CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

Swissquote and HYCM (Henyep Capital Markets) stand out in the world of online brokers for their distinct qualities and regulatory credentials. Founded in 1996, Swissquote is a publicly traded company and operates as a bank. It holds an excellent ForexBrokers.com Trust Score of 99 out of 99, making it highly trusted. Swissquote's strong regulatory standing is affirmed by its possession of five Tier-1 licenses, which are regarded as highly trusted, in addition to two Tier-2 licenses.

In contrast, HYCM, established in 1977, is not publicly traded and does not function as a bank. With a ForexBrokers.com Trust Score of 86, HYCM is considered a trusted broker. The firm holds two Tier-1 licenses and one Tier-2 license, showcasing its regulatory compliance and commitment to client safety. While both brokers have solid credentials, Swissquote's position as a bank and its higher number of Tier-1 licenses may appeal to clients seeking a more trusted platform. However, HYCM's long-established presence and trusted status may also attract investors looking for reliability.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

1996

|

1977

|

|

Publicly Traded (Listed)

info

|

Yes

|

No

|

|

Bank

info

|

Yes

|

No

|

|

Tier-1 Licenses

info

|

5

|

2

|

|

Tier-2 Licenses

info

|

2

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

0

|

1

|

Fees

When comparing Swissquote and HYCM in terms of commissions and fees, it's clear that each has its unique advantages. Swissquote, a Swiss banking giant, offers a sense of security and prestige but comes with higher trading costs. The broker provides different pricing structures across its various entities, with the U.K. entity offering slightly more favorable costs alongside a lighter deposit requirement. Clients can choose from accounts ranging from the Standard to the Elite, with varying minimum deposits and spreads starting from 1.3 pips for the Standard account in the U.K. and 1.7 pips in Switzerland. In terms of performance, Swissquote receives a 3.5-star rating for commissions and fees and ranks #52 among 62 brokers according to ForexBrokers.com.

On the other hand, HYCM is known for its competitive pricing strategies. The Raw account is particularly attractive for traders, offering an all-in cost of approximately 0.6 pips for the EUR/USD after commissions. This account is contrasted by the Classic account, which features a variable spread starting at 1.2 pips, and a fixed-spread account with a spread of 1.5 pips. HYCM garners a 4.5-star rating for its commissions and fees and holds the #15 spot out of 62 brokers according to ForexBrokers.com, highlighting its cost-effective approach.

In summary, while Swissquote provides a renowned brand with diverse account options, it does come with higher associated costs, making it less appealing for those seeking low-cost trading. HYCM, on the other hand, stands out with its more cost-effective offerings, particularly for those using its Raw account, and maintains a strong reputation for affordable trading conditions.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$1000

|

$20

|

|

Average Spread EUR/USD - Standard

info

|

N/A

info |

1.2

info |

|

All-in Cost EUR/USD - Active

info

|

N/A

info |

0.6

info |

|

Active Trader or VIP Discounts

info

|

Yes

|

Yes

|

|

ACH or SEPA Transfers

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

Yes

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

Yes

|

Yes

|

|

Visa/Mastercard (Credit/Debit)

info

|

Yes

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

Swissquote and HYCM (Henyep Capital Markets) are popular online trading platforms, each offering diverse investment opportunities. Swissquote provides a substantial range of tradeable symbols, numbering 472, alongside 80 forex pairs. HYCM, however, offers a larger amount of tradable symbols at 1199 but has slightly fewer forex pairs with 70. Both brokers allow investors to trade forex as CFDs or spot contracts and give access to exchange-traded securities on U.S. and international exchanges. This means you can invest in companies like Apple or Vodafone on both platforms without dealing with CFDs.

