Saxo Review for Forex Trading

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Saxo is an exclusive multi-asset broker with brilliant research and a superb trading platform experience – as well as a stunning selection of over 70,000 tradeable instruments.

For active traders, Saxo provides an immersive, rich trading experience with a towering selection of tools, research, and premium features.

-

Minimum Deposit:

$0 -

Trust Score:

99 -

Tradeable Symbols (Total):

70000

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Saxo pros & cons

Pros

- Saxo, founded in 1992, operates three regulated banks and is highly trusted and thoroughly regulated.

- Offers access to over 70,000 instruments, including crypto derivatives, micro-futures, and forex options.

- The SaxoTraderGo platform includes everything that traders might need to navigate the market.

- Supports advanced order types, including algorithmic orders and risk management features.

- Publishes average spread data by order size and trading session, highlighting its ability to deliver best execution at scale.

- Corellian Academy's risk management content complements Saxo’s educational offerings.

- VIP and Platinum accounts have highly competitive pricing, while Classic accounts align with industry averages.

- Production of high-quality educational and research videos ramped up in 2023.

- Saxo complies with Denmark's Pillar II FSA capital requirements, maintaining 20 million euros in capital.

- Recently launched TradingView, enabling algorithmic trading with Pine script and API access.

Cons

- Educational content could be improved with progress tracking, quizzes, and more lessons that include video content.

- High minimum deposits for Platinum ($200,000) and VIP ($1,000,000) accounts may be too steep for some. If you find Saxo's minimum deposit requirements too steep, consider consider IG or CMC Markets.

- SaxoTraderPRO's customization takes time; more predefined layouts would be helpful.

- SaxoTraderGO doesn’t allow quick order adjustments by dragging and dropping on charts.

Overall Summary

| Feature |

Saxo Saxo

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Saxo safe?

Saxo is considered Highly Trusted, with an overall Trust Score of 99 out of 99. Saxo is not publicly traded, does operate a bank, and is authorised by seven Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and zero Tier-4 regulators (High Risk). Saxo is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Saxo entities are regulated.

| Feature |

Saxo Saxo

|

|---|---|

| Year Founded | 1992 |

| Publicly Traded (Listed) | No |

| Bank | Yes |

| Tier-1 Licenses | 7 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

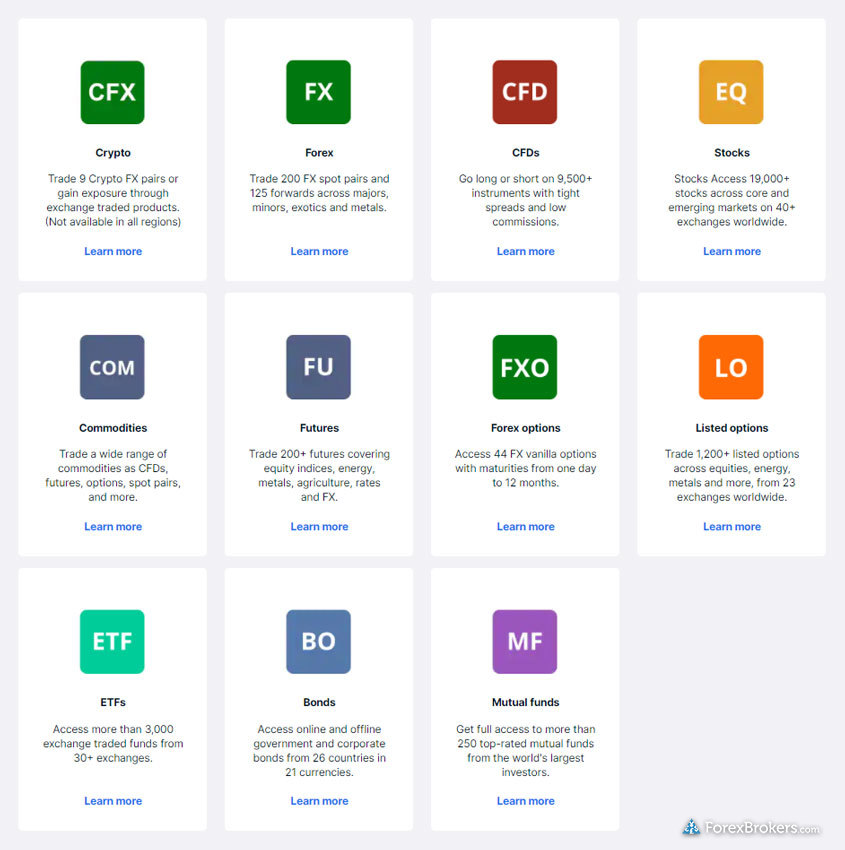

Range of investments

Saxo is a multi-asset broker that offers investors and traders a vast selection of more than 70,000 tradeable symbols. In addition to electronically-tradeable markets that span nearly every asset type, Saxo offers spot forex, FX options, non-deliverable forwards (NDFs), Contracts for Difference (CFDs), stocks, stock options, exchange-traded funds (like Bitcoin ETFs), exchange-traded notes (ETNs), futures, and 33,000 bonds (available only via phone).

