CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

When comparing online brokers HYCM and Moneta Markets, it's important to take a closer look at their regulatory standings and trust scores. Established in 1977, HYCM operates under two Tier-1 licenses and one Tier-2 license, resulting in a Trust Score of 86 from ForexBrokers.com. This places HYCM in the "trusted" category, indicating a reliable regulatory foundation. On the other hand, Moneta Markets, founded in 2009, holds one Tier-1 and one Tier-2 license. Moneta Markets has a Trust Score of 72, categorizing it as an average risk broker.

Neither HYCM nor Moneta Markets is publicly traded or functions as a bank, which are aspects that might interest some investors. However, the presence of multiple high-level regulatory licenses and trust scores help ensure a level of safety and stability when dealing with these platforms. Potential clients should weigh these factors when deciding which broker is more aligned with their investment preferences.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Year Founded

info

|

1977

|

2009

|

|

Publicly Traded (Listed)

info

|

No

|

No

|

|

Bank

info

|

No

|

No

|

|

Tier-1 Licenses

info

|

2

|

1

|

|

Tier-2 Licenses

info

|

1

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

1

|

1

|

Fees

When it comes to comparing the commissions and fees of online brokers HYCM (Henyep Capital Markets) and Moneta Markets, both brokers offer distinct options tailored to different trading needs. HYCM provides a range of accounts, including the Raw account with competitive pricing at an all-in cost of about 0.6 pips for the popular EUR/USD pair, following commission charges. Their Classic account comes with a higher variable spread starting at 1.2 pips, while the fixed-spread account begins at 1.5 pips. HYCM boasts a strong 4.5-star rating for commissions and fees, ranking #15 out of 62 brokers in a ForexBrokers.com comparison.

Moneta Markets also offers diverse account choices, including the commission-based Moneta Prime ECN and Ultra ECN accounts, alongside a commission-free Direct STP account. Although the Direct STP account operates without commissions, its forex spreads are higher, averaging 1.38 pips for the EUR/USD pair as of August 2023. The Prime ECN account provides an average spread of 0.194 pips with a $6 commission per round-trip lot, culminating in a total cost of approximately 0.79 pips for EUR/USD trading. Their Ultra ECN account shines with industry-better spreads and a $2 commission per round-trip lot, but requires a substantial $20,000 deposit to access. Matching HYCM, Moneta Markets achieves a 4.5-star rating for commissions and fees, ranking just behind at #16.

In summary, both brokers stand on equal footing with their 4.5-star ratings for commissions and fees, yet cater to varying trader preferences. HYCM gives traders a choice between competitive spreads in their Raw account and the more predictable costs of their fixed-spread option. On the other hand, Moneta Markets provides flexibility through their commission-free STP option or compelling ECN accounts, each with advantageous cost structures contingent on the account and deposit size. Consequently, traders may find their choice between HYCM and Moneta Markets shaped by the specific trading conditions and entry requirements of each broker.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Minimum Deposit

info

|

$20

|

$50

|

|

Average Spread EUR/USD - Standard

info

|

1.2

info |

1.38

info |

|

All-in Cost EUR/USD - Active

info

|

0.6

info |

0.79

info |

|

Active Trader or VIP Discounts

info

|

Yes

|

No

|

|

ACH or SEPA Transfers

info

|

No

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

No

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

Yes

|

No

|

|

Visa/Mastercard (Credit/Debit)

info

|

Yes

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

When exploring online brokers, both HYCM (Henyep Capital Markets) and Moneta Markets provide forex trading as both CFDs and spot contracts; however, their overall investment offerings differ. HYCM stands out with a higher variety, boasting 1199 tradeable symbols compared to Moneta's 1016. Particularly in forex trading, HYCM offers 70 currency pairs, while Moneta Markets provides 54. Additionally, HYCM grants access to exchange-traded securities on U.S and international exchanges, letting clients invest in shares like Apple and Vodafone directly, an option not available with Moneta Markets. Both brokers enable trading in cryptocurrency derivatives, though neither offers delivered cryptocurrencies.