When it comes to additional features, Swissquote excels by offering copy trading, which HYCM does not provide, and it stands out by allowing clients to buy actual cryptocurrencies besides derivatives. In comparison, HYCM only offers cryptocurrency derivatives. These varied options have earned Swissquote a 5-star rating for Range of Investments, placing it second out of 62 brokers according to ForexBrokers.com. Meanwhile, HYCM has earned a still respectable 4-star rating, ranking 33rd in the same category. Overall, both brokers offer considerable investment selections, although Swissquote provides a few more choices for the discerning trader.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

472

|

1199

|

|

Forex Pairs (Total)

info

|

80

|

70

|

|

U.S. Stock Trading (Non CFD)

info

|

Yes

|

Yes

|

|

Int'l Stock Trading (Non CFD)

info

|

Yes

|

Yes

|

|

Social Trading / Copy Trading

info

|

Yes

|

No

|

|

Cryptocurrency (Physical)

info

|

Yes

|

No

|

|

Cryptocurrency (Derivative)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

When choosing between Swissquote and HYCM for trading platforms and tools, both brokers present solid options with unique features tailored to various trader preferences. Swissquote stands out with its proprietary platform, alongside support for popular software like MetaTrader 4 and MetaTrader 5, offering a robust package for all traders. The broker provides a web-based interface and a Windows desktop version, making it accessible and versatile. Swissquote also leads in features for those keen on analytics, offering 75 drawing tools for charting. Additionally, Swissquote supports copy trading, an option not available with HYCM, enhancing its appeal for traders looking to replicate successful strategies effortlessly.

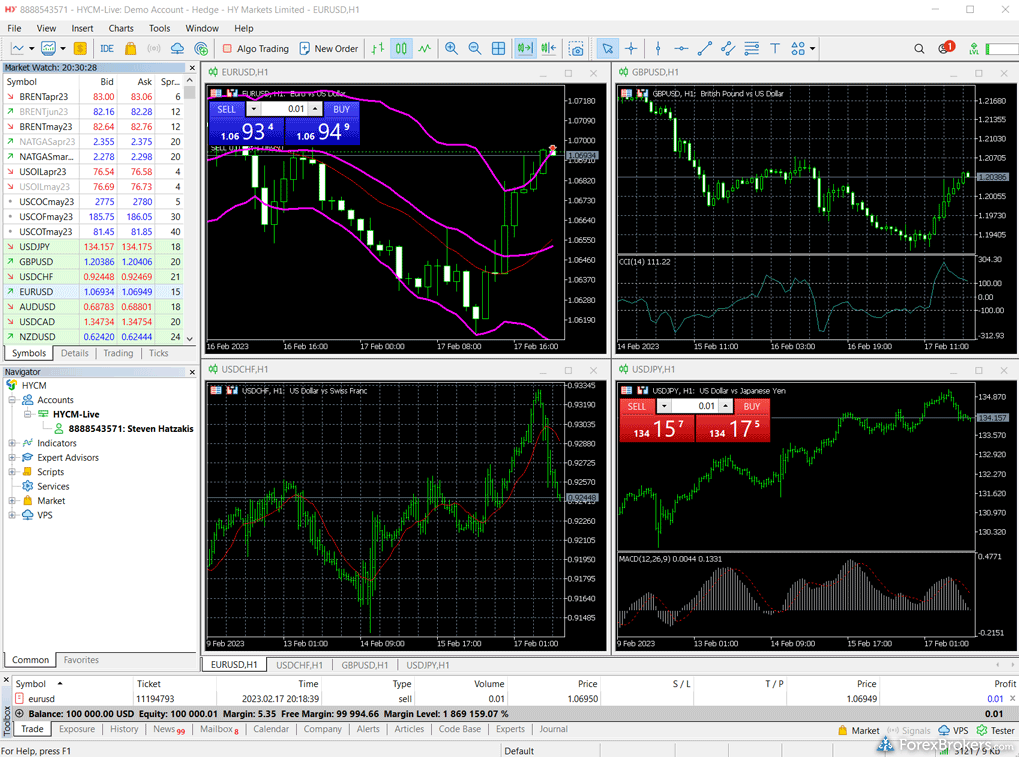

HYCM competes with Swissquote by also offering MetaTrader 4 and MetaTrader 5, alongside its proprietary platform, easily accessed through both browser and desktop interfaces. However, it trails in charting tools, providing only 15 drawing tools, and lacks a copy trading feature. Despite this, both brokers cover essential trading needs, including virtual demo accounts for simulated trading and the convenience of trading directly from stock charts. Swissquote slightly outshines with its 11-column watch lists compared to HYCM’s 7, providing more detailed market monitoring. Swissquote’s edge is reflected in its higher rating of 4.5 stars for trading platforms and tools, along with a ranking of 12 out of 62 brokers by ForexBrokers.com, while HYCM scores 4 stars and ranks 40th.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Platform