Exchange-traded securities: In addition to trading CFD shares, Saxo also offers ISA/SIPP accounts for share dealing. To learn more, see our U.K. StockBrokers.com review of Saxo.

Cryptocurrency: Saxo was featured among our top picks for the best crypto trading platforms. Cryptocurrency trading is available through derivatives, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The following table summarizes the different investment products available to Saxo clients.

| Feature |

Saxo Saxo

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 70000 |

| Forex Pairs (Total) | 190 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

Overall, Saxo delivers excellent all-around pricing. For active traders, high-volume traders, and those able to maintain large account balances, Saxo's pricing is among the lowest in the industry.

Pricing summary: As of November 2023, average spread data on the EUR/USD were 1.1, 1.0 and 0.9 pips, for the Classic, Platinum, and VIP accounts, respectively. Bottom line: Pricing for Saxo's Platinum and VIP accounts is closer to the industry average, compared to its Classic account which is slightly higher.

It's worth noting that the minimum spread for each account was about 0.2 pips lower than the average for the above period (i.e. the Classic account had minimum spreads of 0.9 pips, while its average stood at 1.1). It's also worth noting that Saxo waives custody fees share trading for traders that opt into securities lending.

Classic account minimums: The entry-level Classic account minimum deposit was recently reduced to $0 for new customers in all regions.

Platinum account minimums: The minimum deposit for the Platinum account is $200,000 (or AUD 300,000 if you are a forex trader in Australia). Traders with the Classic account can qualify to be upgraded to Platinum by earning volume-related Loyalty points through Saxo’s Loyalty Program. For example, trading over $40 million worth of forex would earn you 120,000 points – which would be enough to upgrade from Classic to Platinum for 12 months.

VIP account minimums: Saxo won our 2025 Annual Award for the #1 VIP Client Experience. Saxo’s VIP account, which offers the most savings on pricing, is reserved for elite investors who either deposit at least $1,000,000, or who qualify to be upgraded under Saxo’s loyalty rewards program. Traders looking to have their account tier upgraded to VIP would need to trade at least $167 million in forex volume – this upgrade would be valid for one year. The VIP account also provides access to exclusive events and connections to Saxo analysts.

Commission-free: Saxo is commission-free, which means it makes money off the spread, when it comes to forex trading. There is one exception; traders who trade less than 50,000 units (half of one standard lot) per month are charged a ticket-fee of $3 per side.

Best execution: Saxo is committed to the FX Global Code, an evolving interbank standard focused on enhanced disclosures and execution best practices. The mission of the FX Global Code is to promote integrity and transparency across the global foreign exchange market. Saxo's reliable market maker execution earned it a spot on my list of the best market makers.

| Feature |

Saxo Saxo

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 1.1 |

| All-in Cost EUR/USD - Active | 0.9 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Saxo does a great job of unifying the excellent SaxoTraderGO web-based platform experience across devices. Saxo’s SaxoTraderGO mobile app is a favorite of mine, and competes with the best forex brokers for mobile, such as IG, CMC Markets, and Charles Schwab (U.S. citizens only). Saxo earned Best in Class honors for Mobile Trading Apps in our 2025 Annual Awards.

Apps overview: One of the strengths of Saxo’s platform suite is how closely the SaxoTraderGO web-based platform experience mirrors Saxo’s flagship mobile app offering.

Ease of use: The SaxoTraderGO mobile app is an absolute pleasure to use, due to its impressive, intelligent design. One standout feature that I really appreciate is the ability to access such an abundance of useful information within each tab for a given asset. For example, when viewing the EUR/USD pair, traders can see related videos, articles, news headlines, market research, and trading signals. The intuitive design of the SaxoTraderGO app and the plethora of available information makes it easy for traders to make clear-headed decisions when assessing markets and managing trading positions. Saxo is a true leader in this category.