Moneta Markets distinguishes itself with the facility for copy trading, unlike HYCM. Both brokers are rated 4 out of 5 stars for their investment range, illustrating their competitiveness in the industry. Nevertheless, ForexBrokers.com ranks HYCM slightly higher at 33rd out of 62 brokers compared to Moneta's 35th position in the Range of Investments category. These aspects are essential for traders seeking a flexible and broad investment selection, with each broker catering to different trading preferences.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

1199

|

1016

|

|

Forex Pairs (Total)

info

|

70

|

54

|

|

U.S. Stock Trading (Non CFD)

info

|

Yes

|

No

|

|

Int'l Stock Trading (Non CFD)

info

|

Yes

|

No

|

|

Social Trading / Copy Trading

info

|

No

|

Yes

|

|

Cryptocurrency (Physical)

info

|

No

|

No

|

|

Cryptocurrency (Derivative)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

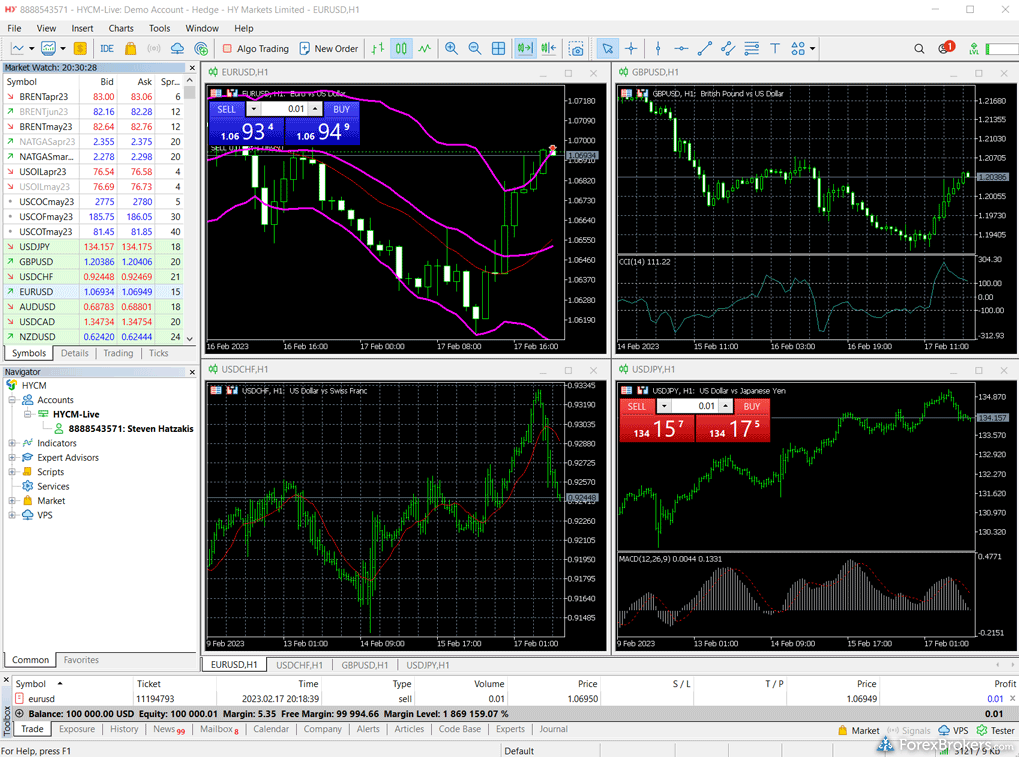

When comparing online brokers HYCM and Moneta Markets for trading platforms and tools, both platforms provide similar offerings in terms of accessibility. HYCM presents users with a proprietary platform, seating it favorably for those who prefer broker-exclusive software, while Moneta Markets does not have a proprietary option. However, both brokers deliver Windows-based desktop and web-browser platforms, ensuring traders can access their accounts easily. For simulation enthusiasts, both HYCM and Moneta Markets offer free virtual demo accounts to practice trading without financial risk.

