Top picks for grid trading brokers

Best broker for grid trading – IG

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

IG IG

|

|

£250.00 |

0.98 info |

IG is my number one choice for grid trading in 2025, thanks in large part to its high ranking across nearly every category relevant to forex traders. IG (LON:IGG) is a highly trusted, publicly traded broker that is regulated in a staggering eight Tier-1 jurisdictions (learn more about Trust Score and why regulation is important).

Trading platforms: IG stands out for its trading platform suite, which I’ve found to be excellent for implementing a variety of forex trading strategies. Whether on MT4 or IG’s flagship web platform, IG supports complex order types and offers numerous tools that can be helpful for advanced strategies and sophisticated grid trading systems.

Competitive pricing: IG offers competitive spreads, making it appealing for high-frequency grid trading. With spreads averaging around 0.82 pips on EUR/USD for active traders, combined with low commissions via its DMA (Direct Market Access) offering, IG is well-suited for traders aiming to minimize costs while deploying grid strategies across volatile market conditions.

Regulatory trust and global access: As one of the most highly-regulated global forex brokers, IG provides a reliable trading environment for grid traders. The availability of nearly 20,000 tradeable instruments means IG offers unmatched market depth, allowing grid traders to diversify and scale strategies across multiple global asset classes.

I've been reviewing IG for close to ten years and it has consistently ranked as one of the best forex brokers – read my IG review to learn more.

Complex order types for grid traders – Interactive Brokers

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

Interactive Brokers Interactive Brokers

|

|

$0 |

0.59 info |

Interactive Brokers (NASDAQ: IBKR) is a highly trusted, well-regulated broker that ranks near the top of nearly every category important to traders, including for its offering of investment products and trading platform suite. Thanks to its support of complex order types, Interactive Brokers is a great choice for carrying out complex strategies like grid trading. All of its platforms, across desktop, web, and mobile are suitable for a wide range of forex trading strategies.