Charting: SaxoTraderGO’s charting capabilities are rich with nearly 20 drawing tools and 62 indicators, and – touching on a theme here – closely matches the experience of the platform’s web-based version. In addition to syncing watchlists, charts in the SaxoTraderGO mobile app sync with the browser-based version of the platform. For example, if you draw trend lines and add indicators in the web version, they will appear in the mobile app (and vice versa).

Trading tools: Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app, including the trade ticket window, watch list and screener features, and all research tabs. The platform’s economic calendar, educational videos, market news from top-tier sources such as Dow Jones Newswire, and pattern recognition analysis from Autochartist are all accessible on the mobile app – just as they are on the web version. Finally, the options strategy finder comes with 13 predefined strategies that let you easily create related multi-leg options orders for a given instrument.

| Feature |

Saxo Saxo

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlist Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 64 |

Other trading platforms

There’s no question; Saxo's proprietary trading platforms are terrific, thanks to their streamlined designs and robust trading tools. Saxo took home our 2025 Annual Awards for #1 Desktop Platform and #1 Platforms and Tools.

Platforms overview: Saxo’s flagship trading suite includes SaxoTraderGO (web) and SaxoTraderPRO (desktop), alongside third-party platforms such as TradingView, MultiCharts, and trading connectivity via API. Saxo’s proprietary platform suite continues to improve with expanded research modules while maintaining its existing look and feel. Hot Topics tab, and integrated webinars – among other more subtle improvements. All of these advanced options put Saxo on my list of the best brokers for day trading forex.

Charting: For this review I focused on Saxo’s proprietary platform suite. While the SaxoTraderGO web-based app is designed for ease of use, it also delivers advanced trading and charting capabilities. The watch-list, screener, and alerts work together in unison, and the platform is designed to bring tools and features within reach without making the experience cluttered or confusing. I truly experienced a zen-like serenity while immersed in the platform, enjoying its near-perfect balance of ease of use and advanced features. Like the platform itself, charts are versatile and powerful, with 62 indicators, 20 drawing tools, and nine selectable chart types – all of which sync across devices. Swapping between instruments is a breeze, and I really like the product overview section, which shows related news and trade signals from Autochartist.

SaxoTraderPRO desktop: Saxo’s award-winning flagship desktop platform is SaxoTraderPRO, which resembles SaxoTraderGO in both look and feel. Functionality is similar; however, the PRO platform offers a larger selection of professional trading features. For example, PRO supports up to six monitors, streaming Level 2 order books, streaming time and sales, and algorithmic orders. Note, additional data subscriptions are required to use tools like the streaming Level 2 order book, which is a standard industry practice. Charting on SaxoTraderPRO is equally powerful as the web version. Subtle touches are seamlessly incorporated, such as the count-down timers which display the time remaining in each candle.

The only minor drawback I found when comparing PRO to GO is that many of the research features that load by default in GO must be added manually by using the “add module” tab. It’s also worth noting that additional data subscriptions are required to use tools like the streaming Level 2 order book – though this is a standard industry practice. Still, the desktop version of SaxoTraderPRO is so immersive and so massive that it felt as though I was in an IMAX theater, especially when going full-screen on a large monitor.

Ease of use: As noted earlier, Saxo provides a universal platform experience across devices, and is again my favorite for the Ease of Use category. The user experience across platforms and devices is consistent, and customized charts and watch lists automatically save and sync with the mobile app.

All in all, Saxo’s close attention to detail can be seen throughout its proprietary platforms. For example, in SaxoTraderGO, the trade ticket comes with advanced options such as the ability to switch between forex CFDs, futures, forwards, or forex options. Also, the Quick Trade option allows you to set price tolerance for slippage when you need immediate fills. Another feature I really appreciate in SaxoTraderGO is the ability to customize your default order parameters, including stop-loss and limit levels, within the platform settings.

Innovative tools: For risk-management purposes, there is an Account Value Shield feature that lets you specify the maximum risk across your account balance. If triggered, this feature will attempt to close all open positions (except for bonds and mutual funds). There are also at least thirteen advanced algorithmic order types available for various supported markets.

Third-party platforms: Saxo supports a variety of third-party platforms, including TradingView, MultiCharts, Updata, Dynamic Trend, and the OpenAPI for Excel.