On the trading technology side, both HYCM and Moneta Markets support MetaTrader 4 and MetaTrader 5, which are preferred by many traders for their versatility and comprehensive tools. Nevertheless, Moneta Markets takes a step ahead in the social trading arena by offering copy trading and ZuluTrade options, whereas HYCM does not. Charting features also show divergence; Moneta Markets provides 78 drawing tools compared to HYCM’s 15, offering more customization in technical analysis. When it comes to organizing market data, HYCM has a slight edge with 7 columns in watchlists compared to Moneta's 4. Despite these differences, both are rated 4 out of 5 stars for their trading platforms and tools. Interestingly, ForexBrokers.com ranks Moneta Markets higher at #33 compared to HYCM's #40 out of 62 brokers in this category.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Platform

info

|

Yes

|

No

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Social Trading / Copy Trading

info

|

No

|

Yes

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

DupliTrade

info

|

No

|

No

|

|

ZuluTrade

info

|

No

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

30

|

105

|

|

Charting - Drawing Tools (Total)

info

|

15

|

78

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

|

Watchlists - Total Fields

info

|

7

|

4

|

View More

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

When comparing the mobile trading apps of HYCM and Moneta Markets, both brokers offer similar features for traders on the go. Each provides apps for iPhone and Android, complete with price alerts and the capability to draw trendlines across forex and stock charts. Traders can view multiple timeframes like daily or intraday and create watchlists with real-time quotes on both apps. Additionally, the mobile apps from HYCM and Moneta Markets automatically save any chart drawings you make.

However, a key difference lies in watchlist syncing. While Moneta Markets allows for seamless syncing between mobile and online accounts, HYCM does not offer this feature. Both platforms cap at 30 technical studies for charting, providing users ample tools for analysis. In ratings, both brokers score 4 out of 5 stars for their mobile trading apps, with Moneta Markets holding a slight edge in ranking, coming 36th compared to HYCM's 37th out of 62 brokers on ForexBrokers.com.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Alerts - Basic Fields