info

|

Yes

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Social Trading / Copy Trading

info

|

Yes

|

No

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

DupliTrade

info

|

No

|

No

|

|

ZuluTrade

info

|

No

|

No

|

|

Charting - Indicators / Studies (Total)

info

|

86

|

30

|

|

Charting - Drawing Tools (Total)

info

|

75

|

15

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

|

Watchlists - Total Fields

info

|

11

|

7

|

View More

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

When it comes to mobile trading apps, Swissquote and HYCM (Henyep Capital Markets) both provide comprehensive options for smartphone users, supporting both iPhone and Android devices. Traders will find essential features like stock and forex price alerts on both platforms, along with the capability to draw trendlines and explore multiple time frames for chart analysis. Each app comes loaded with 30 technical studies, offering ample tools to make informed trading decisions. Moreover, both apps allow the creation of watchlists with real-time quotes, although neither supports syncing watchlists with the online account for changes made across platforms.

Despite offering similar functionalities, Swissquote edges ahead with a rating of 4.5 stars compared to HYCM's 4 stars for their mobile trading services. Ranked at #11 out of 62 brokers by ForexBrokers.com, Swissquote is a preferred choice for users focusing on app performance and user satisfaction. In contrast, HYCM sits at #37, indicating a need for some improvements despite providing a commendable trading experience. Overall, both apps cater well to traders, but Swissquote takes the lead in terms of user endorsement and ranking.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Alerts - Basic Fields

info

|

Yes

|

Yes

|

|

Watchlist Syncing

info

|

No

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

30

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Multiple Time Frames

info

|

Yes

|

Yes

|

|

Mobile Charting - Drawings Autosave

info

|

Yes

|

Yes

|

|

Mobile Watchlist

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

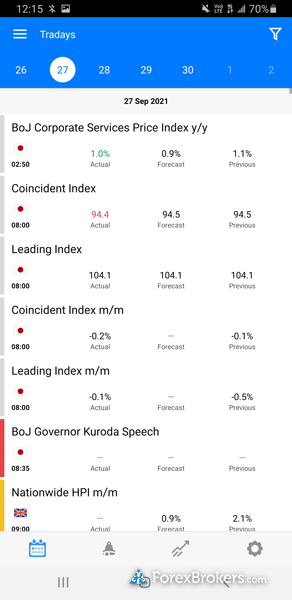

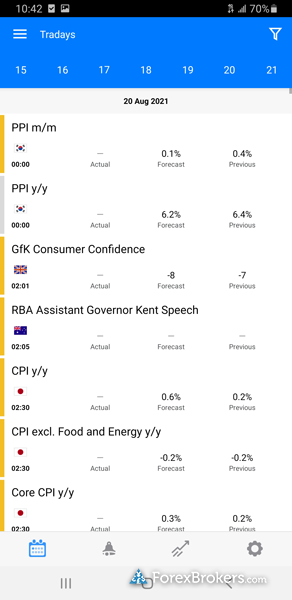

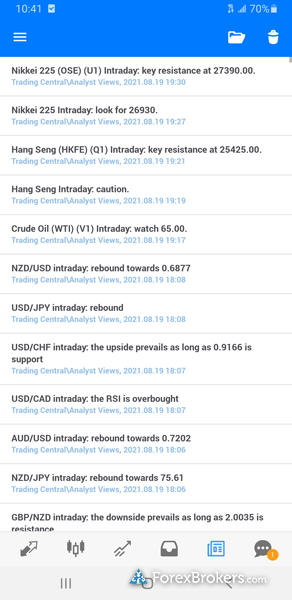

When it comes to market research, both Swissquote and HYCM provide traders with valuable daily market commentary, keeping them informed on current events and trends. Forex news from reputable sources like Bloomberg, Reuters, and Dow Jones is available at both platforms, ensuring traders have access to the latest and most reliable information. For traders who rely heavily on technical analysis, Swissquote offers tools from Autochartist, while HYCM includes offerings from Trading Central, providing diverse options for analyzing market movements. Both brokers include an economic calendar to track significant global news and events.