TradingView

TradingView is a popular trading platform that delivers a range of powerful charting functions, robust analysis tools, and engaging community features. Learn more by checking out our TradingView Guide.

| Feature |

Saxo Saxo

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 64 |

| Charting - Drawing Tools (Total) | 20 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 60 |

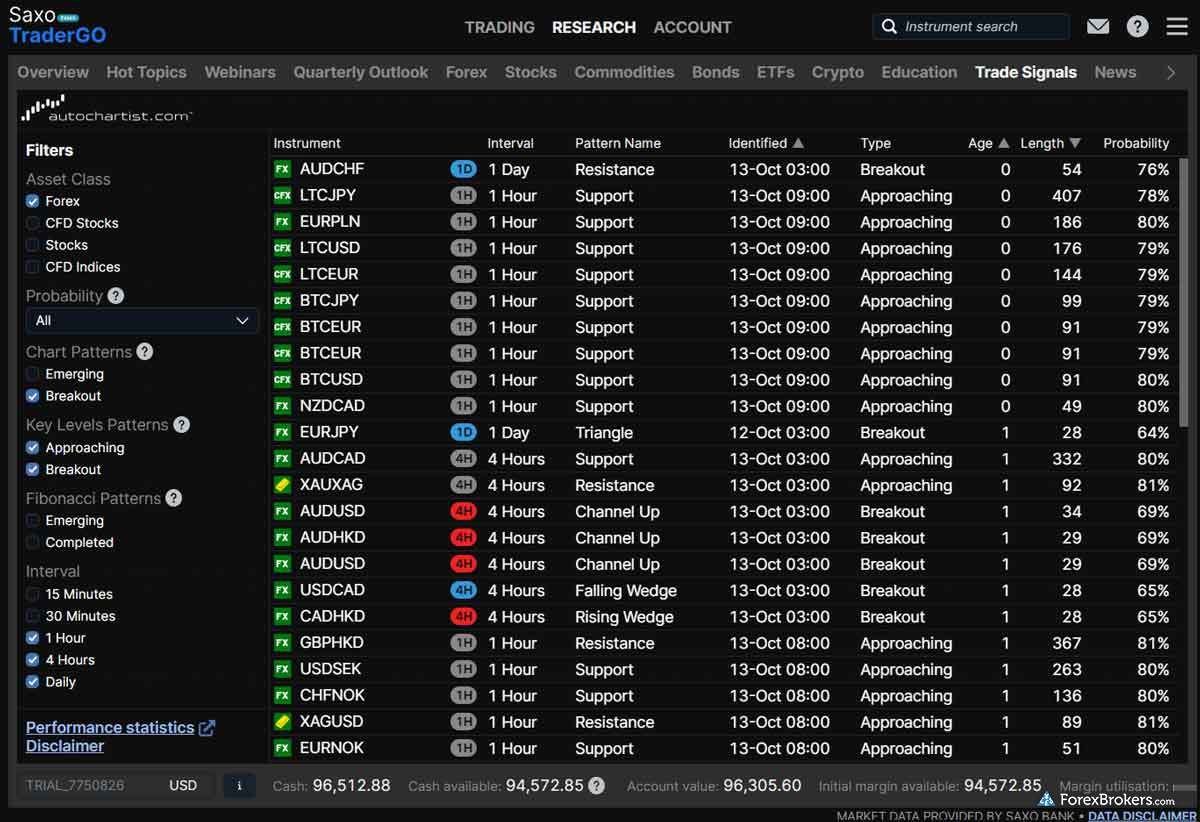

Market research

Saxo appears to be obsessed with helping its clients make money. That’s the feeling I get when perusing the state-of-the-art research from Saxo’s in-house team, or browsing the extensive trading ideas that are available on its website and various platforms, or when I’m engaging with the content available from Saxo’s various top-tier third-party providers. Saxo earned #1 best broker for our Research category in 2025 and is a top choice for traders looking for in-depth forex research. Overall, Saxo continues to build out the variety and depth of research available within its platform suite, including with the introduction of geopolitical theme-based coverage, such as its resource hub that covered the U.S. elections in 2024.