info

|

Yes

|

Yes

|

|

Watchlist Syncing

info

|

No

|

Yes

|

|

Mobile Charting - Indicators / Studies

info

|

30

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Multiple Time Frames

info

|

Yes

|

Yes

|

|

Mobile Charting - Drawings Autosave

info

|

Yes

|

Yes

|

|

Mobile Watchlist

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

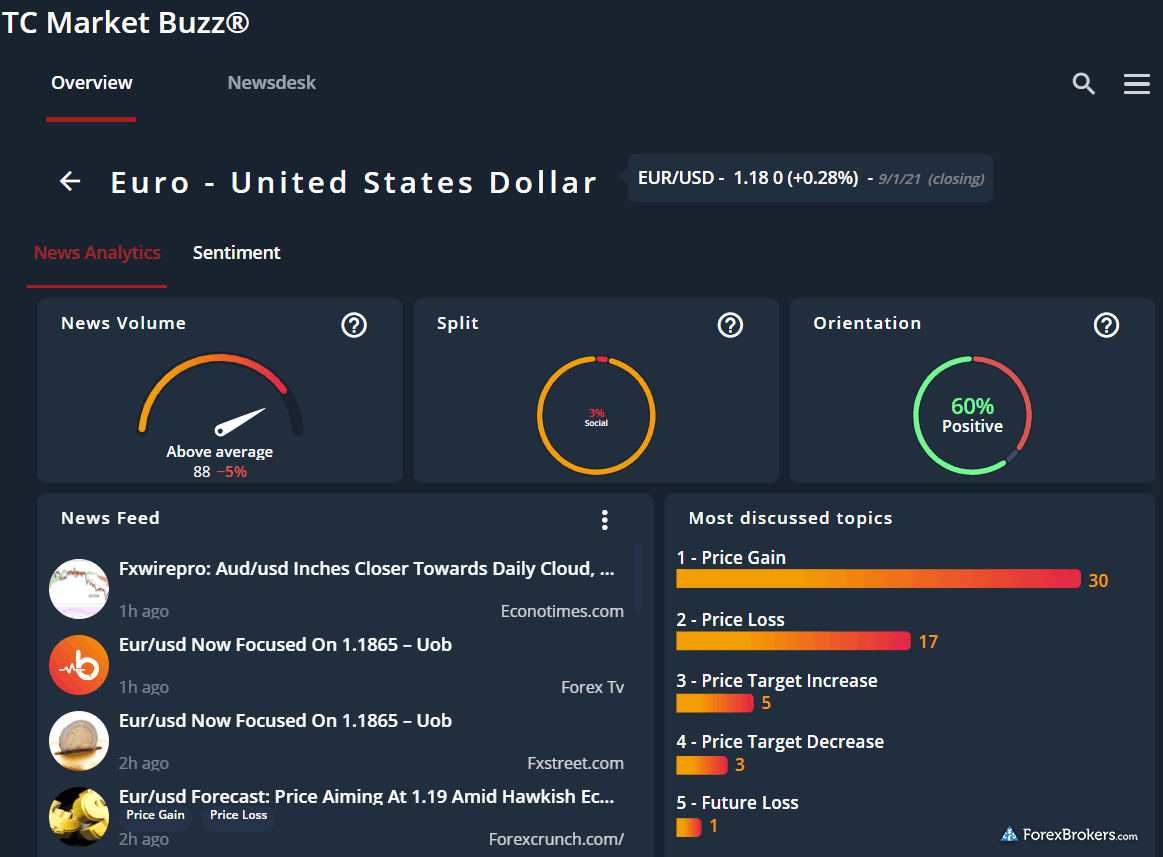

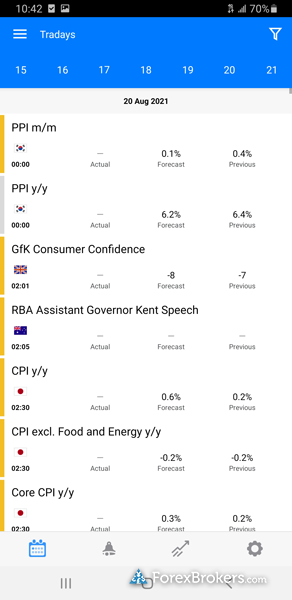

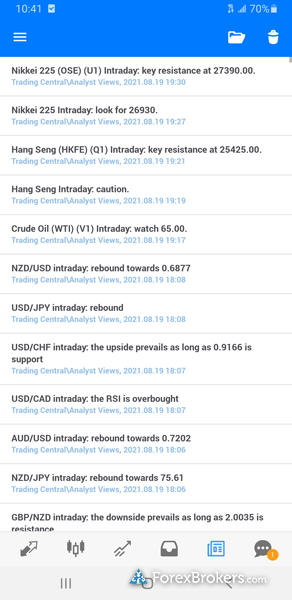

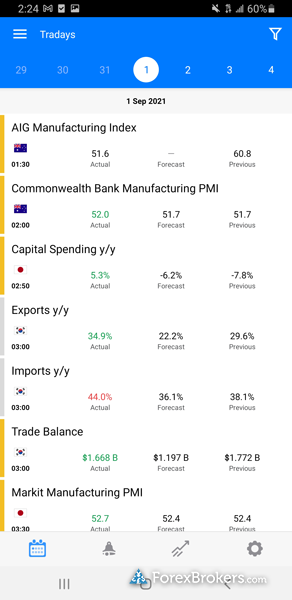

Both HYCM (Henyep Capital Markets) and Moneta Markets provide traders with valuable daily market commentary and deliver forex news from renowned sources like Bloomberg and Reuters. They each integrate advanced analytical tools from Trading Central to assist users in making informed decisions. While both brokers do not offer research tools from companies like Autochartist or Acuity Trading, they do keep traders informed with comprehensive economic calendars showcasing global news events.

Despite the similarities, Moneta Markets holds a slight edge in market research with a 4-star rating compared to HYCM's 3.5 stars. A key differentiator is Moneta Markets' sentiment-based trading tool, which offers insights into the ratio of long or short positions across various instruments—a feature that HYCM lacks. As per ForexBrokers.com, Moneta Markets ranks higher at #32 in the research category, while HYCM is positioned at #35 out of 62 brokers, reflecting Moneta Markets' slight advantage in providing research resources.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Daily Market Commentary

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

No

|

No

|

|

Trading Central (Recognia)

info

|

Yes

|

Yes

|

|

Social Sentiment - Currency Pairs

info

|

No

|

Yes

|

|

TipRanks

info

|

No

|

No

|

|

Signal Centre (Acuity Trading)