Despite having similar offerings in several areas, Swissquote holds a higher research rating of four stars compared to HYCM's 3.5 stars. This distinction is reflected in their rankings on ForexBrokers.com, where Swissquote is ranked 16th out of 62 brokers for research capabilities, while HYCM occupies the 35th spot. These rankings and ratings showcase the comprehensive nature of Swissquote’s research tools and resources, providing a slight edge to traders who prioritize research in their trading strategies. While both brokers have their strengths, Swissquote’s inclusion of Autochartist tools gives it a notable advantage for traders focusing on technical analysis.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

Yes

|

No

|

|

Trading Central (Recognia)

info

|

No

|

Yes

|

|

Social Sentiment - Currency Pairs

info

|

No

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Signal Centre (Acuity Trading)

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

When it comes to educational resources for beginners, Swissquote stands out as a comprehensive choice. It provides over ten educational pieces centered on forex and CFDs through articles, videos, and archived webinars. With frequent webinars available at least once a month and a searchable archive, Swissquote makes it easy for clients to find learning materials. Their collection includes more than ten beginner videos and advanced videos focused on trading topics, meeting the needs of both new and experienced traders. Additionally, Swissquote offers a dictionary with over fifty investing terms, helping newcomers understand the trading world better. Rated 4 out of 5 stars for education, it ranks 21st among 62 brokers by ForexBrokers.com.

HYCM (Henyep Capital Markets) also provides a solid platform for beginner education with over ten forex and CFDs educational materials, including articles, videos, and webinars. However, it does not offer regular monthly webinars, which could limit immediate learning opportunities. Like Swissquote, HYCM maintains a searchable archive of webinars and provides more than ten educational videos for beginners, although it lacks a collection equivalent in depth for advanced traders. An investor dictionary with over fifty terms is available to assist novices in building their trading vocabulary. HYCM is rated 3.5 stars for education and is ranked 32nd out of 62 brokers by ForexBrokers.com, showing room for growth in their educational offerings.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Education (Forex or CFDs)

info

|

Yes

|

Yes

|

|

Client Webinars

info

|

Yes

|

No

|

|

Client Webinars (Archived)

info

|

Yes

|

Yes

|

|

Videos - Beginner Trading Videos

info

|

Yes

|

Yes

|

|

Videos - Advanced Trading Videos

info

|

Yes

|

No

|

|

Investor Dictionary (Glossary)

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 62 of the best forex brokers, our research and account testing finds that Swissquote is better than HYCM (Henyep Capital Markets). Swissquote finished with an overall rank of #11, while HYCM (Henyep Capital Markets) finished with an overall rank of #29.

Traders choose Swissquote for its quality research and vast multi-asset offering – as long as they are willing to pay a premium to have their brokerage account held with a Swiss bank.

FAQs

Can you trade cryptocurrency with Swissquote or HYCM (Henyep Capital Markets)?

When comparing online brokers Swissquote and HYCM, Swissquote provides the capability to purchase actual delivered cryptocurrency, in addition to cryptocurrency derivatives, whereas HYCM only offers the option to trade cryptocurrency derivatives.

What funding options does each broker offer?

When comparing Swissquote and HYCM (Henyep Capital Markets) in terms of deposit and withdrawal options, Swissquote offers greater flexibility with availability of ACH, SEPA, PayPal, Skrill, Visa, Mastercard, and bank wires, whereas HYCM lacks ACH, SEPA, and PayPal options but does provide Skrill, Visa, Mastercard, and bank wire services.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Overall Rating