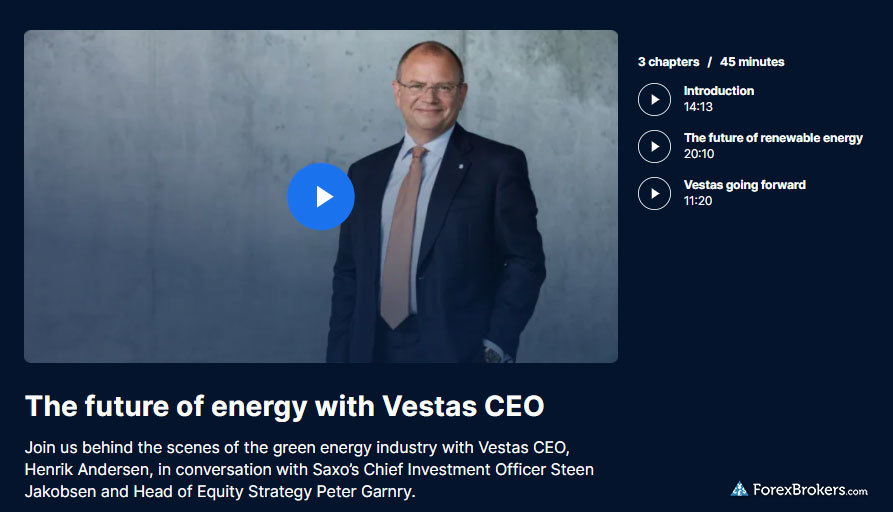

Research overview: Saxo offers a diverse research offering across its websites and platforms, in a variety of formats (video, articles, podcasts and headlines). It provides in-house content, such as the daily updates published by its own analysts in Saxo’s Market Analysis section, as well as third-party content such as the news headlines that stream from sources like Dow Jones, NewsEdge, and RanSquawk.

Market news and analysis: Saxo does an outstanding job of centralizing its research within the SaxoTraderGO and SaxoTraderPRO platforms. Third-party trading signals and analysis are provided by Autochartist, which is nicely integrated into the software. I found it easy to discover relevant content, as its research articles are categorized by asset class or geopolitical themes. When viewing the EUR/USD pair, for example, you’ll see related news and trading ideas. To find flaws in Saxo’s offering, I had to get picky. For example, there is an integrated economic calendar, yet it is not interactive.

Video content: Video research is seamlessly integrated into the Saxo website and its proprietary platforms. I found the video content itself to be of high quality, like Saxo’s Fintech Unfiltered series, for example. Saxo also includes playlists on YouTube, though it’s worth mentioning that many of Saxo’s videos are unlisted, and thus not easy to find or identify. Saxo’s focus seems to be on its websites and trading platforms, rather than its YouTube channel. This approach provides a much cleaner customer experience, and prevents the need to bounce between YouTube and a trading platform. That said, bringing all of its video content into one place would help highlight Saxo’s video content, and make it easier for traders to discover.

Reports: Saxo’s research team delivers quarterly outlooks and yearly forecast reports, available in PDF and including accompanying videos. These reports are excellent for traders and investors seeking to take a theme-based position based on quality research. Being proprietary, the reports are also engaging. For example, I personally enjoy reading the annual “Outrageous Predictions” forecast each year.

| Feature |

Saxo Saxo

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

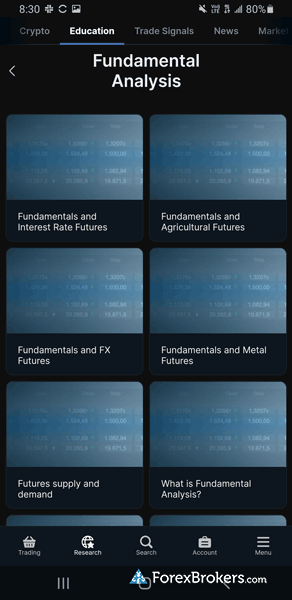

Education

Saxo provides a diverse selection of quality educational materials in both written and video format. The scope of educational resources available at Saxo rises above the industry average, yet falls slightly behind category leaders.

Learning center: Under its Insights section, Saxo provides market analysis articles produced by the firm’s in-house Saxo Strategy (Saxo Strats) team, which can be filtered by analyst or asset class. These articles are updated multiple times a day, and feature client sentiment data and market movers. The Insights section also contains 20 videos for beginners, which range in length from 5 to 20 minutes. I also found the Thought Starters series to be helpful, featuring short articles that cover concepts such as using indicators for technical analysis or risk management strategies.

Room for improvement: Aside from 41 platform video tutorials available in Saxo’s flagship platform suite, I counted at least eleven for risk-management, eight for fundamental analysis, and six for fundamental analysis. Some of Saxo’s videos are produced by in-house staff, while CME Group powers the rest of the courses.