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

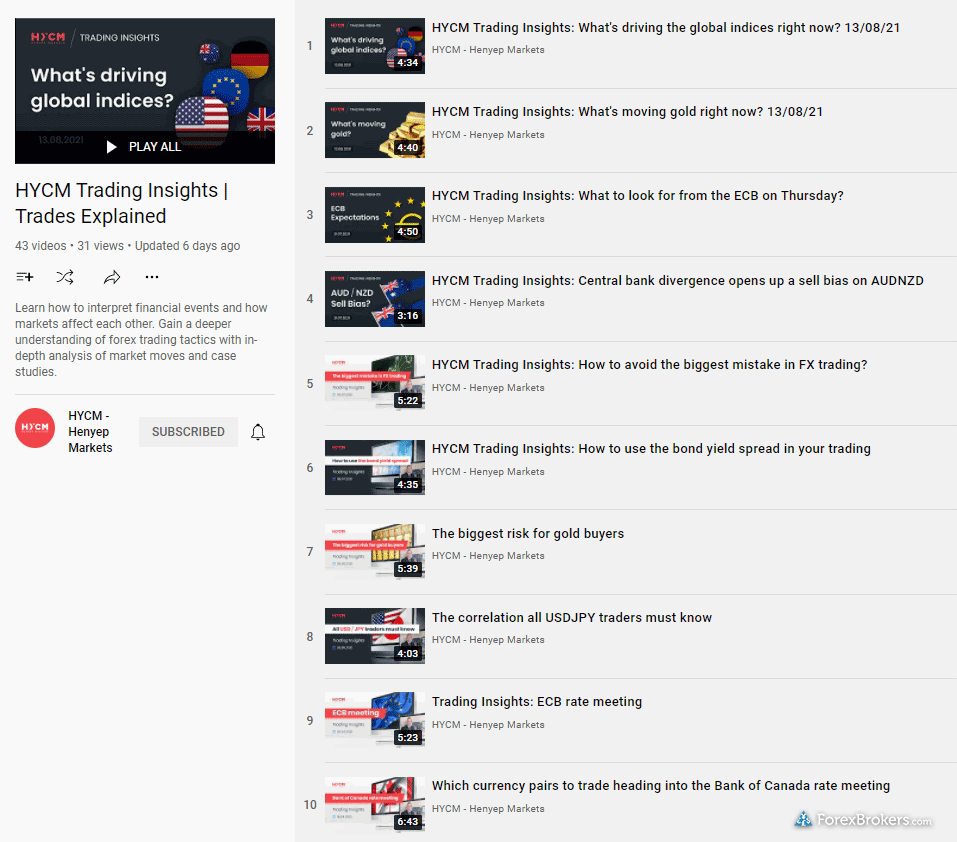

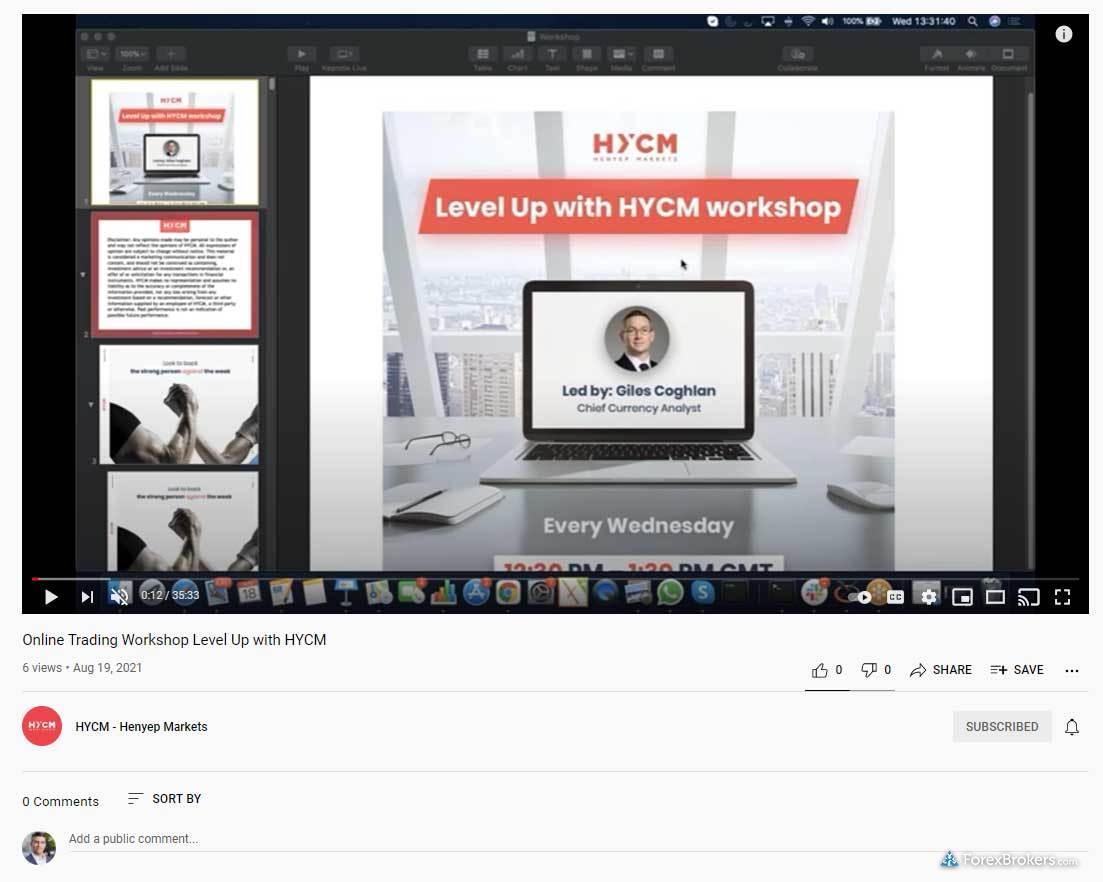

When comparing the educational resources available for beginners, both HYCM and Moneta Markets provide a decent range of learning materials focusing on forex and CFDs. Each broker offers more than ten educational pieces, ensuring that newcomers have access to articles, videos, and similar resources to kickstart their trading journey. However, the experience differs when delving deeper. HYCM provides a useful searchable archive of recorded client webinars, a feature that Moneta Markets lacks. This can be particularly beneficial for learners who want to revisit past sessions at their convenience.

In terms of beginner-specific video content, both brokers have a solid collection, but Moneta Markets goes further by offering advanced videos for experienced traders. HYCM, on the other hand, provides an investor dictionary with over 50 investing terms, which Moneta Markets does not offer. Based on these offerings, Moneta Markets receives a slightly higher education rating, with four stars compared to HYCM’s 3.5. Surprisingly, despite this higher rating, Moneta Markets is ranked just below HYCM in the education category by ForexBrokers.com, with Moneta Markets sitting at #33 and HYCM at #32 out of 62 brokers.

|

Feature |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