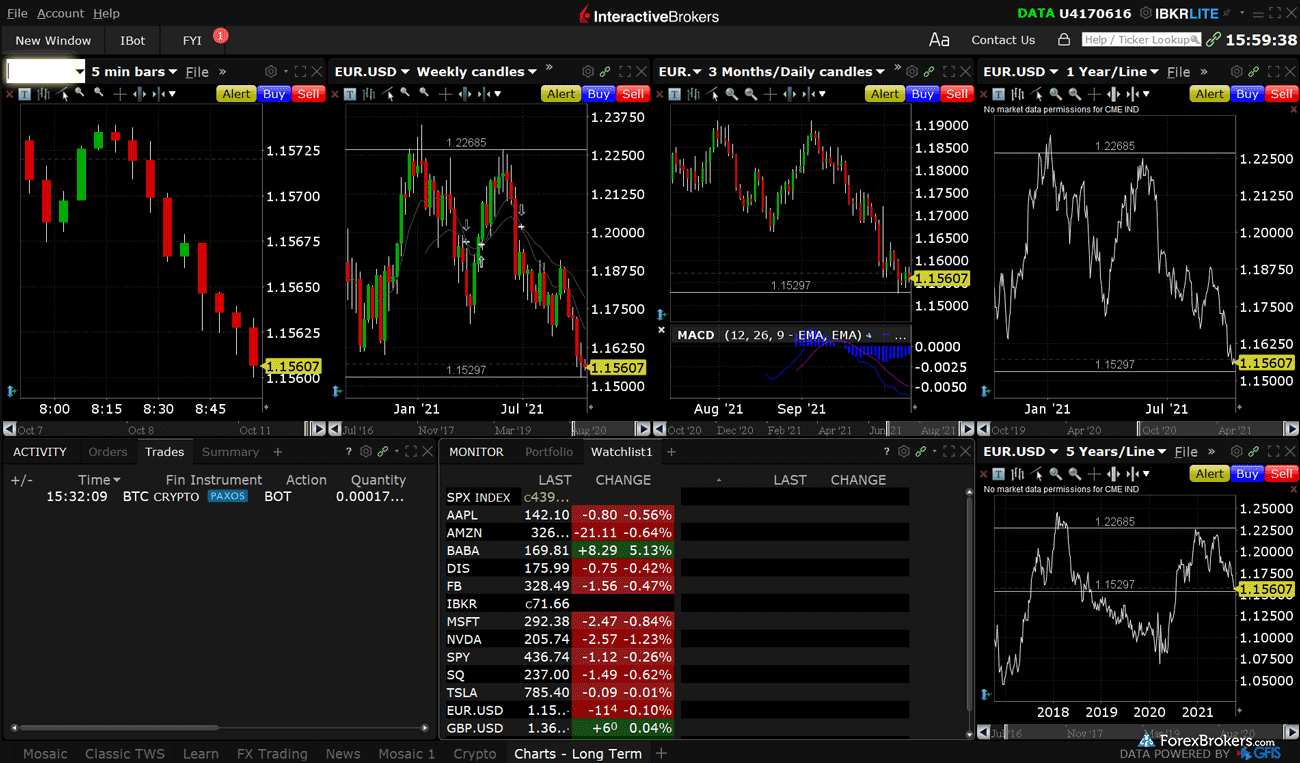

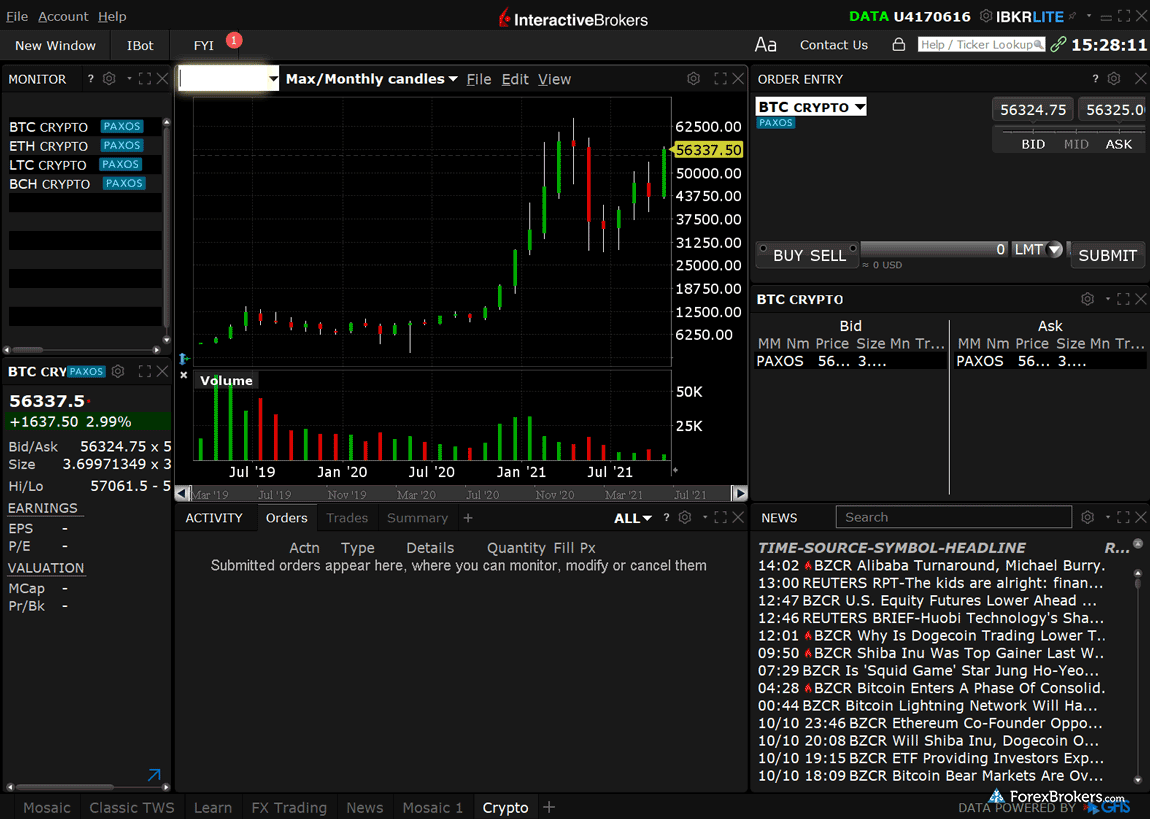

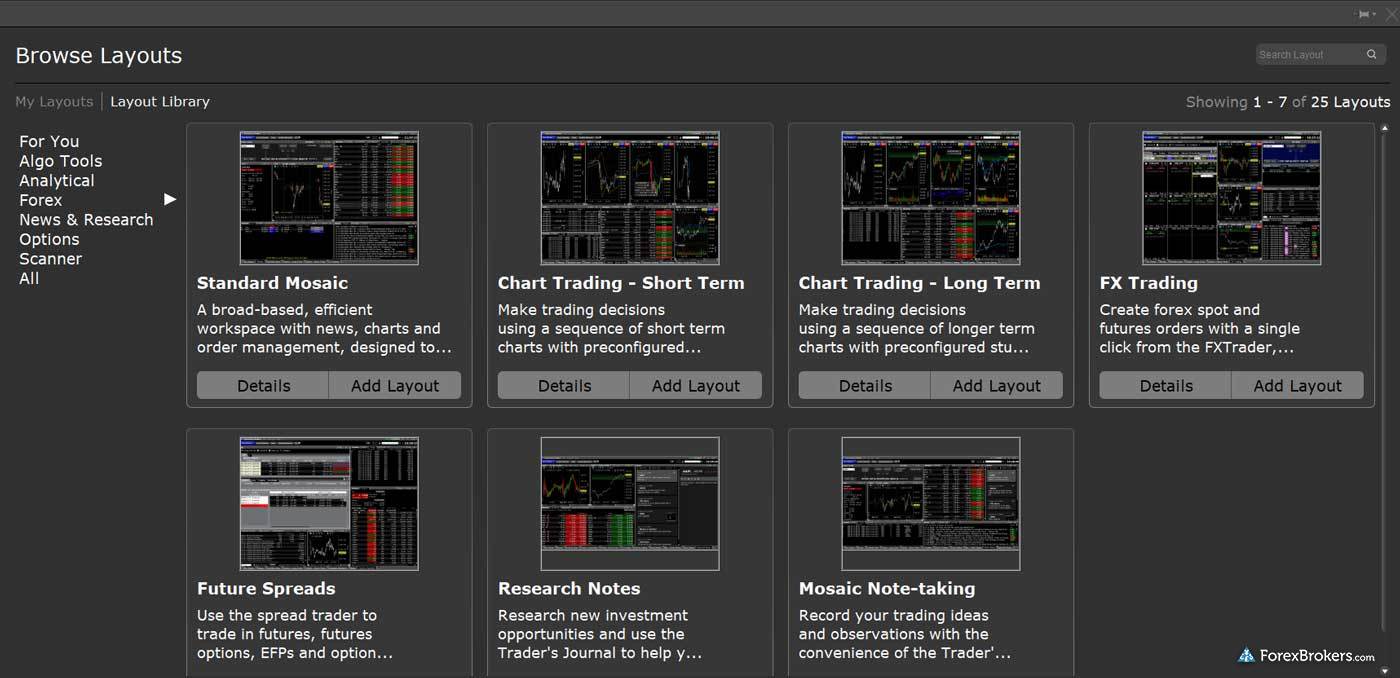

Platforms and order types: IBKR’s desktop platform, Trader Workstation (TWS), offers an extensive range of trading tools and complex order configurations. This includes the support for grid trading, with its FXTrader terminal allowing traders to access up to 91 forex CFDsor 105 cash forex pairs. The platform’s powerful charting tools and customizations provide the necessary features for executing a grid trading strategy efficiently. The web-based Client Portal is more user-friendly but still offers key tools for grid trading.