There is a lot to like about Saxo’s video content, and there’s a lot of it – there are 41 platform tutorials alone, alongside educational videos covering subjects like risk management and fundamental analysis. That said, bringing all of the educational video content into one easily-accessible location, and then organizing it by experience level or category would make the content easier to find and navigate. Lastly, Saxo's YouTube channel is simply not very active, and falls short when it comes to financial markets education.

| Feature |

Saxo Saxo

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Saxo is a highly trusted, global brand that delivers just about everything that traders need. The client experience is seamless, and is rich with advanced tools and quality market research.

Saxo also does an excellent job of unifying its desktop, web, and mobile platforms. Saxo was Best in Class across nine categories for 2025, and won our awards for #1 Platform & Tools, #1 Desktop Platform, #1 Research, and #1 VIP Client Experience.

With the minimum deposit reduced from $2,000 down to $0 for clients in 2024, Saxo's Classic account provides the complete package for discerning traders. For its Platinum and VIP accounts, if the steeper deposit requirement is a deal-breaker, I recommend checking out IG or CMC Markets.

Is Saxo a good trading platform?

Whether you are an experienced investor or you’re just getting started as a trader, Saxo’s trading platform is an excellent choice. Each year, Saxo ranks at the top of nearly every category in our annual review. It’s best known for its innovative SaxoTraderGO trading platform suite, which includes its mobile and web trading app, as well as its SaxoTraderPRO platform desktop software.

In addition to robust educational content, you gain access to excellent research, a wide range of over 70,000 symbols to trade across global markets, and a variety of asset classes – all within an easy-to-use trading platform.

Is Saxo reliable?

Saxo is highly reliable thanks to its numerous banking and financial services licenses. It has been in operation for nearly 30 years, and has had an impeccable regulatory track record since 1992. Saxo is trusted by hundreds of thousands of clients from all over the world, and has over $120 billion in client assets under its custody.

Is my money safe in Saxo?

In addition to operating three banks (in Denmark, Luxembourg, and Switzerland), Saxo is well-capitalized with over $120 billion in client assets as of its latest annual report for 2023. Saxo has an excellent regulatory track record and holds numerous licenses in Tier 1 jurisdictions, making it a low-risk broker for investing and trading in financial markets. These factors make Saxo a trusted and reliable broker to hold your money when it comes to trading CFDs, forex, shares, options, and exchange-traded and over-the-counter (OTC) derivatives.

About Saxo

Established in 1992, Saxo is one of the leading retail forex and multi-asset brokerages, servicing over 1.1 million clients from its regulated entities across 15 international jurisdictions, including the U.K., Denmark, and Singapore, under the Saxo Bank Group. Saxo employs over 2350 full-time staff and is majority-owned by China-based Geely Holding Group. Catering to both retail and institutional clients, Saxo has processed over 57 million transactions in 2023 alone holding over $120 billion (converted from 816 billion Danish krone to U.S. dollars) in client assets as of its 2023 annual report, and following its integration of BinckBank. Saxo was recently designated as a Systemically Important Financial Institution (SIFI) from the Danish FSA, in addition to receiving an investment-grade A rating from S&P Global Ratings. Saxo powers over 490 wholesale partners and financial intermediares, with over 200 million requests to its OpenAPI daily.

ForexBrokers.com 2025 Annual Awards

For the ForexBrokers.com 2025 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Range of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Copy Trading, Ease of Use, MetaTrader, TradingView, Algo Trading, Crypto Trading, and Professional Trading.

ForexBrokers.com also recognized brokers that demonstrated excellence and innovation with our exclusive Industry Awards.

Category awards

| Rank #1 | Streak #1 | Best in Class | Best in Class Streak | |

| Overall | 9 | |||

| Range of Investments | 9 | |||

| Mobile Trading Apps | 9 | |||

| Platforms & Tools | 5 | 9 | ||

| Trust Score | 6 | |||

| Research | 1 | 9 | ||

| Crypto Trading | 4 | |||

| Professional Trading | 4 | |||

| TradingView | 1 |

Industry awards

| Rank #1 | Streak | |

| #1 Desktop Platform | 3 | |

| #1 VIP Client Experience | 6 |

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Saxo Regulation, Saxo Education, Saxo YouTube channel

Popular Forex Guides

- Best Forex Brokers for Beginners of 2025

- Best Copy Trading Platforms for 2025

- Best Forex Brokers for 2025

- Best Brokers for TradingView of 2025

- International Forex Brokers Search

- Best Forex Trading Apps for 2025

- Best Low Spread Forex Brokers for 2025

- Compare Forex Brokers

- Best MetaTrader 4 (MT4) Brokers for 2025