Moneta Markets Moneta Markets

|

|

Education (Forex or CFDs)

info

|

Yes

|

Yes

|

|

Client Webinars

info

|

No

|

No

|

|

Client Webinars (Archived)

info

|

Yes

|

No

|

|

Videos - Beginner Trading Videos

info

|

Yes

|

Yes

|

|

Videos - Advanced Trading Videos

info

|

No

|

Yes

|

|

Investor Dictionary (Glossary)

info

|

Yes

|

No

|

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 62 of the best forex brokers, our research and account testing finds that HYCM (Henyep Capital Markets) is better than Moneta Markets. HYCM (Henyep Capital Markets) finished with an overall rank of #29, while Moneta Markets finished with an overall rank of #35.

HYCM is a trusted brand that offers a straightforward MetaTrader platform experience. Its Raw account delivers competitive pricing, and traders gain access to third-party modules from Trading Central as well as exchange-traded securities (available through a separate platform). That said, HYCM offers a narrow range of symbols to forex and CFD traders.

FAQs

Can you trade cryptocurrency with HYCM (Henyep Capital Markets) or Moneta Markets?

Both HYCM (Henyep Capital Markets) and Moneta Markets do not provide the option to purchase actual delivered cryptocurrencies; however, they both offer the ability to trade cryptocurrency derivatives.

What funding options does each broker offer?

