Admirals Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

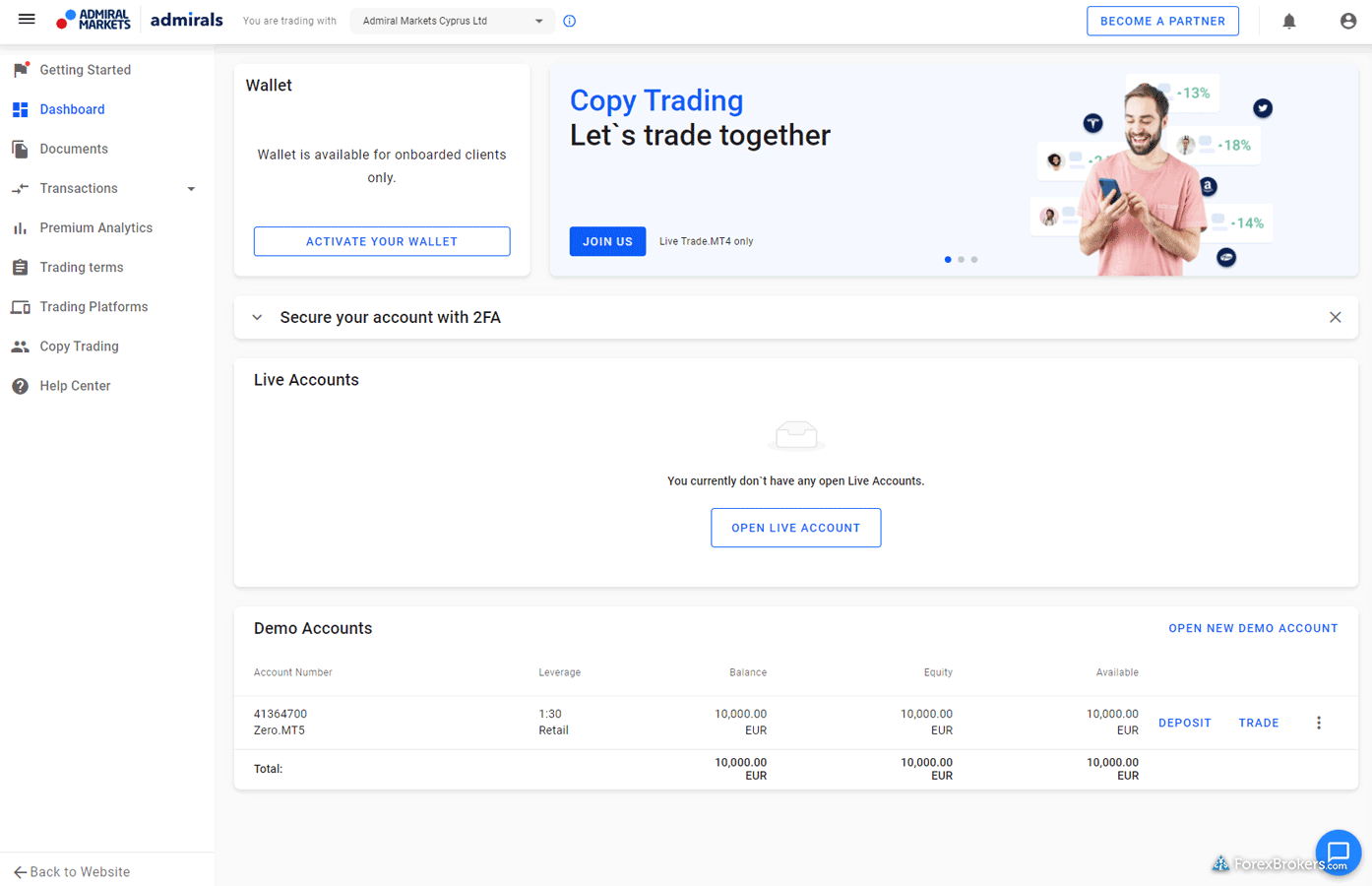

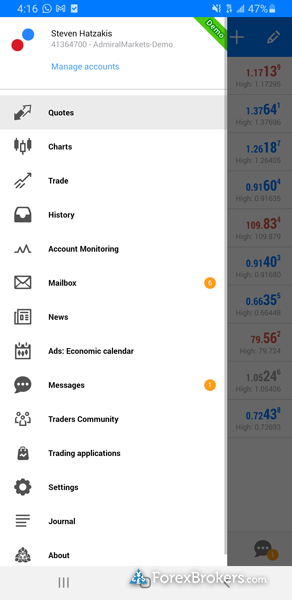

Traders choose Admirals (formerly Admiral Markets) for its excellent investor education and advanced MetaTrader features — such as the Supreme add-ons — alongside an extensive range of shares, forex and CFD markets, and premium research content.

-

Minimum Deposit:

$100 -

Trust Score:

93 -

Tradeable Symbols (Total):

8702

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Admirals pros & cons

Pros

- Founded in 2011, Admirals is regulated in four Tier-1 jurisdictions, three Tier-2 jurisdictions, and one Tier-4 jurisdiction.

- Admirals offers advanced MetaTrader features such as the StereoTrader dashboard and Supreme indicators.

- Premium Analytics features Dow Jones News, sentiment analysis from Acuity Trading, and Trading Central signals.