Competitive pricing: Interactive Brokers charges competitive commissions for forex trading, with commissions starting at just $4 per round-turn for $100,000 worth of currency. For active traders, IBKR offers significant discounts that can bring down costs further, making it an excellent option for those looking to trade in large volumes while deploying grid strategies. The broker aggregates prices from 17 interbank dealers, ensuring deep liquidity for precise execution.

Trust and global reach: As one of the most well-capitalized brokers globally, with $373.8 billion in client equity, IBKR offers access to 135 market centers in 33 countries. Grid traders will appreciate the broker's commitment to transparency and competitive pricing in global markets, providing the confidence needed to execute large and complex grid trades across a range of instruments.

Read my Interactive Brokers review to learn more.

Best for professional-grade grid trading – Saxo

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

Saxo Saxo

|

|

$0 |

1.1 info |

Saxo, part of the Saxo Bank Group, is a highly trusted broker with an award-winning, cutting-edge platform suite. With regulatory licenses in seven Tier-1 jurisdictions and access to over 70,000 tradeable instruments, Saxo is a premier choice for sophisticated traders in 2025.

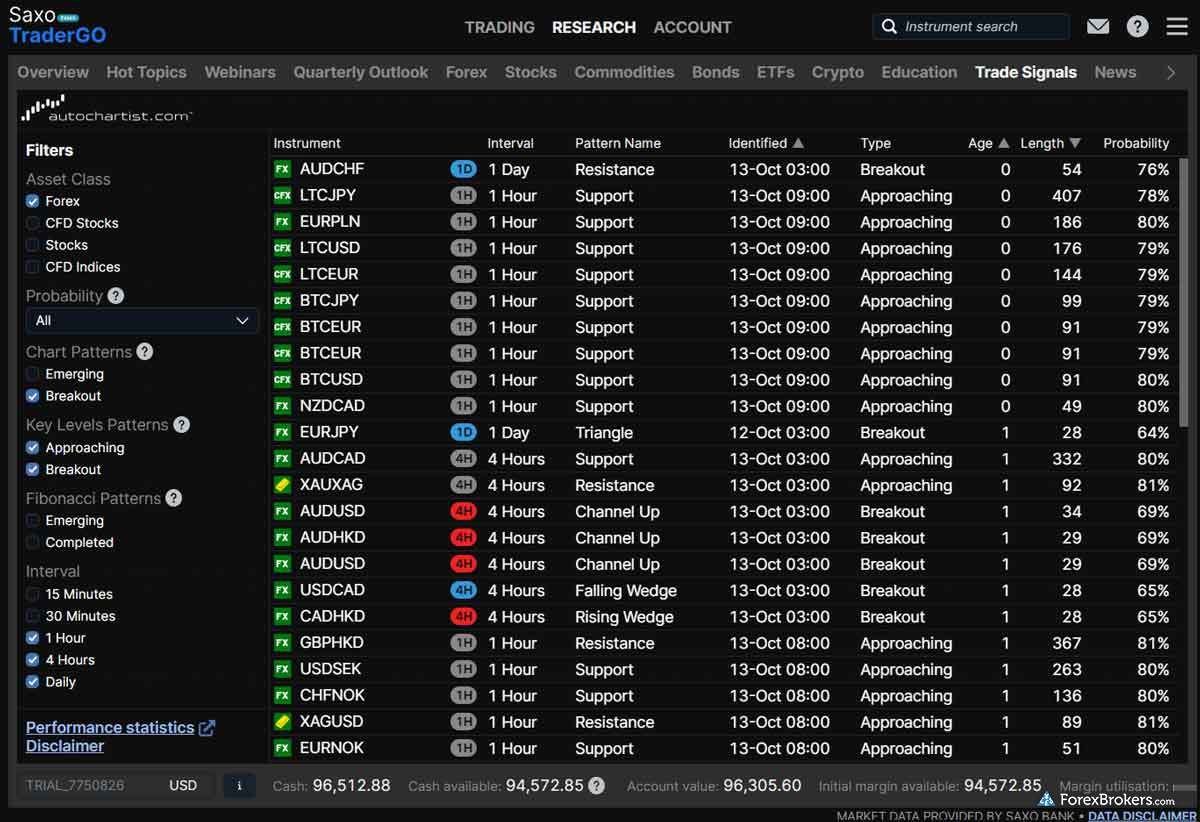

Saxo’s premium trading environment, combined with its vast research resources, makes it a powerful choice for traders using a grid strategy. Saxo’s platforms support algorithmic and complex order types, enhancing the efficiency of executing multiple simultaneous orders. Saxo’s proprietary platforms – SaxoTraderGO and SaxoTraderPRO – offer advanced tools and customizable features that make them well-suited for complex order setups like grid trading.

Platform and tools: Saxo’s platforms provide the versatility needed to implement a range of grid trading strategies. SaxoTraderGO offers a clean, intuitive interface that is excellent for users seeking to set up multiple pending orders across a grid. SaxoTraderPRO, the broker’s desktop platform, is highly customizable and designed for power users – but is still a great choice for beginner forex traders. Advanced traders can optimize their grid trading setups with support for multi-monitor setups, streaming Level 2 order books, and algorithmic order capabilities for algo trading. Both platforms feature synchronized watchlists and detailed charting tools, which are ideal for visually managing grid trades across multiple instruments.