Both HYCM (Henyep Capital Markets) and Moneta Markets provide Visa/Mastercard and bank wire options for depositing and withdrawing funds, but only HYCM supports Skrill, while neither broker offers ACH, SEPA, or PayPal transactions.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Broker Screenshots

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Trading Platforms Gallery (click to expand) info

|

|

|

|

|

Mobile Trading Gallery (click to expand) info

|

|

|

|

|

Research Gallery (click to expand) info

|

|

|

|

|

Education Gallery (click to expand) info

|

|

|

|

|

Regulation

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Trust Score info

|

86

|

72

|

|

|

Year Founded info

|

1977

|

2009

|

|

|

Publicly Traded (Listed) info

|

No

|

No

|

|

|

Bank info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

info

|

No

info

|

|

|

Tier-1 Licenses info

|

2

|

1

|

|

|

Tier-2 Licenses info

|

1

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

1

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Australia (ASIC Authorised) info

|

No

|

Yes

|

|

|

Canada (CIRO Authorised) info

|

No

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

Yes

|

No

|

|

|

Japan (SFC Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

No

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

No

|

No

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

No

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Kenya (CMA Authorised) info

|

No

|

No

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

No

|

Yes

|

|

|

UAE (DFSA/Central Bank Authorised) info

|

Yes

|

No

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

No

|

No

|

|

|

Investments

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

1199

|

1016

|

|

|

Forex Pairs (Total) info

|

70

|

54

|

|

|

U.S. Stock Trading (Non CFD) info

|

Yes

|

No

|

|

|

Int'l Stock Trading (Non CFD) info

|

Yes

|

No

|

|

|

Social Trading / Copy Trading info

|

No

|

Yes

|

|

|

Cryptocurrency (Physical) info

|

No

|

No

|

|

|

Cryptocurrency (Derivative) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Average Spread EUR/USD - Standard info

|

1.2

info

|

1.38

info

|

|

|

All-in Cost EUR/USD - Active info

|

0.6

info

|

0.79

info

|

|

|

Active Trader or VIP Discounts info

|

Yes

|

No

|

|

|

Inactivity Fee info

|

No

|

No

|

|

|

Execution: Agency Broker info

|

Yes

|

No

|

|

|

Execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Minimum Deposit info

|

$20

|

$50

|

|

|

PayPal (Deposit/Withdraw) info

|

No

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

Yes

|

No

|

|

|

Visa/Mastercard (Credit/Debit) info

|

Yes

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

ACH or SEPA Transfers info

|

No

|

No

|

|

|

Trading Platforms

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Proprietary Platform info

|

Yes

|

No

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Social Trading / Copy Trading info

|

No

|

Yes

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

No

|

No

|

|

|

DupliTrade info

|

No

|

No

|

|

|

ZuluTrade info

|

No

|

Yes

|

|

|

Trading Tools

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Alerts - Basic Fields info

|

Yes

|

Yes

|

|

|

Watchlists - Total Fields info

|

7

|

4

|

|

|

Charting - Indicators / Studies (Total) info

|

30

|

105

|

|

|

Charting - Drawing Tools (Total) info

|

15

|

78

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Alerts - Basic Fields info

|

Yes

|

Yes

|

|

|

Mobile Watchlist info

|

Yes

|

Yes

|

|

|

Watchlist Syncing info

|

No

|

Yes

|

|

|

Mobile Charting - Indicators / Studies info

|

30

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Multiple Time Frames info

|

Yes

|

Yes

|

|

|

Mobile Charting - Drawings Autosave info

|

Yes

|

Yes

|

|

|

Mobile Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Daily Market Commentary info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

No

|

No

|

|

|

Trading Central (Recognia) info

|

Yes

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Social Sentiment - Currency Pairs info

|

No

|

Yes

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

HYCM (Henyep Capital Markets) |

Moneta Markets |

|

|

Education (Forex or CFDs) info

|

Yes

|

Yes

|

|

|

Client Webinars info

|

No

|

No

|

|

|

Client Webinars (Archived) info

|

Yes

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

No

|

Yes

|

|

|

Investor Dictionary (Glossary) info

|

Yes

|

No

|

|

arrow_upward