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Overall Rating info

|

|

|

|

|

Commissions & Fees |

|

|

|

|

Range of Investments |

|

|

|

|

Platform & Tools |

|

|

|

|

Mobile Trading |

|

|

|

|

Research |

|

|

|

|

Education |

|

|

|

|

Trust Score info

|

99

|

86

|

|

|

Winner |

check_circle

|

|

|

|

Review |

Swissquote Review

|

HYCM (Henyep Capital Markets) Review

|

|

|

Broker Screenshots

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Trading Platforms Gallery (click to expand) info

|

|

|

|

|

Mobile Trading Gallery (click to expand) info

|

|

|

|

|

Research Gallery (click to expand) info

|

|

|

|

|

Education Gallery (click to expand) info

|

|

|

|

|

Regulation

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

99

|

86

|

|

|

Year Founded info

|

1996

|

1977

|

|

|

Publicly Traded (Listed) info

|

Yes

|

No

|

|

|

Bank info

|

Yes

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-1 Licenses info

|

5

|

2

|

|

|

Tier-2 Licenses info

|

2

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

0

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

No

|

No

|

|

|

Canada (CIRO Authorised) info

|

No

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

Yes

|

Yes

|

|

|

Japan (SFC Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

Yes

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

Yes

|

No

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

Yes

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

No

|

No

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

Yes

|

No

|

|

|

UAE (DFSA/Central Bank Authorised) info

|

Yes

|

Yes

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

No

|

No

|

|

|

Investments

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

472

|

1199

|

|

|

Forex Pairs (Total) info

|

80

|

70

|

|

|

U.S. Stock Trading (Non CFD) info

|

Yes

|

Yes

|

|

|

Int'l Stock Trading (Non CFD) info

|

Yes

|

Yes

|

|

|

Social Trading / Copy Trading info

|

Yes

|

No

|

|

|

Cryptocurrency (Physical) info

|

Yes

|

No

|

|

|

Cryptocurrency (Derivative) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Average Spread EUR/USD - Standard info

|

N/A

info

|

1.2

info

|

|

|

All-in Cost EUR/USD - Active info

|

N/A

info

|

0.6

info

|

|

|

Active Trader or VIP Discounts info

|

Yes

|

Yes

|

|

|

Inactivity Fee info

|

Yes

|

No

|

|

|

Execution: Agency Broker info

|

Yes

|

Yes

|

|

|

Execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$1000

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

Yes

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Visa/Mastercard (Credit/Debit) info

|

Yes

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

ACH or SEPA Transfers info

|

Yes

|

No

|

|

|

Trading Platforms

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Platform info

|

Yes

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Social Trading / Copy Trading info

|

Yes

|

No

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

No

|

No

|

|

|

DupliTrade info

|

No

|

No

|

|

|

ZuluTrade info

|

No

|

No

|

|

|

Trading Tools

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Alerts - Basic Fields info

|

Yes

|

Yes

|

|

|

Watchlists - Total Fields info

|

11

|

7

|

|

|

Charting - Indicators / Studies (Total) info

|

86

|

30

|

|

|

Charting - Drawing Tools (Total) info

|

75

|

15

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Alerts - Basic Fields info

|

Yes

|

Yes

|

|

|

Mobile Watchlist info

|

Yes

|

Yes

|

|

|

Watchlist Syncing info

|

No

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

30

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Multiple Time Frames info

|

Yes

|

Yes

|

|

|

Mobile Charting - Drawings Autosave info

|

Yes

|

Yes

|

|

|

Mobile Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

Yes

|

No

|

|

|

Trading Central (Recognia) info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Social Sentiment - Currency Pairs info

|

No

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Education (Forex or CFDs) info

|

Yes

|

Yes

|

|

|

Client Webinars info

|

Yes

|

No

|

|

|

Client Webinars (Archived) info

|

Yes

|

Yes

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

|

Investor Dictionary (Glossary) info

|

Yes

|

Yes

|

|

|

Major Forex Pairs

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

GBP/USD info

|

Yes

|

Yes

|

|

|

USD/JPY info

|

Yes

|

Yes

|

|

|

EUR/USD info

|

Yes

|

Yes

|

|

|

USD/CHF info

|

Yes

|

Yes

|

|

|

USD/CAD info

|

Yes

|

Yes

|

|

|

NZD/USD info

|

Yes

|

Yes

|

|

|

AUD/USD info

|

Yes

|

Yes

|

|

|

Review |

Swissquote Review

|

HYCM (Henyep Capital Markets) Review

|

|

arrow_upward