Pricing and execution: Saxo offers competitive pricing, particularly for Platinum and VIP account holders, who benefit from lower spreads and enhanced execution. The broker publishes average spread data by trading session and order size, which is particularly useful for grid traders looking to execute large volumes. According to the most recent data sent to me by Saxo, the average spread on the EUR/USD for VIP account holders was as low as 0.9 pips, making it an attractive option for active traders who rely on tight spreads for their strategy.

Check out my Saxo review to learn more.

FAQs

What level of trading experience is needed for grid trading?

Though at first glance they may seem to provide a straight-forward approach to forex trading, grid trading strategies are generally most suitable for traders with intermediate to advanced experience. That said, much depends on how your strategy is implemented; any strategy involving multiple concurrent or successive orders adds layers of complexity.

Depending on the trading platform you are using for grid trading, you may be required to do some of your own calculations and planning before executing your first trade in a grid trading strategy.

For instance, imagine you're holding a long position and have placed a sell order 25 pips above the current market price. You could then continue to add sell orders, each 25 pips higher than the last, creating a sequence of orders spaced 25 pips apart from the current price.

Similarly, you might set a buy entry limit 25 pips below the current market price. You can follow this by placing additional buy limits every 25 pips below the previous one, forming a tiered structure.

The challenge lies not only in determining the interval, but in ensuring that the position sizing for each trade will add up to a level that is ideal for your balance size and margin requirements.

lightbulbRemember

Each order in a grid trading strategy will commit margin, even if the order isn’t executed. If you place a bunch of grid orders above and below the market, you might tie up a significant amount of your available margin for your strategy.

For these reasons, using some kind of trade calculator can be helpful. Whether you need to calculate the value of a pip for a specific trade size, simulate trading positions, or determine margin requirements, it's important to work out these values to ensure they align with your trading budget and forex account balance. My pip calculator and my lot size calculator can help you get started.

How do I set up a grid trading strategy?

Grid trading can be adapted to a variety of trading styles, depending on how closely you place your buy and sell orders. If you set a small distance between orders, for example, you'll create a dense grid, meaning your trades will trigger more frequently as the market price fluctuates. This can lead to a short-term trading style suitable for active forex traders or day traders.

