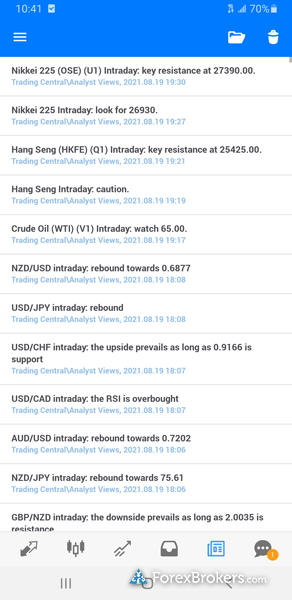

- Access to third-party research modules from Trading Central (Analyst Views, and Economic Calendar).

- HYCM recently launched Seasonax and Financial Source as additional research resources for active live account holders.

- Streaming forex news headlines from MT Newswires via the MetaTrader platform suite.

- Exchange-traded securities (non-CFD) are available through separate platform Henyep Securities.

- HYCM's Raw account has competitive pricing, with an all-in cost of about 0.6 pips for the EUR/USD (after commission).

- Cryptocurrency CFDs are available through its CIMA-regulated entity in Cayman Islands.

- Offers fractional share trading (non-leveraged) across nearly 1000 global stocks commission-free via HYCM Invest.

Cons

- HYCM renounced its Cyprus license in June 2024 and no longer accepts EU clients.

- HYCM's YouTube channel has been inactive for 9 months (as of July 2024).

- While educational content has improved, it is still limited compared to what's available from the best brokers in that category.

- Though improvements have been made to its offering, research at HYCM falls behind industry leaders.

- Cryptocurrency CFDs are not offered by HYCM's EU entity (and are restricted due to regulations in the UK for retail clients).

- HYCM's entity in SVG doesn't offer any regulatory protection to investors.

Overall Summary

| Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|---|---|

| Overall Rating |

|

| Trust Score | 86 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is HYCM safe?

HYCM is considered Trusted, with an overall Trust Score of 86 out of 99. HYCM is not publicly traded, does operate a bank, and is authorised by two Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). HYCM is authorised by the following tier-1 regulators: Securities Futures Commission (SFC), and Financial Conduct Authority (FCA).. Learn more about Trust Score.

| Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|---|---|

| Year Founded | 1977 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Compare Forex Brokers

- Best Low Spread Forex Brokers for 2025

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2025

- Best Forex Trading Apps for 2025

- Best Brokers for TradingView of 2025

- Best Forex Brokers for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- Best Copy Trading Platforms for 2025

More Forex Guides

Popular Forex Broker Reviews

Compare HYCM (Henyep Capital Markets)

See how HYCM (Henyep Capital Markets) stacks up against other brokers.

Show all

Compare HYCM (Henyep Capital Markets) Competitors

Select one or more of these brokers to compare against HYCM (Henyep Capital Markets).

Show all