- Outstanding educational content.

- Offers 8,702 tradeable symbols across CFDs, forex pairs, and exchange-traded securities via the Admiral Invest account.

- Offers 3,800 tradeable symbols across multiple asset classes for MetaTrader 5.

- Provides a unique set of volatility protection tools for managing risk.

- Competitive pricing with typical spreads of 0.8 for the EUR/USD on Admiral's Trade account and similar pricing on the zero-spread account type after factoring in commissions.

- Holds indemnity insurance with Lloyd's of London for up to 100,000 euro per customer in Cyprus.

- Launched fractional investing and automated weekly or monthly recurring stock and ETF investments as part of a multi-asset offering within MT5.

Cons

- Admirals AS is the sole liquidity provider (market-maker) for all its group companies.

- Maximum contract size limited to 100 lots on the MT5 Trade account — compared to 200 on Zero MT5 account.

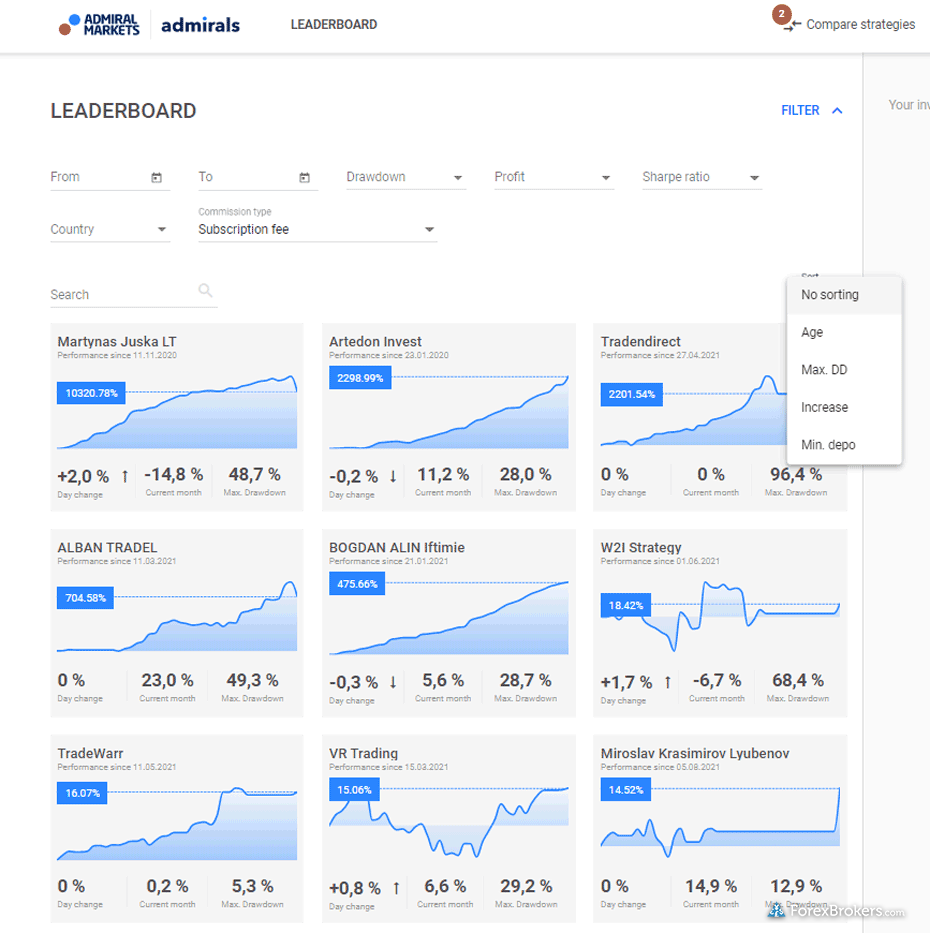

- The social trading feature is new to Admirals, but doesn't yet stack up against competitors like eToro and ZuluTrade.

- Admirals UK YouTube channel is not as active as other competitors, with no new content in the last two months as of late February 2025.

- Inactivity fee of 10 EUR per month could be a deal breaker if you do not trade frequently and are on a budget.

- Admirals App continues to evolve year-over-year yet still trails behind the best brokers in the mobile app category.

Overall Summary

| Feature |

Admirals Admirals

|

|---|---|

| Overall Rating |

|

| Trust Score | 93 |

| Range of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Admirals safe?

Admirals is considered Highly Trusted, with an overall Trust Score of 93 out of 99. Admirals is not publicly traded, does not operate a bank, and is authorised by four Tier-1 regulators (Highly Trusted), two Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Admirals is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

| Feature |

Admirals Admirals

|

|---|---|

| Year Founded | 2001 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 3 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Admirals platforms and tools

2025 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- International Forex Brokers Search

- Best Copy Trading Platforms for 2025

- Best MetaTrader 4 (MT4) Brokers for 2025

- Best Forex Trading Apps for 2025

- Best Forex Brokers for Beginners of 2025

- Best Brokers for TradingView of 2025

- Best Forex Brokers for 2025

- Best Low Spread Forex Brokers for 2025

- Compare Forex Brokers

More Forex Guides

Popular Forex Broker Reviews

Compare Admirals Competitors

Select one or more of these brokers to compare against Admirals.

Show all