If you space your orders farther apart, on the other hand, you’ll execute fewer trades but target larger market movements. This setup may be better suited for long-term traders who are willing to wait for bigger price shifts. Using stop-losses and take-profits in this scenario can help lock in profits and minimize risk, but the overall strategy tends to be slower-paced with fewer trades executed over time.

How to set up a grid trading strategy:

- Set your trading objectives (daily profit and risk goals): Begin by defining your daily goals in terms of maximum profit and risk tolerance. This helps guide your overall strategy and should align your risk management principles with your financial objectives. Knowing your limits can dictate how aggressive or conservative your grid strategy should be.

- Determine the grid interval (distance between orders): Define the distance between each order in pips. Wider intervals tend to work better in trending markets, while tighter intervals suit range-bound markets. Make sure to factor in your spread costs (I can help you find a low-spread forex broker), as these can affect profitability.

- Decide the maximum number of orders: Establishing a limit on the number of open orders at any time helps you control your exposure. More orders can provide more opportunities, but also increase risk. You’ll want to strike a balance between capturing market moves and avoiding over-leverage.

- Set the trade size relative to your account balance: Calculate an appropriate trade size per order. The trade size should be a percentage of your account balance that minimizes risk and allows for multiple orders without over-leveraging.

- Determine your risk/reward and stop-loss/take-profit parameters Calculate your desired risk/reward ratio, along with stop-loss and take-profit levels in pips. In a grid strategy, you can also use orders to offset existing trades, which acts as a proxy for stop-losses and limits. You should assess the total potential loss if all orders are stopped out, and the potential profit if all take-profit levels are hit.

- Test your trading strategy on a demo account and monitor its performance Before going live, practice your strategy on a demo account or with very small trade sizes (e.g., micro lots). Measure the performance of your strategy over time and periodically assess whether adjustments are needed based on market conditions and personal goals. Keep refining the grid parameters as you gain more experience.

Do any brokers offer specific grid trading tools?

The main feature to look for when beginning a grid trading strategy is support for a variety of complex order types. Grid trading strategies depend on the ability to place multiple pending orders with precise risk management controls. At a minimum, your forex broker should allow stop-loss and take-profit orders.

Here are four order types that can be used for a grid trading strategy, whether your overall strategy is trying to follow market trends, catch reversals, or a bit of both (such as in a sideways market):

- Buy Entry Limit (BEL) – Used to buy below the current market price.

- Sell Entry Limit (SEL) – Used to sell above the current market price, typically during a rising market.

- Buy Entry Stop (BES) – Used to buy above the current market price, with the risk of slippage during a strong upward trend.

- Sell Entry Stop (SES) – Used to sell below the current market price, with slippage being a risk during a downward trend.

Advanced tools such as ladder trading, one-cancels-the-other (OTO) orders, and calculators for grid density and intervals can further enhance your strategy, allowing you to fine-tune your grid trading approach.

Should I consider using a trading bot for grid trading?

Grid trading lends itself well to automation due to its structured nature, but you’ll still need to tweak several parameters to guide the bot’s behavior.

For instance, you'll have to define how many orders the bot can hold at once, the time interval between placing new orders, and the trade size. You’ll also need to determine the price gap between orders and set your risk/reward levels, covering target profits and risk per trade.

Here is a rudimentary example of a grid trading bot for TradingView that I developed in Pine Script:

Can I use a demo account to test grid trading strategies?

Yes, a forex paper trading account is an excellent way to familiarize yourself with your trading software and ensure you can carry out your trading strategy. That said, it’s important to use demo accounts for learning how to use your brokers trading platform – not as a way to test or predict the results of any trading strategy. Hypothetical results in a demo environment can’t be relied upon as an accurate indicator of the viability of your trading habits or strategies.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.